ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today the global ETFs industry gathered US$65.16 billion in net inflows in March 2023, bringing year to date net inflows to US$145.02 Bn. During March 2023, assets invested in the global ETFs industry increased by 2.8%, from US$9.60 trillion at the end of February to US$9.86 trillion, according to ETFGI's March 2023 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted)

Highlights

- Global ETFs industry gathered net inflows of $65.16 Bn during March.

- YTD net inflows of $145.02 Bn are the fourth highest on record, after YTD net inflows of $360.71 Bn in 2021, YTD net inflows of $305.81 n in 2022, and YTD net inflows of $197.20 Bn in 2017.

- 46th month of consecutive net inflows.

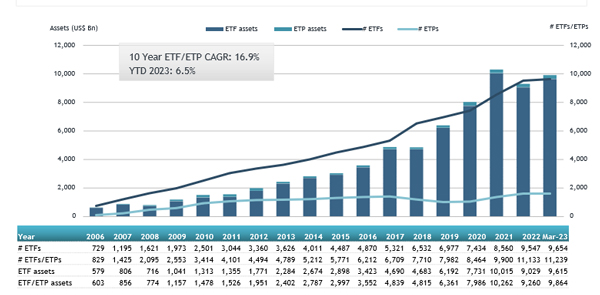

- Assets of $9.86 Tn invested in global ETFs industry at the end of March.

- Assets increased 6.5% YTD in 2023, going from $9.26 Tn at end of 2022 to $9.86 Tn.

“The S&P 500 increased by 3.67 % in March and is up by 7.50% YTD in 2023. Developed markets excluding the US increased by 2.19% in March and are up 7.77% YTD in 2023. Denmark (up 7.10%) and Korea (up 5.16%) saw the best performance amongst the developed markets in March. Emerging markets increased by 2.16% during March and were up 2.90% YTD in 2023. Saudi Arabia (up 5.63%) and Peru (up 3.85%) saw the best performance amongst emerging markets in March.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of March 2023

The Global ETFs industry had 11,239 products, with 23,088 listings, assets of $9.864 trillion, from 671 providers listed on 81 exchanges in 63 countries at the end of March.

During March, ETFs gathered net inflows of $65.16 Bn. Equity ETFs reported net inflows of $13.90 Bn during March, bringing YTD net inflows to $34.36 Bn, significantly lower than the $211.39 Bn in net inflows YTD in 2022. Fixed income ETFs gathered net inflows of $37.34 Bn during March, bringing YTD net inflows to $69.96 Bn, higher than the $29.13 Bn in net inflows YTD 2022. Commodities ETFs/ETPs reported net inflows of $2.08 Bn during March, bringing YTD net inflows to $3.05 Bn, significantly lower than the $19.59 Bn in net inflows YTD in 2022. Active ETFs attracted net inflows of $8.03 Bn during the month, gathering YTD net inflows of $11.27 Bn, lower than the $36.19 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $50.22 Bn during March. iShares Edge MSCI USA Quality Factor ETF (QUAL US) gathered $7.33 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows March 2023: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

26,694.19 |

7,261.54 |

7,333.91 |

|

iShares 7-10 Year Treasury Bond ETF |

|

IEF US |

30,012.51 |

6,329.97 |

6,175.44 |

|

Schwab 5-10 Year Corporate Bond ETF |

|

SCHI US |

5,000.12 |

4,628.71 |

4,613.14 |

|

iShares US Treasury Bond ETF |

|

GOVT US |

25,599.89 |

2,802.48 |

3,730.06 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

|

BIL US |

30,023.41 |

3,214.93 |

3,630.42 |

|

Vanguard S&P 500 ETF |

|

VOO US |

285,469.77 |

4,671.91 |

2,883.06 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

34,554.37 |

5,667.68 |

2,754.33 |

|

iShares 0-3 Month Treasury Bond ETF |

|

SGOV US |

10,372.31 |

2,935.07 |

2,231.70 |

|

SPDR Portfolio Intermediate Term Treasury ETF |

|

SPTI US |

5,479.66 |

1,766.94 |

1,766.47 |

|

JPMorgan Equity Premium Income ETF |

|

JEPI US |

23,426.01 |

5,906.76 |

1,607.99 |

|

WisdomTree Floating Rate Treasury Fund |

|

USFR US |

15,424.70 |

2,325.05 |

1,607.60 |

|

E Fund ChiNext Price Index ETF |

|

159915 CH |

4,943.01 |

1,788.30 |

1,456.43 |

|

iShares 1-3 Year Treasury Bond ETF |

|

SHY US |

28,155.83 |

324.86 |

1,447.23 |

|

Amundi MSCI Emerging Markets II - UCITS ETF - Dist |

|

AE5A GY |

1,762.36 |

1,716.55 |

1,415.62 |

|

SPDR S&P Regional Banking ETF |

|

KRE US |

2,849.23 |

918.25 |

1,363.51 |

|

iShares Core TOPIX ETF |

|

1475 JP |

8,298.80 |

1,601.94 |

1,341.01 |

|

Invesco QQQ Trust |

|

QQQ US |

172,391.16 |

(2,231.47) |

1,318.43 |

|

iShares MSCI EAFE Growth ETF |

|

EFG US |

12,782.99 |

1,812.56 |

1,207.19 |

|

Invesco Nasdaq 100 ETF |

|

QQQM US |

8,888.64 |

1,971.50 |

1,205.17 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

|

LQD US |

35,632.00 |

(965.85) |

1,128.45 |

The top 10 ETPs by net new assets collectively gathered $3.27 Bn over March. iShares Physical Gold ETC - Acc (SGLN LN) gathered $1.10 Bn, the largest individual net inflow.

Top 10 ETPs by net new inflows March 2023: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

|

SGLN LN |

15,556.77 |

739.88 |

1,096.87 |

|

|

SPDR Gold Shares |

|

GLD US |

58,086.11 |

773.60 |

855.12 |

|

ProShares Ultra DJ-UBS Natural Gas |

|

BOIL US |

1,132.23 |

1,684.15 |

315.61 |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

14,868.26 |

(1,110.64) |

217.31 |

|

WisdomTree Brent Crude Oil - Acc |

|

BRNT LN |

2,341.51 |

1,149.59 |

196.15 |

|

United States Natural Gas Fund LP |

|

UNG US |

1,115.15 |

1,132.50 |

130.38 |

|

ProShares Short VIX Short-Term Futures |

|

SVXY US |

301.70 |

(75.33) |

129.12 |

|

MicroSectors US Big Banks Index 3X Leveraged ETN |

|

BNKU US |

160.16 |

114.66 |

114.66 |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

|

GBSP LN |

1,380.81 |

112.26 |

111.06 |

|

WisdomTree Physical Gold - EUR Daily Hedged - Acc |

|

GBSE GY |

535.42 |

111.35 |

105.78 |

Investors have tended to invest in Fixed Income ETFs/ETPs during March.