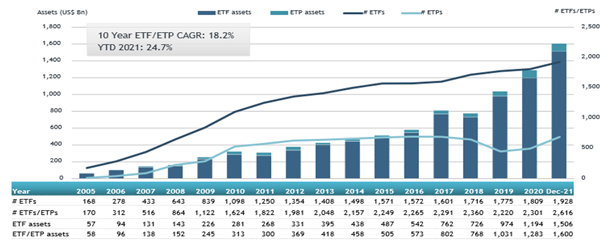

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that the ETFs industry in Europe ended 2021 with record net inflows of US$194 billion and record assets of US$1.60 trillion. During December the industry gathered net inflows of US$11.71 billion, bringing year-to-date net inflows to a record US$193.64 billion. Assets invested in the European ETFs/ETPs industry increased by 3.2% in December and 24.7% during 2021, according to ETFGI's December 2021 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets in the ETFs industry in Europe reach a record $1.60 trillion at the end of 2021.

- At the end of 2021 the European ETFs industry had 2,616 products, with 10,279 listings, from 89 providers listed on 29 exchanges in 24 countries.

- In Europe the top 3 providers are iShares with 43.7% market share; Xtrackers with 10.9%, followed by Lyxor Asset Management with 7.1% market share.

- Assets increased 24.7% YTD in 2021, going from US$1.28 trillion at end of 2020, to US$1.60 trillion.

- Record YTD 2021 net inflows of $193.64 Bn beating the prior record of $108.18 Bn gathered in YTD 2017.

- $193.64 Bn YTD net inflows are $74.39 Bn over full year 2020 record net inflows $119.25 Bn.

- Equity ETFs listed in Europe gathered a record $136.19 Bn 2021 which is more than double the net inflows of $62.59 Bn equity ETFs gathered in 2020.

- 21st month of consecutive net inflows

“The S&P 500 increased 4.48% in December and was up 28.71% in 2021. Developed markets excluding the US, experienced a gain of 4.89% in December an was up 11.38% in 2021. Luxembourg (Up 12.65%) and Ireland (Up 9.68%) experienced the largest gains among the developed markets in December. Emerging markets were up 1.60% during December and gained 1.22% in 2021. Mexico (up 12.80%) and Czech Republic (up 12.55%) gained the most among emerging markets in December, whilst Chile (down 5.26%) and China (down 2.73%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of December 2021

The European ETFs industry had 2,616 products with 10,279 listings, assets of $1.60 trillion, from 89 providers listed on 29 exchanges in 24 countries at the end of 2021.

Equity ETFs/ETPs listed in Europe reported net inflows of $5.64 Bn during December, bringing net inflows for 2021 to $136.19 Bn, much higher than the $62.59 Bn in net inflows equity products had attracted in 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $4.70 Bn during December, taking net inflows for 2021 to $44.53 Bn, greater than the $40.99 Bn in net inflows fixed income products had in 2020. Commodity ETFs/ETPs reported $1.40 Bn in net inflows, bringing net inflows to $3.05 Bn for 2021, which is lower than the $15.68 Bn in net inflows gathered in 2020. Active ETFs/ETPs listed in Europe reported net outflows of $67 Mn in December, bringing net inflows for 2021 to $5.40 Bn, significantly higher than the $1.60 Bn in net inflows active products gathered in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $10.72 Bn during December. iShares Core S&P 500 UCITS ETF - Acc (CSSPX SW) gathered $1.08 Bn the largest individual net inflow.

Top 20 ETFs by net inflows in December 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 UCITS ETF - Acc |

CSSPX SW |

58,223.54 |

3,934.08 |

1,079.97 |

|

iShares Edge MSCI World Minimum Volatility UCITS ETF - Acc |

MVOL LN |

4,329.03 |

80.11 |

990.29 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

JPEA LN |

2,356.35 |

528.51 |

702.18 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

9,449.25 |

2,667.13 |

687.77 |

|

AMUNDI S&P 500 ESG UCITS ETF |

S500 FP |

1,640.76 |

1,124.53 |

642.12 |

|

iShares $ Treasury Bond 1-3yr UCITS ETF |

IBTS LN |

4,102.71 |

1,045.55 |

561.70 |

|

Invesco US Treasury UCITS ETF |

TRES LN |

635.05 |

549.23 |

549.95 |

|

L&G Multi-Strategy Enhanced Commodities UCITS ETF - Acc |

ENCO LN |

608.22 |

571.62 |

535.32 |

|

Lyxor MSCI Europe ESG Leaders DR UCITS ETF - Acc |

ESGE FP |

1,620.12 |

215.84 |

487.01 |

|

iShares Bloomberg Roll Select Commodity Swap UCITS ETF - Acc |

ROLL LN |

844.49 |

562.59 |

476.64 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

4,729.67 |

1,971.64 |

463.72 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

13,689.93 |

2,186.56 |

420.37 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

4,735.14 |

2,352.10 |

418.90 |

|

iShares MSCI Europe ex-UK UCITS ETF |

IEUX LN |

2,124.30 |

555.31 |

414.90 |

|

Xtrackers II Japan Government Bond UCITS ETF - Acc |

XJSE GY |

1,239.40 |

(0.60) |

403.36 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

5,213.21 |

2,013.15 |

398.91 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

3,464.81 |

1,870.87 |

379.59 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

4,501.24 |

2,523.47 |

378.94 |

|

WisdomTree Enhanced Commodity UCITS ETF - USD |

WCOG LN |

388.67 |

378.49 |

368.17 |

|

Invesco EQQQ Nasdaq-100 UCITS ETF |

EQQQ IM |

5,529.96 |

129.45 |

361.97 |

The top 10 ETPs by net new assets collectively gathered $1.56 Bn during December. Invesco Physical Gold ETC – Acc (SGLD LN) gathered $351 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in December 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

14,225.27 |

823.17 |

351.36 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

XAD5 GY |

2,918.67 |

(1,148.04) |

294.24 |

|

WisdomTree Core Physical Gold - Acc |

WGLD LN |

411.79 |

394.17 |

236.40 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,960.36 |

858.40 |

198.96 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

12,855.31 |

(797.24) |

194.88 |

|

WisdomTree WTI Crude Oil - Acc |

CRUD LN |

1,600.46 |

(539.15) |

119.68 |

|

SparkChange Physical Carbon EUA ETC |

CO2P LN |

203.62 |

186.62 |

64.34 |

|

Leverage Shares 3x Tesla ETP - Acc |

TSL3 LN |

74.02 |

73.13 |

39.13 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

1,941.75 |

(1,191.39) |

32.18 |

|

Xetra Gold EUR - Acc |

4GLD GY |

13,711.25 |

1,205.38 |

31.56 |

Investors have tended to invest in Equity ETFs and ETPs during December.