ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in the United States gathered net inflows of US$35.54 billion during July, bringing year-to-date net inflows to US$343.03 billion. During the month, assets invested in the ETFs industry in the US increased by 6.9%, from US$6.18 trillion at the end of June to US$6.61 trillion, according to ETFGI's July 2022 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Net inflows of $35.54 Bn in July 2022.

- YTD net inflows of $343.03 Bn in 2022 are the second highest on record, after YTD net inflows of $523.89 Bn in 2021.

- Assets invested in the ETFs industry in the US increased by 6.9% in July, going from $6.18 Tr at the end of June to $6.61 Tr.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

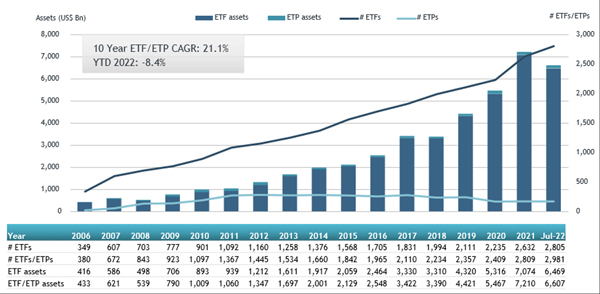

Growth in US ETF and ETP assets as of the end of July 2022

The ETFs industry in the United States had 2,981 products, assets of $6.61 Tn, from 251 providers on 3 exchanges.

During July, ETFs/ETPs gathered net inflows of $35.54 Bn. Equity ETFs/ETPs gathered net inflows of $6.90 Bn during July, bringing YTD net inflows to $166.32 Bn, lower than the $360.22 Bn in net inflows equity products gathered at this point in 2021. Fixed income ETFs/ETPs gathered net inflows of $26.87 Bn during July, bringing YTD net inflows to $92.90 Bn, which is lower than the $100.87 Bn in net inflows fixed income products had attracted YTD in 2021. Commodities ETFs/ETPs reported net outflows of $5.89 Bn during July, bringing YTD net inflows to $4.19 Bn, higher than the $7.62 Bn in net outflows commodities products had reported year to date in 2021. Active ETFs/ETPs gathered net inflows of $4.39 Bn during the month, bringing YTD net inflows to $57.36 Bn, which is lower than the $63.91 Bn in net inflows active products had reported by the end of July 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.23 Bn during July. iShares US Treasury Bond ETF (GOVT US) gathered $4.77 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets July 2022: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares US Treasury Bond ETF |

GOVT US |

23,041.64 |

8,154.68 |

4,772.77 |

|

Vanguard S&P 500 ETF |

VOO US |

271,258.78 |

29,475.63 |

4,173.78 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

24,868.55 |

9,415.77 |

4,134.88 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

35,754.83 |

1,938.26 |

3,318.00 |

|

iShares Core S&P 500 ETF |

IVV US |

302,751.94 |

13,458.81 |

2,388.81 |

|

iShares 10-20 Year Treasury Bond ETF |

TLH US |

4,667.80 |

3,471.37 |

2,203.05 |

|

Invesco QQQ Trust |

QQQ US |

174,303.63 |

2,141.07 |

1,722.92 |

|

Vanguard Total Stock Market ETF |

VTI US |

267,116.66 |

14,364.86 |

1,671.58 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

15,392.31 |

(4,595.01) |

1,604.19 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

8,080.98 |

(624.56) |

1,530.23 |

|

iShares 7-10 Year Treasury Bond ETF |

IEF US |

21,616.61 |

5,487.47 |

1,463.38 |

|

iShares MSCI EAFE Growth ETF |

EFG US |

10,133.05 |

(756.29) |

1,415.23 |

|

iShares MSCI USA Min Vol Factor ETF |

USMV US |

28,645.33 |

830.55 |

1,357.72 |

|

ProShares UltraPro Short QQQ |

SQQQ US |

4,225.73 |

2,209.87 |

1,348.66 |

|

Vanguard Growth ETF |

VUG US |

77,124.52 |

6,166.44 |

1,318.22 |

|

iShares Broad USD High Yield Corporate Bond ETF |

USHY US |

8,300.99 |

365.91 |

1,316.47 |

|

iShares Core S&P Small-Cap ETF |

IJR US |

67,819.42 |

1,123.55 |

1,304.23 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

11,690.54 |

6,510.80 |

1,127.84 |

|

Invesco S&P 500 Low Volatility ETF |

SPLV US |

11,014.65 |

2,580.24 |

1,033.21 |

|

SPDR Portfolio S&P 500 Growth ETF |

SPYG US |

14,435.38 |

984.22 |

1,021.37 |

The top 10 ETPs by net new assets collectively gathered $1.84 Bn during July. ProShares Ultra VIX Short-Term Futures (UVXY US) gathered $695 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets July 2022: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

1,275.90 |

351.65 |

694.48 |

|

ProShares UltraShort DJ-UBS Natural Gas |

KOLD US |

369.60 |

582.38 |

325.35 |

|

SPDR Gold MiniShares Trust |

GLDM US |

5,168.22 |

1,056.03 |

251.64 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

1,963.99 |

1,134.09 |

220.83 |

|

Invesco CurrencyShares Euro Currency Trust |

FXE US |

329.65 |

142.38 |

118.20 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

355.07 |

58.06 |

88.22 |

|

ProShares UltraShort DJ-UBS Crude Oil |

SCO US |

537.40 |

604.60 |

45.69 |

|

MicroSectors Gold Miners 3X Leveraged ETN - Acc |

GDXU US |

66.41 |

55.97 |

33.16 |

|

Invesco CurrencyShares Japanese Yen Trust |

FXY US |

178.40 |

33.33 |

30.97 |

|

ProShares Ultra Silver |

AGQ US |

377.96 |

12.29 |

29.37 |

Investors have tended to invest in Fixed Income ETFs/ETPs during July.

.jpg)