ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that Thematic ETFs and ETPs listed globally gathered net inflows of US$2.61 billion during March, bringing year-to-date net inflows to record US$45.19 billion which is much higher than the prior record of US$25.21 billion gathered at this point last year. Total assets invested in Thematic ETFs and ETPs decreased by 3.1% from US$393.67 billion at the end of February 2021 to US$381.59 billion, according to ETFGI’s March 2021 Global ETFs and ETPs Thematic industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $381.59 Bn invested in Thematic ETFs and ETPs listed globally at the end of Q1 are the third highest on record.

- During March Thematic ETFs and ETPs gathered net inflows of $2.61 Bn.

- YTD net inflows of $45.19 Bn are a record, passing the prior record of $25.21 Bn gathered in Q1 2020.

“The S&P 500® gained 4.4% in March and 6.2% in Q1, supported by the increasing pace of COVID-19 vaccinations and continued monetary and fiscal support. Global equities gained 2.5% in March and 5.2% in Q1, as measured by the S&P Global BMI. 38 of the 50 countries advanced during the month and 35 were positive at the end of Q1. Developed markets ex-U.S. gained 2.3% in USD terms in March and 4.0% in Q1. Emerging markets were down 1.6% in USD terms in March and up 2.8% in Q1, as measured by the S&P Emerging BMI.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

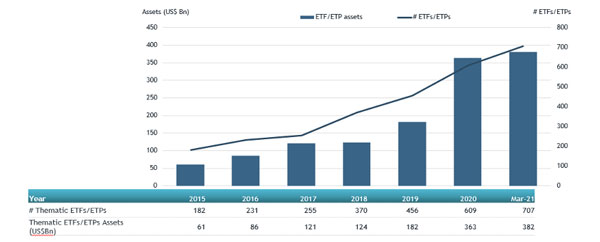

Global Thematic ETF and ETP asset growth as at end of March 2021

Since the launch of the first Thematic ETF/ETP in 2001, the iShares North American Natural Resources ETF, the number and diversity of products have increased steadily. Globally there are 707 Thematic ETFs and ETPs, with 1,352 listings, assets of US$382 Bn, from 187 providers listed on 48 exchanges in 40 countries.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $7.26 Bn at the end of March. ARK Innovation ETF (ARKK US) gathered $1,67 Bn the largest net inflows.

Top 20 Thematic ETFs/ETPs by net new assets March 2021

|

Name |

Ticker |

Assets (US$ Mn) Mar-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Mar-21 |

|

ARK Innovation ETF |

ARKK US |

22,996.04 |

7,132.44 |

1,666.71 |

|

Global X U.S. Infrastructure Development ETF |

PAVE US |

2,324.68 |

1,309.80 |

651.43 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

FNGU US |

1,403.47 |

650.96 |

516.63 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

2,764.87 |

1,144.09 |

432.53 |

|

Deka MSCI USA Climate Change ESG UCITS ETF |

D6RQ GY |

654.26 |

509.46 |

427.76 |

|

FlexShares Morningstar Global Upstream Natural Resources Index Fund |

GUNR US |

4,703.24 |

838.53 |

373.26 |

|

VanEck Vectors Social Sentiment ETF |

BUZZ US |

356.08 |

355.75 |

355.75 |

|

ARK Space Exploration & Innovation ETF |

ARKX US |

344.26 |

344.26 |

344.26 |

|

Invesco Dynamic Leisure and Entertainment ETF |

PEJ US |

1,880.69 |

1,120.46 |

340.67 |

|

Huatai-PineBridge CSI Rare Earth Industry ETF |

516780 CH |

301.24 |

328.39 |

328.39 |

|

Invesco Global Clean Energy UCITS ETF - Acc |

GCLX LN |

2.48 |

275.41 |

275.41 |

|

Samsung KODEX Secondary Battery Industry ETF |

305720 KS |

1,172.52 |

829.39 |

260.38 |

|

iShares Global Clean Energy ETF |

ICLN US |

5,456.83 |

2,071.96 |

246.48 |

|

AGFiQ Global Infrastructure ETF |

QIF CN |

201.79 |

195.97 |

195.97 |

|

Xtrackers Artificial Intelligence & Big Data UCITS ETF - Acc |

XAIX GY |

605.43 |

452.41 |

181.69 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

621.13 |

689.05 |

157.37 |

|

iShares Global Infrastructure UCITS ETF |

INFR LN |

1,123.19 |

228.48 |

137.57 |

|

L&G Hydrogen Economy UCITS ETF - Acc |

HTWG LN |

299.48 |

314.71 |

125.83 |

|

iShares US Infrastructure ETF |

IFRA US |

369.79 |

247.37 |

121.75 |

|

Direxion Moonshot Innovators ETF |

MOON US |

277.79 |

262.60 |

115.60 |