ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, ETFGI reports the ETFs industry in the US reached a record of 8.54 trillion US Dollars at the end of February. ETFs listed in the US reported net inflows of US$58.29 billion during February, bringing year-to-date net inflows to US$129.38 billion, according to ETFGI's February 2024 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in the US reached a record of $8.54 Tn at the end of February beating the previous record of $8.19 Tn at the end of January 2024.

- Net inflows of $58.29 Bn in February 2024.

- YTD net inflows of $129.38 Bn are the second highest on record, while the highest recorded YTD net inflows are of $153.96 Bn for 2021 and the third highest recorded YTD net inflows are of $99.03 Bn in 2022.

- 22nd month of consecutive net inflows.

“The S&P 500 index increased by 5.34% in February and is up by 7.11% YTD. Developed markets excluding the US increased by 1.90% in February and are up 1.58% YTD. Ireland (up 8.60%) and Israel (up 8.27%) saw the largest increases amongst the developed markets in February. Emerging markets increased by 4.18% during February and are up 0.57% YTD. China (up 8.41%) and Peru (up 7.12%) saw the largest increases amongst emerging markets in February”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

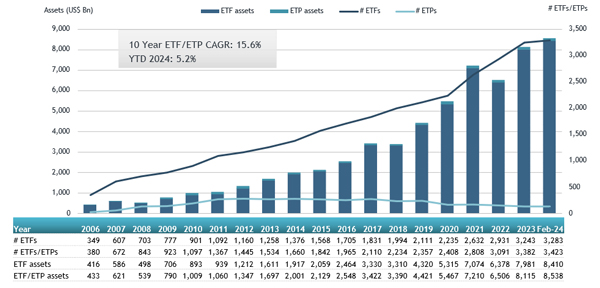

Growth in assets invested in the ETFs industry in the US as of the end of February

The ETFs industry in the US had 3,423 products, assets of $8.54 Tn, from 311 providers listed on 3 exchanges at the end of February.

During February, the ETFs gathered net inflows of $58.29 Bn. Equity ETFs gathered net inflows of

$31.35 Bn, bringing YTD net inflows to $45.97 Bn, much higher than the $7.29 Bn in net inflows YTD in 2023. Fixed income ETFs had net inflows of $6.19 Bn during February, bringing YTD net inflows to $21.81 Bn, higher than the $19.33 Bn in net inflows YTD in 2023. Commodities ETFs/ETPs reported net outflows of $2.55 Bn during February, bringing YTD net outflows to $5.36 Bn, lower than the $485.92 Mn in net inflows YTD in 2023. Active ETFs attracted net inflows of $18.19 Bn over the month, gathering YTD net inflows of $37.60 Bn, much higher than the $19.34 Bn in net inflows reported YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $48.30 Bn during February Vanguard S&P 500 ETF (VOO US) gathered $6.47 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets February 2024: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

415,632.82 |

16,310.05 |

6,467.13 |

|

Vanguard Information Technology ETF |

VGT US |

69,869.54 |

6,393.13 |

5,709.15 |

|

iShares Core S&P 500 ETF |

IVV US |

441,511.29 |

17,140.23 |

5,160.17 |

|

iShares Bitcoin Trust |

IBIT US |

10,009.46 |

7,769.26 |

4,969.22 |

|

Vanguard Intermediate-Term Treasury ETF |

VGIT US |

25,118.57 |

3,805.69 |

3,377.48 |

|

SPDR Portfolio S&P 500 ETF |

SPLG US |

32,162.82 |

4,419.51 |

2,981.11 |

|

Vanguard Total Stock Market ETF |

VTI US |

373,538.38 |

5,421.10 |

2,698.20 |

|

Fidelity Wise Origin Bitcoin Fund |

FBTC US |

6,471.90 |

4,800.11 |

2,296.22 |

|

Vanguard Total Bond Market ETF |

BND US |

105,550.84 |

2,902.79 |

1,655.43 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

101,640.34 |

2,096.53 |

1,592.21 |

|

Vanguard Small-Cap ETF |

VB US |

53,813.76 |

1,705.19 |

1,319.93 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

126,187.30 |

1,763.64 |

1,238.69 |

|

Vanguard Growth ETF |

VUG US |

116,116.33 |

1,857.00 |

1,236.08 |

|

Consumer Discretionary Select Sector SPDR Fund |

XLY US |

20,963.37 |

763.70 |

1,234.87 |

|

Vanguard Long-Term Treasury ETF |

VGLT US |

11,782.09 |

1,525.15 |

1,212.71 |

|

iShares MSCI Emerging Markets ex China ETF |

EMXC US |

10,902.16 |

1,976.35 |

1,207.31 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

65,942.99 |

1,887.49 |

1,124.39 |

|

Pacer US Small Cap Cash Cows 100 ETF |

CALF US |

8,897.62 |

2,103.80 |

988.38 |

|

ARK 21Shares Bitcoin ETF |

ARKB US |

2,105.52 |

1,585.12 |

927.37 |

|

VanEck Vectors Semiconductors ETF |

SMH US |

16,299.38 |

1,967.40 |

901.08 |

The top 10 ETPs by net assets collectively gathered $495.02 Mn during February. United States Natural Gas Fund LP (UNG US) gathered $221.07 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets February 2024: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

United States Natural Gas Fund LP |

UNG US |

869.11 |

(11.69) |

221.07 |

|

Alerian MLP Index ETNs due January 28 2044 |

AMJB US |

108.60 |

105.26 |

105.26 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

584.62 |

87.84 |

75.32 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

289.15 |

58.17 |

19.54 |

|

Invesco DB Commodity Index Tracking Fund |

DBC US |

1,659.59 |

(20.26) |

16.52 |

|

MicroSectors FANG+ Index -3X Inverse Leveraged ETNs due January 8, 2038 |

FNGD US |

114.88 |

14.34 |

14.34 |

|

United States Gasoline Fund LP |

UGA US |

107.02 |

13.07 |

13.13 |

|

SPDR Gold MiniShares Trust |

GLDM US |

6,374.01 |

55.44 |

11.43 |

|

ProShares Short VIX Short-Term Futures |

SVXY US |

329.43 |

41.80 |

9.73 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

155.72 |

21.10 |

8.69 |

Investors have tended to invest in Equity ETFs/ETPs during February.