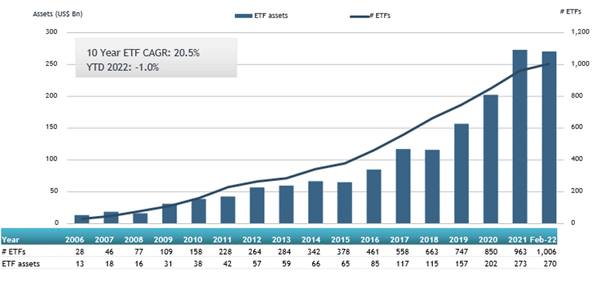

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs listed in Canada gathered net inflows of US$3.36 billion during February, bringing year-to-date net inflows to US$7.77 billion. At the end of the month, Canadian ETF assets increased by 0.4%, from US$269 billion at the end of January to US$270 billion but are below the record high of US$273 billion set at the end of 2021, according to ETFGI's February 2022 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $270 Bn invested in ETFs listed in Canada at end of February are the 2nd highest on record.

- Assets increased by 0.4%, from $269 billion at the end of January to $270 billion at end of February

- Net inflows of $3.36 Bn gathered in February 2022.

- $46.51 Bn in net inflows gathered in the past 12 months.

- 32nd month of consecutive net inflows.

- Majority of net inflows have gone into Equity exposure in February and year to date.

“The S&P 500 decreased by 2.99% in February as the world watches the situation in the Ukraine unfold. Developed markets excluding the US, experienced a loss of 1.34% in February. Japan (down 0.59%) and Portugal (down 0.62%) experienced the smallest losses amongst the developed markets in February, while Austria suffered the largest loss of 10.92%. Emerging markets decreased by 3.43% during February. Peru (up 7.07%) and UAE (up 6.02%) gained the most while Russia (down 50.32 %) and Hungary (down 24.63 %) witnessed the largest declines. S&P Dow Jones announced the removal of all stocks domiciled and listed in Russia due to the country’s invasion of Ukraine.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in Canadian ETF assets as of the end of February 2022

The Canadian ETF industry had 1,006 ETFs, with 1,274 listings, assets of $270 Bn, from 42 providers listed on 2 exchanges at the end of February.

During February 2022, ETFs gathered net inflows of $3.36 Bn. Equity ETFs gathered net inflows of $2.19 Bn over February, bringing year to date net inflows to $5.68 Bn, higher than the $4.35 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs had net outflows of $531 Mn during February, bringing net outflows for the year through February 2022 to $464 Mn, lower than the $960 Mn in net inflows fixed income products had attracted by the end of February 2021. Commodities ETFs reported net outflows of $43 Mn during February, bringing net outflows for the year to February 2022 to $194 Mn, lower than the $10 Mn in net outflows commodities products had reported year to date in 2021. Active ETFs attracted net inflows of $1.42 Bn over the month, gathering net inflows year to date of $2.31 Bn, higher than the $1.77 Bn in net inflows active products had reported in the first two months of 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.62 Bn during February. iShares S&P/TSX 60 Index Fund (XIU CN) gathered $980 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets February 2022: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XIU CN |

9,983.43 |

1,365.63 |

979.85 |

|

|

BMO MSCI USA ESG Leaders Index ETF |

ESGY CN |

1,223.46 |

592.56 |

584.45 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

601.42 |

382.91 |

352.07 |

|

iShares Core S&P/TSX Capped Composite Index ETF |

XIC CN |

8,242.80 |

138.13 |

338.48 |

|

Horizons Cash Maximizer ETF - Acc |

HSAV CN |

1,636.95 |

435.33 |

232.66 |

|

Horizon S&P/TSX 60 Index ETF - Acc |

HXT CN |

2,596.23 |

334.52 |

155.76 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

4,826.75 |

3.28 |

105.47 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

5,092.12 |

372.54 |

101.66 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

4,070.48 |

237.21 |

72.47 |

|

BMO Covered Call Canadian Banks ETF |

ZWB CN |

2,197.90 |

120.32 |

69.10 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

2,656.13 |

172.84 |

66.82 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

1,485.75 |

210.52 |

65.71 |

|

BMO S&P 500 Index ETF |

ZSP CN |

8,425.56 |

475.29 |

65.54 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

4,414.59 |

(62.96) |

63.82 |

|

Vanguard FTSE Developed All Cap EX North America Index ETF |

VIU CN |

2,267.15 |

145.90 |

63.80 |

|

Mackenzie US Large Cap Equity Index ETF |

QUU CN |

1,713.75 |

102.42 |

63.55 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

3,845.57 |

133.17 |

63.20 |

|

iShares Floating Rate Index ETF |

XFR CN |

310.22 |

91.82 |

59.98 |

|

AGFiQ US Market Neutral Anti-Beta CAD-Hedged ETF |

QBTL CN |

318.81 |

56.33 |

56.33 |

|

CI First Asset Morningstar Canada Momentum Index ETF |

WXM CN |

735.91 |

81.78 |

55.86 |

Investors have tended to invest in Equity ETFs during February.