ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that ETFs industry in Asia Pacific ex Japan gathered net inflows of US$559 million during February, bringing year-to-date net inflows to US$1.99 billion. During the month, assets invested in the Asia Pacific ex-Japan ETFs industry increased by 6.1%, from US$555 billion at the end of January to US$588 billion, according to ETFGI's February 2023 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Asia Pacific ex Japan gathered $559 million in net inflows during February

- YTD net inflows of $1.99 Bn are the eighth highest on record, while the highest recorded YTD net inflows are $31.38 Bn for 2022 followed by YTD net inflows of $12.34 Bn in 2021.

- 20th month of consecutive net inflows.

- Assets of $588 Bn invested in ETFs industry in Asia Pacific ex Japan at end of February.

“The S&P 500 decreased by 2.44 % in February but is up by 3.69% YTD in 2023. Developed markets excluding the US decreased by 2.59% in February but are up 5.47% YTD in 2023. Israel (down 6.97%) and Hong Kong (down 6.94%) saw the largest decreases amongst the developed markets in February. Emerging markets decreased by 5.57% during February but are up 0.72% YTD in 2023. Colombia (down 11.62%) and Thailand (down 9.38%) saw the largest decreases amongst emerging markets in February.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

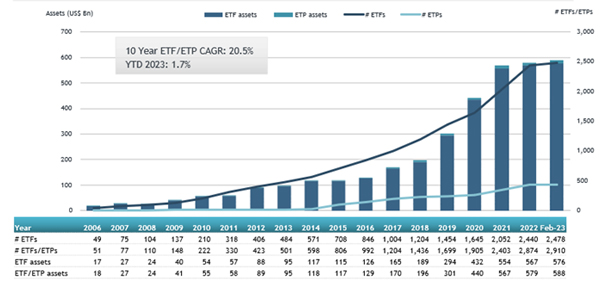

Asia Pacific (ex-Japan) ETF and ETP asset growth as at the end of February 2023

ETFs industry in Asia Pacific ex Japan had 2,910 products, with 3,075 listings, assets of $588 Bn, from 236 providers listed on 20 exchanges in 15 countries at the end of February.

During February, ETFs gathered net inflows of $559 Mn. Equity ETFs suffered net outflows of $4.50 Bn over February, bringing YTD net outflows to $2.66 Bn, much lower than the $26.35 Bn in net inflows YTD in 2022. Fixed income ETFs reported net inflows of $3.10 Mn during February, bringing YTD net inflows to $2.94 Bn, lower than the $3.87 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net inflows of $99 Mn during February, bringing YTD net outflows to $137 Mn, less than the $1.05 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $1.45 Bn over the month, gathering YTD net inflows of $1.89 Bn, slightly higher than the $1.78 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $6.54 Bn during February. Cathay Taiwan Select ESG Sustainability High Yield ETF (00878 TT) gathered $615 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets in February 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

5,410.19 |

666.05 |

615.33 |

|

Yuanta US Treasury 20+ Year Bond ETF |

00679B TT |

1,918.98 |

489.41 |

490.55 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

17,015.98 |

(909.76) |

489.45 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

16,066.60 |

(623.11) |

430.60 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

8,077.87 |

524.31 |

391.41 |

|

GTJA Allianz CSI All-share Semi-conductor Product and Equipment ETF - Acc |

512480 CH |

2,701.58 |

518.89 |

376.37 |

|

Samsung KODEX 200 ETF |

069500 KS |

4,524.41 |

416.43 |

375.12 |

|

Hang Seng China Enterprises Index ETF |

2828 HK |

3,875.16 |

(642.75) |

368.72 |

|

E Fund ChiNext Price Index ETF |

159915 CH |

3,449.95 |

331.87 |

359.00 |

|

CTBC Bloomberg USD Corporate 10+ Year High Grade Capped Bond ETF - Acc |

00772B TT |

2,570.44 |

461.72 |

320.35 |

|

ChinaAMC CNI Semi-conductor Chip ETF |

159995 CH |

3,560.16 |

600.40 |

288.47 |

|

CSOP Hang Seng TECH Index Daily 2X Leveraged Product |

7226 HK |

718.01 |

82.91 |

269.77 |

|

Yuanta US 20+ Year BBB Corporate Bond ETF - Acc |

00720B TT |

1,625.58 |

574.97 |

262.89 |

|

HuaAn ChiNext 50 ETF Fund |

159949 CH |

1,908.27 |

273.92 |

235.03 |

|

KGI 15+ Years AAA-A US Corporate Bond ETF |

00777B TT |

1,320.12 |

225.91 |

225.91 |

|

KGI 25+ Years US Treasury Bond ETF |

00779B TT |

842.54 |

216.80 |

216.80 |

|

CCB Cash TianYi Traded Money Market Fund - Acc |

511660 CH |

2,771.04 |

204.98 |

214.82 |

|

iShares Core S&P/ASX 200 ETF |

IOZ AU |

2,711.12 |

252.84 |

206.81 |

|

Harvest CSI Vaccine and Biotechnology ETF |

562860 CH |

199.79 |

200.44 |

200.44 |

|

Samsung Kodex KOSDAQ150 Inverse ETF - Acc |

251340 KS |

395.94 |

209.44 |

199.68 |

The top ETPs by net new assets collectively gathered $186.33 Mn during February. Samsung Securities Samsung Leverage Natural Gas Futures ETN B 68 - Acc (530068 KS) gathered $82.18 Mn, the largest individual net inflow.

Top ETPs by net inflows in February 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Samsung Securities Samsung Leverage Natural Gas Futures ETN B 68 - Acc |

530068 KS |

133.55 |

113.36 |

82.18 |

|

Korea Investment & Securities TRUE Inverse 2X KOSDAQ 150 Futures ETN 82 |

570082 KS |

47.03 |

37.63 |

37.63 |

|

KB Securities KB Leveraged NASDAQ 100 ETN |

580015 KS |

21.62 |

14.41 |

14.41 |

|

KB Securities KB Bloomberg Leverage Natural Gas Futures ETN H 45 |

580045 KS |

17.96 |

13.47 |

13.47 |

|

KB Securities KB Natural Gas Futures ETN H 20 |

580020 KS |

20.08 |

13.39 |

13.39 |

|

Shinhan Securities Shinhan Bloomberg 2X Natural Gas Futures ETN H 73 |

500073 KS |

17.97 |

13.87 |

8.98 |

|

Korea Investment & Securities TRUE Inverse 2X EURO STOXX 50 ETN H 27 - Acc |

570027 KS |

9.62 |

4.81 |

4.81 |

|

Global X Physical Gold |

GOLD AU |

1,720.96 |

(12.41) |

4.55 |

|

Hana Securities Hana Bloomberg Leverage Natural Gas Futures ETN H 19 |

700019 KS |

5.40 |

3.60 |

3.60 |

|

Daishin Securities Daishin S&P 2X Natural Gas Futures ETN 28 |

510028 KS |

4.97 |

3.32 |

3.32 |

Investors have tended to invest in Fixed Income ETFs/ETPs during February.