ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reports the ETFs industry in Canada gathered a record US$64.03 billion in net inflows during 2024. Net inflows of US$8.65 billion were gathered during December, bringing year-to-date net inflows to a record US$64.03 billion, according to ETFGI's December 2024 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record 2024 net inflows of $64.03 Bn, while the second highest full year net inflows was $46.55 Bn in 2021 and the third highest full year net inflows was $31.59 Bn in 2023.

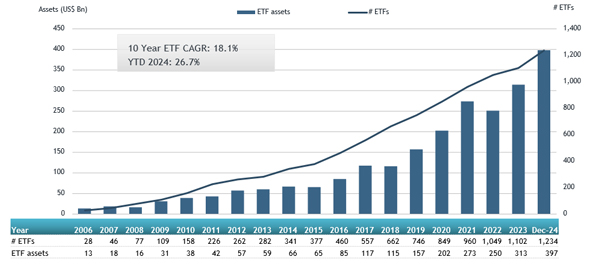

- Assets of $397.15 Bn invested in the ETFs industry in Canada at the end of 2024 are the second highest on record, below the record $404.60 Bn set at the end of November 2024.

- Assets increased 26.7% in 2024, going from $313.48 Bn at the end of 2023 to $397.15 Bn.

- 30th month of consecutive net inflows.

“The S&P 500 index decreased by 2.38% in December but was up by 25.02% in 2024. The developed markets excluding the US index decreased by 2.78% in December but is up 3.81% in 2024. Denmark (down 12.34%) and Australia (down 7.90%) saw the largest decreases amongst the developed markets in December. The emerging markets index increased by 0.19% during December and is up 11.96% in 2024. United Arab Emirates (up 6.42%) and Greece (up 4.21%) saw the largest increases amongst emerging markets in December”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Asset growth in the ETFs industry in the Canada as of the end of December

The ETFs industry in Canada had 1,234 ETFs, with 1,542 listings, assets of $397.15 Bn, from 45 providers on 2 exchanges.

During December, ETFs gathered net inflows of $8.65 Bn. Equity ETFs reported net inflows of $5.29 Bn during December, bringing net inflows for 2024 to $29.48 Bn, higher than the $7.37 Bn in net in 2023. Fixed income ETFs had net inflows of $1.30 Bn during December, bringing 2024 net inflows to $10.19 Bn, higher than the $6.78 Bn in net inflows in 2023. Active ETFs attracted net inflows of $2.35 Bn in the month, gathering 2024 net inflows of $23.36 Bn, higher than the $16.32 Bn in net inflows in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $4.67 Bn during December. iShares S&P/TSX 60 Index Fund (XIU CN) gathered $1.28 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets December 2024: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XIU CN |

11,426.80 |

1,417.97 |

1,282.80 |

|

|

Vanguard S&P 500 Index ETF |

VFV CN |

14,387.83 |

4,496.39 |

371.23 |

|

BMO Long Federal Bond Index ETF |

ZFL CN |

2,606.01 |

388.10 |

249.85 |

|

BMO S&P 500 Index ETF |

ZSP CN |

15,561.42 |

1,977.86 |

237.45 |

|

iShares Core Equity ETF Portfolio |

XEQT CN |

4,107.56 |

2,076.08 |

234.14 |

|

Vanguard S&P 500 Index ETF (CAD-hedged) |

VSP CN |

2,796.88 |

455.25 |

231.98 |

|

iShares S&P/TSX Capped Energy Index ETF |

XEG CN |

1,191.81 |

(146.24) |

228.22 |

|

iShares Core Canadian Short Term Bond Index ETF |

XSB CN |

1,899.52 |

326.89 |

196.17 |

|

BMO Money Market Fund |

ZMMK CN |

2,241.90 |

1,689.01 |

177.94 |

|

CIBC US Equity Index ETF |

CUEI CN |

517.76 |

262.94 |

162.90 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

5,847.32 |

777.04 |

156.31 |

|

BMO MSCI USA High Quality Index ETF |

ZUQ CN |

909.45 |

336.27 |

150.96 |

|

BMO NASDAQ 100 Equity Index ETF |

ZNQ CN |

931.65 |

420.04 |

141.39 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

7,658.84 |

1,219.89 |

134.73 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

4,078.55 |

1,282.32 |

132.91 |

|

Fidelity All-in-One Balanced ETF |

FBAL CN |

1,434.30 |

1,045.08 |

132.63 |

|

iShares Core S&P 500 Index ETF (CAD-Hedged) |

XSP CN |

7,879.62 |

306.30 |

124.70 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

6,894.22 |

2,232.68 |

114.33 |

|

BMO MSCI Emerging Markets Index ETF |

ZEM CN |

795.76 |

(186.37) |

110.14 |

|

Invesco 1-5 Year Laddered Investment Grade Corporate Bond Index |

PSB CN |

371.79 |

118.91 |

101.04 |

Investors have tended to invest in Equity ETFs during December.