ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that thematic ETFs listed globally gathered net inflows of US$923.69 million, bringing year-to-date net inflows to US$10.81 billion, according to ETFGI’s April 2025 ETF and ETP Thematic industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Thematic ETFs listed globally gathered $923.69 Mn in net inflows of $923.69 Mn during April.

- Year-to-date (YTD) net inflows of $10.81 billion rank as the fourth highest on record. The highest YTD net inflows were recorded in 2021 at $61.42 billion, followed by $19.34 billion in 2022, and $12.44 billion in 2020.

- Assets of US$317.43 Bn invested in the Thematic ETFs listed globally at the end of April, below the record high assets of $329.79 Bn in January 2025.

- 5th month of consecutive net inflows.

The S&P 500 Index declined by 0.68% in April and is down 4.92% year-to-date (YTD) in 2025. In contrast, the Developed Markets Ex-U.S. Index rose 4.86% in April and is up 10.85% YTD. Among developed markets, Spain and Portugal posted the strongest gains in April, rising 8.65% and 7.67%, respectively. The Emerging Markets Index increased by 0.88% during April and is up 1.80% YTD. Within emerging markets, Hungary led with a 10.78% gain, followed closely by Mexico at 10.40%," said Deborah Fuhr, Managing Partner, Founder, and Owner of ETFGI.

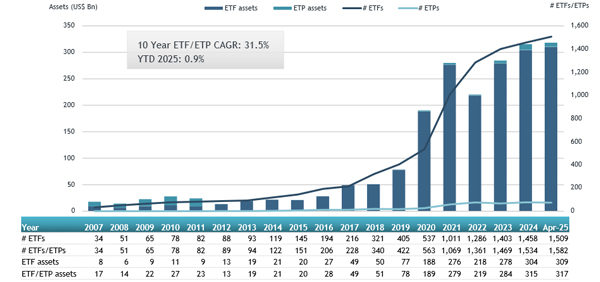

Growth in assets in the Thematic ETFs listed globally as of end of April

Since the launch of the first Thematic ETF listed in 2001, the iShares North American Natural Resources ETF, the number and diversity of products have increased steadily.

There are now 1,582 Thematic ETFs listed globally, with 3,049 listings, assets of $317.43 Bn, from 276 providers listed on 53 exchanges in 41 countries at the end of April. During April, 29 new Thematic ETFs were launched.

Overview of Thematic ETFs listed globally

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.47 Bn, during April. E Fund CSI Science and Technology Innovation Board 50 ETF (588080 CH) gathered $490.68 Mn, the largest individual net inflow.

Top 20 Thematic ETFs by net new assets April 2025

|

Name |

Ticker |

Assets ($ Mn) Apr-25 |

NNA ($ Mn) YTD-25 |

NNA ($ Mn) Apr-25 |

|

E Fund CSI Science and Technology Innovation Board 50 ETF |

588080 CH |

8,405.45 |

49.36 |

490.68 |

|

ICBC Credit Suisse CNI HK Connect Innovative Drug ETF |

159217 CH |

377.43 |

377.43 |

377.43 |

|

NEXT FUNDS MSCI Global Climate 500 Japan Selection Index ETF |

294A JP |

570.29 |

26.64 |

338.56 |

|

ChinaAMC CSI Robot ETF |

562500 CH |

1,882.12 |

1,313.46 |

289.15 |

|

HuaAn ChiNext 50 ETF Fund |

159949 CH |

3,439.89 |

(331.13) |

217.50 |

|

MicroSectors FANG+ 3X Leveraged ETN |

FNGB US |

387.39 |

390.39 |

193.21 |

|

ChinaAMC CSI Anime Comic and Game ETF |

159869 CH |

926.49 |

52.77 |

159.60 |

|

Swisscanto (IE) ESGen SDG Index Equity USA UCITS ETF |

SWCSU SW |

145.57 |

143.74 |

143.74 |

|

China Universal CNI HK Connect Innovative Drug ETF |

159570 CH |

418.11 |

289.81 |

140.82 |

|

Tianhong CSI Robot ETF |

159770 CH |

749.13 |

584.38 |

136.38 |

|

iShares Global Infrastructure ETF |

IGF US |

6,410.32 |

1,036.35 |

126.15 |

|

CCB Principal SSE STAR Innovation Value Strategy Custom ETF |

588910 CH |

144.17 |

123.00 |

123.00 |

|

E FundSI Artificial Intelligence ETF |

159819 CH |

2,130.95 |

1,029.90 |

114.40 |

|

KIM ACE Tesla Value Chain Active ETF |

457480 KS |

757.18 |

428.54 |

104.85 |

|

AXS Change Finance ESG ETF |

CHGX US |

140.54 |

102.54 |

104.62 |

|

Global X Cybersecurity ETF |

BUG US |

1,015.68 |

175.63 |

104.34 |

|

Yinhua CNI HK Connect Innovative Drug ETF |

159567 CH |

180.58 |

112.07 |

82.40 |

|

iShares Paris-Aligned Climate MSCI USA ETF |

PABU US |

2,067.60 |

269.54 |

78.21 |

|

SPDR S&P Kensho New Economies Composite ETF |

KOMP US |

2,019.00 |

97.16 |

71.68 |

|

Wanjia CSI Robot ETF |

560630 CH |

68.31 |

71.49 |

71.49 |