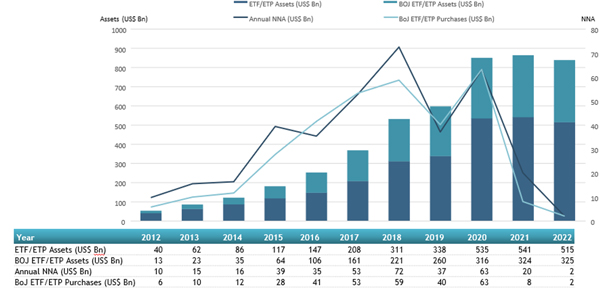

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today the Bank of Japan holds 63% of the assets invested in ETFs listed in Japan at the end of February. The ETFs industry in Japan gathered net inflows of US$669 million during February. Assets invested in the ETFs industry in Japan have decreased by 0.7%, from US$518 billion at the end of January to US$515 billion, according to ETFGI's February 2022 Japanese ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $515 Bn are invested in the ETFs industry in Japan at the end of February 2022.

- The Bank of Japan holds 63% of the assets invested in ETFs listed in Japan at the end of February.

- Net inflows of $669 million gathered during February.

- 3rd month of consecutive net inflows.

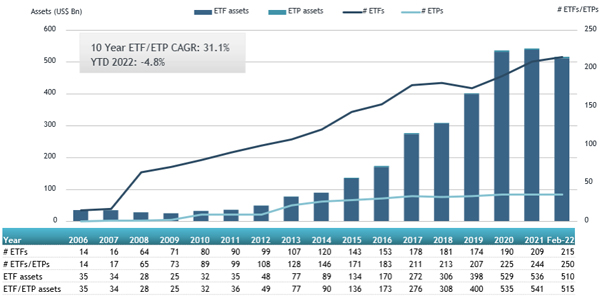

- Assets have decreased 4.8% YTD in 2022, going from $541 Bn at end of 2021 to $515 Bn.

“The S&P 500 decreased by 2.99% in February as the world watches the situation in the Ukraine unfold. Developed markets excluding the US, experienced a loss of 1.34% in February. Japan (down 0.59%) and Portugal (down 0.62%) experienced the smallest losses amongst the developed markets in February, while Austria suffered the largest loss of 10.92%. Emerging markets decreased by 3.43% during February. Peru (up 7.07%) and UAE (up 6.02%) gained the most while Russia (down 50.32 %) and Hungary (down 24.63 %) witnessed the largest declines. S&P Dow Jones announced the removal of all stocks domiciled and listed in Russia due to the country’s invasion of Ukraine.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Japan ETF and ETP asset growth as of the end of February 2022

The Japanese ETFs industry had 250 products, with 283 listings, assets of $515 Bn, from 18 providers listed on 3 exchanges at the end of February.

Equity ETFs gathered net inflows of $948 Mn over February, bringing year to date net inflows to $1.07 Bn, lower than the $8.12 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs had net inflows of $254 Mn during February, bringing net inflows for the first two months of the year to $518 Mn, higher than the $156 Mn in net inflows fixed income products had attracted year to date in 2021. Commodities ETFs reported net outflows of $81 Mn during February, bringing net outflows year to date to $170 Mn, lower than the $154 Mn in net outflows commodities products had reported at this point in 2021.

At the end of February 2022, the Bank of Japan held ETF/ETP assets of $325 Bn. During February 2022, the Bank of Japan purchased ETF/ETP assets of $1 Bn.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $1.78 Bn during February. The NEXT FUNDS TOPIX Exchange Traded Fund (1306 JP) gathered $555 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets February 2022: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

1306 JP |

136,038.56 |

792.33 |

555.25 |

|

Daiwa ETF NIKKEI 225 |

1320 JP |

30,032.67 |

(655.28) |

206.11 |

|

MAXIS TOPIX ETF |

1348 JP |

20,329.83 |

277.64 |

154.87 |

|

Listed Index Fund US Bond (No Currency Hedge) - Acc |

1486 JP |

358.85 |

161.47 |

135.97 |

|

Listed Index Fund TOPIX |

1308 JP |

63,588.22 |

463.12 |

121.02 |

|

NEXT FUNDS Tokyo Stock Exchange REIT Index ETF |

1343 JP |

3,729.77 |

264.46 |

96.84 |

|

Global X Japan Global Leaders ESG ETF |

2641 JP |

101.59 |

77.27 |

77.27 |

|

NZAM ETF TOPIX |

2524 JP |

1,220.89 |

92.83 |

69.91 |

|

iShares Core 7-10 Year US Treasury Bond JPY Hedged ETF |

1482 JP |

665.27 |

171.93 |

55.76 |

|

One ETF TOPIX - Acc |

1473 JP |

3,065.59 |

(319.40) |

52.95 |

|

NEXT FUNDS S&P 500 Yen-Hedged Exchange Traded Fund |

2634 JP |

233.91 |

50.15 |

44.55 |

|

SMDAM REIT Index ETF |

1398 JP |

886.90 |

(24.84) |

28.10 |

|

NEXT FUNDS Nikkei 225 High Dividend Yield Stock 50 Index Exchange Traded Fund |

1489 JP |

316.65 |

23.07 |

27.79 |

|

NEXT FUNDS International Bond FTSE WGBI ex Japan Yen-Hedged Exchange Traded Fund |

2512 JP |

617.73 |

67.88 |

25.74 |

|

iFreeETF NASDAQ100 NON HEDGED |

2840 JP |

29.23 |

24.20 |

24.20 |

|

iShares Japan REIT ETF |

1476 JP |

2,631.43 |

115.32 |

23.95 |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund - Acc |

1357 JP |

1,375.19 |

(182.80) |

22.28 |

|

MAXIS S&P500 US Equity ETF |

2558 JP |

263.90 |

41.89 |

21.03 |

|

Listed Index Fund US Equity NASDAQ100 Currency Hedge - JPY Hdg |

2569 JP |

214.94 |

(25.05) |

20.81 |

|

iFreeETF NASDAQ100 Inverse |

2842 JP |

21.35 |

20.04 |

20.04 |

Investors have tended to invest in Equity ETFs/ETPs during February.