ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reports that Thematic ETFs and ETPs listed globally gathered net inflows of US$2.38 billion during December, bringing net inflows for 2021 to US$80.54 billion which is lower than the US$106.19 billion gathered at this point last year. Total assets invested in Thematic ETFs and ETPs decreased by 1.0% from US$441 billion at the end of November 2021 to US$437 billion, according to ETFGI’s December 2021 ETF and ETP Thematic industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Thematic ETFs and ETPs listed globally end 2021 at $437 Bn which is lower than the record $441.3 Bn in October 2021.

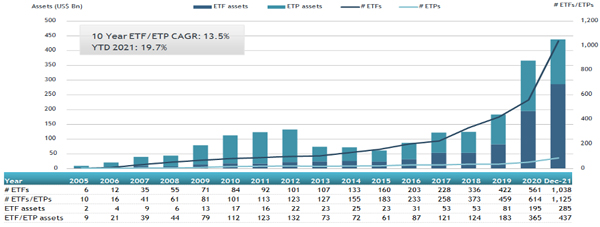

- Assets increased by 19.7% in 2021, going from US$365 billion at end of 2020, to US$437 billion.

- Full year 2021 net inflows of $80.54 Bn are the second highest on record.

- $80.54 Bn net inflows in 2021 are $25.65 Bn lower than the record $106.19 Bn gathered in 2020.

- 25th month of consecutive net inflows

- By assets iShares is the largest thematic provider with 21.1% market share; SPDR ETFs is second with 16.4% market share, followed by Mirae Asset Global ETFs (includes the Mirae, Global V and Horizon ETFs brands) 7.8% market share.

“The S&P 500 increased 4.48% in December and was up 28.71% in 2021. Developed markets excluding the US, experienced a gain of 4.89% in December an was up 11.38% in 2021. Luxembourg (Up 12.65%) and Ireland (Up 9.68%) experienced the largest gains among the developed markets in December. Emerging markets were up 1.60% during December and gained 1.22% in 2021. Mexico (up 12.80%) and Czech Republic (up 12.55%) gained the most among emerging markets in December, whilst Chile (down 5.26%) and China (down 2.73%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global Thematic ETF and ETP asset growth as at end of December 2021

Since the launch of the first Thematic ETF/ETP in 2001, the iShares North American Natural Resources ETF, the number and diversity of products have increased steadily. At the end of 2021 there were 2,169 thematic ETFs/ETPs listed globally, with assets of $437 Bn, from 236 providers listed on 51 exchanges in 40 countries. During December, 66 new Thematic ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $4.26 Bn during December. Mirae Asset TIGER China Electric Vehicle Solactive ETF (371460 KS) gathered $477 Mn the largest individual net inflow.

Top 20 Thematic ETFs/ETPs by net new assets December 2021

|

Name |

Ticker |

Assets (US$ Mn) Dec-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Dec-21 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

2,686.05 |

2,402.65 |

477.16 |

|

Invesco Physical Gold ETC – Acc |

SGLD LN |

14,225.27 |

823.17 |

351.36 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

XAD5 GY |

2,918.67 |

(1,148.04) |

294.24 |

|

FlexShares Morningstar Global Upstream Natural Resources Index Fund |

GUNR US |

6,617.53 |

2,270.29 |

287.64 |

|

iShares Global Aggregate Bond ESG UCITS ETF - Eur Hdg Acc |

AEGE GY |

530.65 |

540.57 |

247.87 |

|

WisdomTree Core Physical Gold - Acc |

WGLD LN |

411.79 |

394.17 |

236.40 |

|

Ping An CSI New Energy Automobile Industry ETF |

515700 CH |

1,063.01 |

8.55 |

224.38 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,960.36 |

858.40 |

198.96 |

|

iShares Physical Gold ETC – Acc |

SGLN LN |

12,855.31 |

(797.24) |

194.88 |

|

Invesco MSCI Europe ESG Climate Paris Aligned UCITS ETF - Acc |

PAES LN |

188.49 |

190.36 |

190.36 |

|

Samsung KODEX Secondary Battery Industry ETF |

305720 KS |

1,094.41 |

546.47 |

182.03 |

|

First Trust NASDAQ CEA Cybersecurity ETF |

CIBR US |

5,760.56 |

1,915.34 |

178.07 |

|

iShares Global Water UCITS ETF |

IH2O LN |

2,906.49 |

817.11 |

177.87 |

|

Roundhill Ball Metaverse ETF |

META US |

933.95 |

981.49 |

172.08 |

|

ChinaAMC CSI New Energy Automobile ETF |

515030 CH |

1,507.43 |

(212.38) |

162.99 |

|

MIRAE ASSET TIGER SECONDARY CELL ETF - Acc |

305540 KS |

1,097.74 |

498.85 |

154.47 |

|

Mirae Asset TIGER Global Metaverse Active ETF |

412770 KS |

154.33 |

152.37 |

152.37 |

|

UBS ETF (IE) MSCI Japan Climate Paris Aligned UCITS ETF (JPY) A-acc |

AW15 GY |

150.80 |

151.19 |

134.08 |

|

KraneShares Global Carbon Strategy ETF |

KRBN US |

1,622.37 |

1,182.36 |

122.93 |

|

Harvest CSI Rare Earth Industry ETF |

516150 CH |

375.56 |

331.59 |

121.31 |

.jpg)