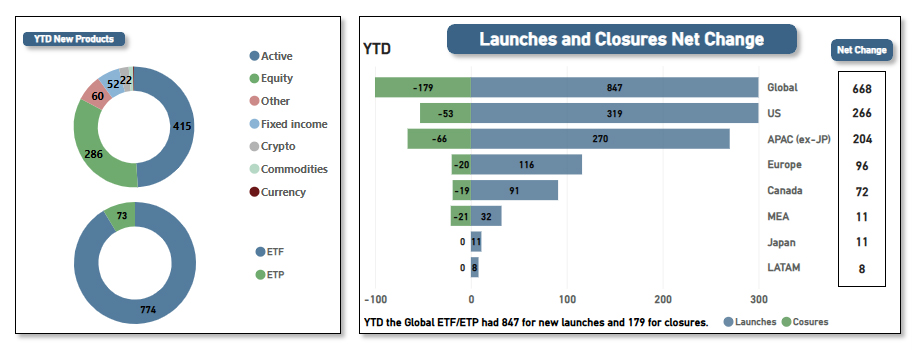

ETFGI, a leading independent research and consultancy firm known for its expertise in subscription-based research, consulting services, industry events, and ETF TV, announced that the global ETFs industry reached a new milestone at the end of the first four months of 2025, with 847 new products listed. After accounting for 179 closures, this represents a net increase of 668 products—surpassing the previous record of 563 new listings in the first 4 months of 2022.

The 847 new ETF launches in the first 4 months of 2025 were distributed as follows: 319 in the United States, 270 in Asia Pacific (excluding Japan), and 116 in Europe. Asia Pacific (excluding Japan) also recorded the highest number of closures at 66, followed by the United States with 53, and the Middle East and Africa with 21.

A total of 266 providers contributed to these new listings, which span 35 exchanges globally. Meanwhile, 179 closures were reported from 71 providers across 20 exchanges. Among the newly launched products, 415 are Active ETFs, 286 are Index Equity ETFs, and 52 are Index Fixed Income ETFs.

New listings and closures in the Global ETFs industry YTD through end of April 2025

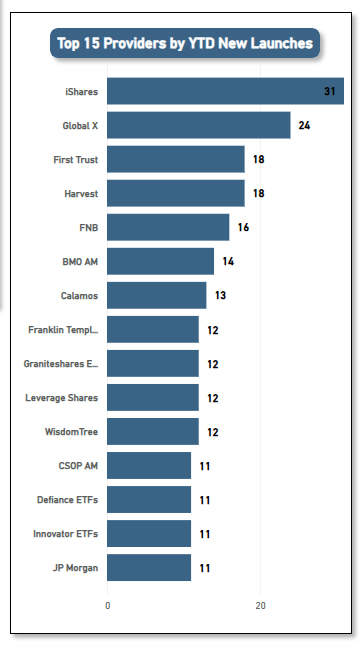

The 847 newly launched products are managed by 266 different providers. iShares led with the highest number of new listings at 31, followed by Global X with 24. First Trust and Harvest each launched 18 new products.

Top 15 providers of new launches YTD through end of April 2025

From 2021 to 2025 (year-to-date through the end of April), the global ETF industry has experienced a notable rise in new product launches, increasing from 493 in 2021 to 847 in 2025. In 2025, the United States and Asia Pacific (excluding Japan) led the way with 319 and 270 new listings, respectively, while Latin America saw only 8 launches.

The peak number of launches in 2025 was recorded in the U.S. (319), Asia Pacific ex-Japan (270), Canada (91), and the Middle East and Africa (32). In contrast, Europe reached its peak in 2022 with 171 launches, Japan in 2024 with 18, and Latin America in 2022 with 11

New listings in the first 4 months of the year in the Global ETFs industry: 2021 to 2025

Source: ETFGI, ETF issuers and exchanges.

The number of product closures YTD through end of April 2025 decreased in every region compared to the same period in 2024, except Asia Pacific (ex-Japan) and Middle East and Africa. In 2025, Asia Pacific (excluding Japan), the US and Middle East and Africa recorded the highest number of closures, with 66, 53 and 21 respectively, while Japan and Latin America have not seen any closures.

Compared to the five years for closures, Asia Pacific (ex-Japan) recorded its most closures in 2025 with 66, while the US had its highest closures of 81 in 2024. Europe recorded its highest closures of 71 in 2021, Middle East and Africa recorded 38 closures in 2023, Canada saw 39 closures in 2023.

This report underscores the dynamic nature of the ETF industry and highlights the continued growth and diversification of the market. Contact ETFGI to learn about our subscription research services contact@etfgi.com

Closures in the first 4 months of the year in the Global ETFs industry: 2021 to 2025

Source: ETFGI, ETF issuers and exchanges.

As of the end of April 2025, assets invested in the global ETFs industry reached US$15.44 trillion. The industry recorded net inflows of US$157.03 billion during the month. According to ETFGI’s April 2025 Global ETFs and ETPs Industry Landscape Insights report, the global ETFs ecosystem comprised 14,013 products with 27,751 listings, offered by 858 providers across 81 exchanges in 63 countries.

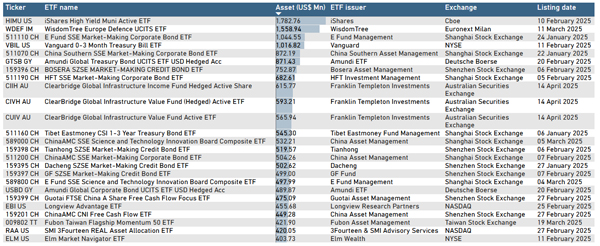

Year-to-date through April 2025, the ETF market has experienced robust growth, driven in part by strong asset accumulation in newly launched ETFs. The top five ETFs by assets include:

iShares High Yield Muni Active ETF (HIMU US) – US$1.78 billion

WisdomTree Europe Defence UCITS ETF (WDEF IM) – US$1.56 billion

E Fund SSE Market-Making Corporate Bond ETF (511110 CH) – US$1.04 billion

Vanguard 0–3 Month Treasury Bill ETF (VBIL US) – US$1.02 billion

China Southern SSE Market-Making Corporate Bond ETF (511070 CH) – US$872.19 million

The top 25 list features ETFs across a diverse range of strategies and sectors—including high dividend, equity, active, and climate-focused products—highlighting the breadth of investment opportunities available to investors today.

Top 25 Global New ETF/ETP by Asset YTD through end of April 2025

.jpg)