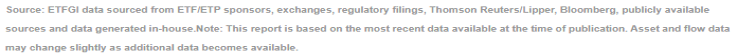

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today the ETFs industry in Canada celebrated its 32nd anniversary and reached a record US$276 billion US Dollars in assets at the end of Q1 2022. The ETFs industry in Canada gathered net inflows of US$4.29 billion during March, bringing year-to-date net inflows to US$12.05 billion. At the end of the month, Canadian ETF assets increased by 2.0%, from US$270 billion at the end of February to US$276 billion, according to ETFGI's March 2022 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- March 9th marked the 32nd anniversary of the listing of the first ETF in Canada.

- Record $276 Bn invested in ETFs industry in Canada at the end of March 2022.

- Assets increased 1.0% YTD in 2022, going from $273 Bn at the end of 2021, to $276 Bn.

- Net inflows of $4.29 Bn in March 2022.

- Year-to-date net inflows are $12.05 Bn slightly down from the YTD $12.08 Bn gathered in 2022 and the record YTD $12.10 Bn gathered in 2021.

- $46.57 Bn in net inflows gathered in the past 12 months.

- 33rd month of consecutive net inflows.

- Equity ETFs and ETPs listed in Canada gathered a record $7.38 Bn in YTD net inflows 2022.

“The S&P 500 increased by 3.71% in March but is down 4.60% YTD in 2022. Developed markets excluding the US, increased by 1.10% in March but are down 5.57% YTD 2022. Australia (up 10.46%) and Portugal (up 6.50%) experienced the largest increases amongst the developed markets in March. Emerging markets decreased by 2.27% during March but are down 6.52% YTD in 2022. Egypt (down 14.31%) and China (down 8.34%) witnessed the largest declines among emerging markets in March, whilst Brazil (up 14.51%) and Colombia (up 11.98%) gained the most.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in Canadian ETF assets as of the end of March 2022

Thirty two years ago on March 9th, 1990 the first ETF was listed in Canada on the Toronto Stock Exchange: the TIPs (Toronto 35 Index Participation Fund) tracking the TSX 35 index. The TIPS ETF listed nearly three years before the first ETF the SPDR S&P 500 ETF (SPY) was listed in the United States on January 29, 1993.

At the end of March 2022, the Canadian ETFs industry had 1,014 products, with 1,281 listings, record assets of $276 Bn, from 42 providers listed on 2 exchanges.

During March, ETFs gathered net inflows of $4.29 Bn. Equity ETFs gathered net inflows of $1.70 Bn during March, bringing YTD net inflows 2022 to $7.38 Bn, higher than the $5.35 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs gathered net inflows of $1.51 Bn during March, bringing net inflows for the YTD to $1.04 Bn, lower than the $1.37 Bn in net inflows fixed income products had attracted YTD in 2021. Commodities ETFs reported net outflows of $38 Mn during March, bringing net outflows YTD 2022 to $232 Mn, lower than the $207 Mn in net inflows commodities products had reported year to date in 2021. Active ETFs suffered net inflows of $726 Mn during March, YTD net inflows are $3.03 Bn, lower than the $3.92 Bn in net inflows active products had reported in the first three months of 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $4.55 Bn during March. Horizons Cdn Select Universe Bond ETF (HBB CN) gathered $519 Mn, the largest individual net inflow.Top 20 ETFs by net new assets March 2022: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

HBB CN |

1,321.03 |

141.39 |

519.46 |

|

|

BMO Aggregate Bond Index ETF |

ZAG CN |

5,039.45 |

400.99 |

397.71 |

|

BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF |

ZMU CN |

1,745.18 |

397.85 |

393.66 |

|

Horizon S&P/TSX 60 Index ETF - Acc |

HXT CN |

3,070.22 |

720.79 |

386.27 |

|

BMO Mid-Term US IG Corporate Bond Index ETF |

ZIC CN |

1,821.29 |

391.75 |

383.00 |

|

iShares S&P/TSX Capped Energy Index ETF |

XEG CN |

1,678.94 |

333.40 |

259.32 |

|

BMO MSCI USA ESG Leaders Index ETF |

ESGY CN |

1,504.71 |

839.19 |

246.63 |

|

BMO Japan Index ETF |

ZJPN CN |

237.31 |

240.81 |

235.06 |

|

BMO MSCI Europe High Quality Hedged to CAD Index ETF |

ZEQ CN |

624.14 |

258.71 |

232.14 |

|

BMO High Yield US Corporate Bond Hedged to CAD Index ETF |

ZHY CN |

679.14 |

209.86 |

201.28 |

|

BMO High Yield US Corporate Bond Index ETF |

ZJK CN |

713.78 |

212.08 |

200.74 |

|

BMO Equal Weight Banks Index ETF |

ZEB CN |

2,183.96 |

23.25 |

154.01 |

|

Purpose Bitcoin ETF - CAD - Acc |

BTCC/B CN |

1,626.22 |

242.70 |

144.73 |

|

Mackenzie US Large Cap Equity Index ETF |

QUU CN |

1,899.12 |

245.73 |

143.31 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

5,315.88 |

500.60 |

128.06 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

4,247.81 |

364.68 |

127.47 |

|

BMO Ultra Short-Term US Bond ETF |

ZUS/U CN |

231.94 |

97.12 |

107.20 |

|

iShares 1-10 Year Laddered Goverment Bond Index Fund |

CLG CN |

366.08 |

113.77 |

103.90 |

|

BMO Core Plus Bond Fund ETF - CAD Hdg - Acc |

ZCPB CN |

1,064.54 |

126.84 |

101.20 |

|

NBI Active International Equity ETF |

NINT CN |

183.96 |

101.82 |

89.04 |

Investors have tended to invest in Equity ETFs during March.