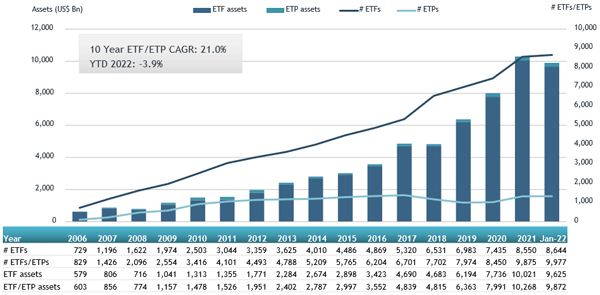

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, ETFGI reported today the global ETFs industry gathered US$76.40 billion of net inflows in January 2022. Due to market declines in January the assets invested in the global ETFs industry decreased by 3.9% from a record US$10.27 trillion at the end of December 2021, to US$9.87 trillion, according to ETFGI's January 2022 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of anan annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Due to market declines in January the assets invested in the global ETFs industry decreased by 3.9% from a record $10.27 trillion at the end of December 2021, to US$9.87 trillion.

- Net inflows of $76.40 Bn in January are slightly lower than the net inflows of $85.38 Bn gathered in January 2021.

- $1.29 Tn in net inflows gathered in the past 12 months.

- 32nd month of consecutive net inflows

- Equity ETFs and ETPs listed globally gathered $61.85 Bn net inflows in January 2022.

“The S&P 500 decreased by 5.17% in January. Developed markets excluding the US, experienced a loss of 5.33% in January. All countries in developed markets experienced losses, with New Zealand suffering the biggest loss of 14.35%. Emerging markets decreased by 0.94% during January. Chile (up 12.44%) and Colombia (up 12.36%) gained the most, whilst Russia (down 8.74 %) and Poland (down 4.82%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of January 2022

At the end of January 2022, the Global ETFs industry had 9,977 products, with 20,221 listings, assets of

$9.87 Tn, from 617 providers listed on 79 exchanges in 62 countries.

During January 2022, ETFs/ETPs gathered net inflows of $76.40 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $61.85 Bn inJanuary, greater than the $48.48 Bn in net inflows equity products attracted in January 2021. Fixed Income ETFs/ETPs listed globally reported net outflows of $4.13 Bn during January, much lower than the $16.12 Bn in net inflows fixed income products had attracted in January 2021. Commodity ETFs/ETPs listed globally gathered net inflows of $3.79 Bn, higher than the $2.83 Bn in net inflows commodity products had attracted in January 2021. Active ETFs/ETPs reported $8.79 Bn in net inflows, lower than the $16.93 Bn in net inflows active products had attracted in January 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $45.39 Bn during January. Vanguard S&P 500 ETF (VOO US) gathered $4.40 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows January 2022: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

269,700.45 |

4,402.19 |

4,402.19 |

|

Vanguard Total Stock Market ETF |

VTI US |

282,653.02 |

4,046.99 |

4,046.99 |

|

Financial Select Sector SPDR Fund |

XLF US |

47,897.77 |

3,930.49 |

3,930.49 |

|

iShares MSCI Kokusai ETF |

TOK US |

3,972.63 |

3,666.67 |

3,666.67 |

|

ProShares UltraPro QQQ |

TQQQ US |

18,456.69 |

3,080.14 |

3,080.14 |

|

Vanguard Value ETF |

VTV US |

93,974.99 |

2,245.01 |

2,245.01 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

107,764.18 |

2,237.01 |

2,237.01 |

|

Consumer Staples Select Sector SPDR Fund |

XLP US |

15,391.83 |

2,138.23 |

2,138.23 |

|

Energy Select Sector SPDR Fund |

XLE US |

33,520.94 |

1,999.97 |

1,999.97 |

|

iShares Core Total USD Bond Market ETF |

IUSB US |

17,934.98 |

1,928.17 |

1,928.17 |

|

Direxion Daily Semiconductors Bull 3x Shares |

SOXL US |

5,472.67 |

1,867.67 |

1,867.67 |

|

Schwab US Dividend Equity ETF |

SCHD US |

32,147.69 |

1,802.93 |

1,802.93 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

101,678.25 |

1,774.93 |

1,774.93 |

|

iShares MSCI ACWI ETF |

ACWI US |

18,397.85 |

1,724.86 |

1,724.86 |

|

VanEck Vectors Semiconductors ETF |

SMH US |

7,965.30 |

1,665.92 |

1,665.92 |

|

Invesco S&P 500 Equal Weight ETF |

RSP US |

32,202.08 |

1,580.69 |

1,580.69 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

52,953.33 |

1,358.32 |

1,358.32 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc |

ACWIU SW |

2,236.77 |

1,335.07 |

1,335.07 |

|

iShares S&P 500 Value ETF |

IVE US |

24,845.85 |

1,327.92 |

1,327.92 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

4,516.08 |

1,278.11 |

1,278.11 |

The top 10 ETPs by net new assets collectively gathered $3.66 Bn over January. SPDR Gold Shares (GLD US) gathered $2.50 Bn, the largest individual net inflow.

Top 10 ETPs by net new inflows January 2022: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

57,747.32 |

2,501.52 |

2,501.52 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

XAD5 GY |

2,798.66 |

285.83 |

285.83 |

|

MicroSectors FANG Innovation 3X Leveraged ETN |

BULZ US |

382.56 |

170.52 |

170.52 |

|

Invesco DB Commodity Index Tracking Fund |

DBC US |

2,981.56 |

147.05 |

147.05 |

|

WisdomTree Energy Enhanced - Acc EUR Daily Hdg |

WNRG GY |

133.49 |

129.48 |

129.48 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

2,318.82 |

123.24 |

123.24 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

12,803.55 |

84.53 |

84.53 |

|

iShares Silver Trust |

SLV US |

12,002.64 |

80.54 |

80.54 |

|

ProShares UltraShort DJ-UBS Natural Gas |

KOLD US |

185.86 |

80.06 |

80.06 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

2,175.76 |

60.73 |

60.73 |

Investors have tended to invest in Equity ETFs/ETPs during January.