ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs industry in Canada gathered net inflows of US$1.52 billion during July, bringing year-to-date net inflows to US$16.79 billion. During the month, Canadian ETF assets increased by 5.8%, from US$243 billion at the end of June to US$257 billion, according to ETFGI's July 2022 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

-

Net inflows of $1.52 Bn in July 2022.

-

Net inflows of $16.79 Bn during 2022 are the third highest on record, after YTD net inflows of $28.60 Bn in 2021 and YTD net inflows of $21.71 Bn in 2020.

-

Assets of $257 Bn invested in ETFs listed in Canada at the end of July 2022.

-

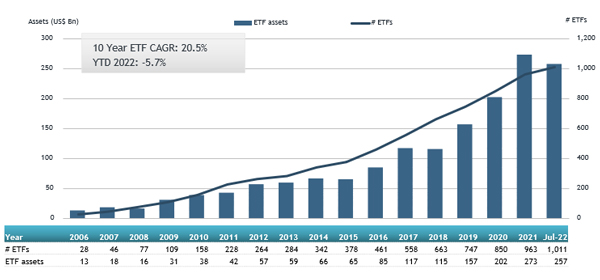

Assets have decreased 5.7% YTD in 2022, going from $273 Bn at the end of 2021, to $257 Bn.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in Canadian ETF assets as of the end of July 2022

The Canadian ETF industry had 1,011 ETFs, with 1,277 listings, assets of $257 Bn, from 42 providers on 2 exchanges at the end of July 2022.

During July, ETFs gathered net inflows of $1.52 Bn. Equity ETFs suffered net outflows of $625 Mn during July, bringing net inflows for the year through July 2022 to $6.19 Bn, lower than the $13.00 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs gathered net inflows of $328 Mn during July, bringing net inflows for the year through July 2022 to $2.05 Bn, lower than the $3.37 Bn in net inflows fixed income products had attracted by the end of July 2021. Active ETFs attracted net inflows of $1.51 Bn over the month, gathering net inflows for the year in Canada of $8.01 Bn, slightly lower than the $8.14 Bn in net inflows active products had reported by the end of July 2021. Currency ETFs reported net inflows of $155 Mn during July, bringing net inflows for the year through July 2022 to $36 Mn, lower than the $3.12 Bn in net inflows currency products had reported year to date in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.47 Bn during July. TD Canadian Long Term Federal Bond ETF (TCLB CN) gathered $313 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets July 2022: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

TCLB CN |

1,052.21 |

875.41 |

313.28 |

|

|

BMO Short Federal Bond Index ETF |

ZFS CN |

562.47 |

204.22 |

296.37 |

|

CI High Interest Savings ETF |

CSAV CN |

2,268.87 |

637.56 |

236.91 |

|

High Interest Savings Account Fund |

HISA CN |

349.43 |

142.84 |

151.44 |

|

Purpose High Interest Savings ETF |

PSA CN |

1,721.67 |

299.30 |

147.36 |

|

BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF |

ZMU CN |

1,786.68 |

540.11 |

147.21 |

|

iShares Canadian Corporate Bond Index Fund |

XCB CN |

1,132.67 |

65.17 |

118.25 |

|

BMO Mid-Term US IG Corporate Bond Index ETF |

ZIC CN |

1,845.56 |

474.29 |

106.69 |

|

BMO MSCI Emerging Markets Index ETF |

ZEM CN |

921.34 |

(431.16) |

100.97 |

|

BMO Money Market Fund |

ZMMK CN |

178.52 |

50.21 |

100.23 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

2,726.06 |

456.99 |

91.99 |

|

Invesco ESG Global Bond ETF |

IWBE CN |

123.46 |

122.15 |

88.87 |

|

BMO S&P/TSX Capped Composite Index ETF |

ZCN CN |

5,562.19 |

50.70 |

78.93 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

4,072.32 |

96.41 |

75.05 |

|

iShares Core Growth ETF Portfo |

XGRO CN |

1,111.70 |

249.51 |

74.20 |

|

Purpose Bitcoin ETF - CAD - Acc |

BTCC/B CN |

571.41 |

108.49 |

73.45 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

4,139.33 |

578.69 |

69.76 |

|

BMO Short Corporate Bond Index ETF |

ZCS CN |

1,077.20 |

108.36 |

69.12 |

|

Purpose Ether ETF - CAD Hdg |

ETHH CN |

317.45 |

232.79 |

68.30 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

3,719.87 |

320.49 |

64.31 |

Investors have tended to invest in Active ETFs during July.