ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, ETFGI reports that record assets and net inflows of US$9.73 trillion and US$834 billion in ETFs and ETPs listed globally at the end of August. ETFs and ETPs listed globally gathered net inflows of US$94.64 billion during August, bringing year-to-date net inflows to US$834.21 billion which is higher than the US$427.56 billion gathered at this point last year and higher than the full year 2020 record net inflows US$762.77 Bn. Assets invested in the global ETFs/ETPs industry have increased by 2.8% from US$9.46 trillion at the end of July 2021, to US$9.73 trillion at the end of August, according to ETFGI's August 2021 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $9.73 trillion invested in ETFs and ETPs listed globally at the end of August 2021.

- Record YTD 2021 net inflows of $834.21 Bn beating the prior record of $433.25 Bn gathered in YTD 2017.

- $834.21 Bn YTD net inflows are $344.02 Bn higher than the full year 2020 record net inflows $762.77 Bn.

- $1.78 trillion in net inflows gathered in the past 12 months.

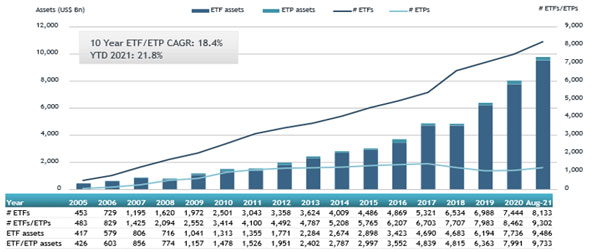

- Assets increased 21.8% YTD in 2021, going from US$7.99 trillion at end of 2020, to US$9.73 trillion.

- 27th month of consecutive net inflows

- Equity ETFs and ETPs listed in the US gathered a record $581.25 Bn in YTD net inflows 2021.

“At the end of August, the S&P 500 posted its 7th straight month of gains, up 3.0% in the month, benefitting from continued support from the Fed and as positive earnings. Developed ex-U.S. markets gained 1.8% in August as most countries advanced, while Korea (down 1.3%) and Hong Kong (down 0.9%) declined the most, due in part to concerns of the new announced regulatory requirements set to take effect in China. Emerging markets were up 3.0% with Thailand (up 10.8%) and the Philippines (up 10.4%) leading the gains at the end of August.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of August 2021

The Global ETF/ETP industry had 9,302 ETFs/ETPs, with 18,802 listings, assets of $9.733 trillion, from 568 providers on 78 exchanges in 62 countries at the end of August.

During August 2021, ETFs/ETPs gathered net inflows of $94.64 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $69.06 Bn over August, bringing net inflows for 2021 to $581.25 Bn, much greater than the $136.96 Bn in net inflows equity products had attracted for the corresponding period through August 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $19.99 Bn during August, bringing net inflows for 2021 to $153.33 Bn, lower than the $160.43 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs listed globally gathered net outflows of $1.91 Bn, bringing net outflows for 2021 to $8.04 Bn, significantly lower than the $68.08 Bn in net inflows commodity products had attracted over the same period last year. Active ETFs/ETPs reported $6.99 Bn in net inflows, bringing net inflows for 2021 to $95.22 Bn, higher than the $43.04 Bn in net inflows active products had attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.58 Bn during August. SPDR S&P 500 ETF Trust (SPY US) gathered $7.81 Bn largest individual net inflow.

Top 20 ETFs by net new inflows August 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

403,532.75 |

4,572.32 |

7,805.21 |

|

Vanguard S&P 500 ETF |

|

VOO US |

255,707.08 |

36,598.04 |

4,543.18 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

270,049.66 |

27,824.68 |

4,241.23 |

|

Invesco QQQ Trust |

|

QQQ US |

193,122.10 |

9,031.51 |

2,500.07 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

|

LQD US |

42,688.85 |

(11,196.24) |

2,416.99 |

|

iShares TIPS Bond ETF |

|

TIP US |

33,297.91 |

6,430.65 |

1,991.81 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

43,267.33 |

9,426.38 |

1,967.42 |

|

iShares Core S&P 500 ETF |

|

IVV US |

301,884.88 |

16,237.32 |

1,703.49 |

|

iShares MSCI EAFE Small-Cap ETF |

|

SCZ US |

15,155.61 |

2,339.20 |

1,648.01 |

|

KraneShares CSI China Internet ETF |

|

KWEB US |

6,692.12 |

4,979.06 |

1,462.45 |

|

Vanguard Total Bond Market ETF |

|

BND US |

81,470.12 |

14,523.27 |

1,365.21 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

50,780.59 |

8,591.56 |

1,183.79 |

|

Samsung KODEX 200 ETF |

|

069500 KS |

4,649.02 |

(652.78) |

1,149.51 |

|

iShares Russell 2000 ETF |

|

IWM US |

68,459.30 |

1,211.76 |

1,022.22 |

|

iShares S&P/TSX 60 Index Fund |

|

XIU CN |

9,566.35 |

870.94 |

1,008.95 |

|

Utilities Select Sector SPDR Fund |

|

XLU US |

13,679.76 |

779.01 |

989.78 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

25,587.74 |

(196.00) |

925.39 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

105,813.02 |

8,596.41 |

921.73 |

|

iShares Russell 1000 Growth ETF |

|

IWF US |

75,761.84 |

(1,509.37) |

889.50 |

|

Daiwa ETF TOPIX |

|

1305 JP |

67,565.40 |

2,109.09 |

847.47 |

The top 10 ETPs by net new assets collectively gathered $1.62 Bn over August. Invesco Physical Gold ETC - Acc (SGLD LN) gathered $529 Mn largest individual net inflow.

Top 10 ETPs by net new inflows August 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

13,677.54 |

306.79 |

528.65 |

|

ProShares Ultra VIX Short-Term Futures |

|

UVXY US |

946.85 |

1,511.49 |

359.31 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

|

VXX US |

969.26 |

1,078.46 |

213.27 |

|

Xetra Gold EUR - Acc |

|

4GLD GY |

13,935.75 |

1,300.08 |

151.94 |

|

Invesco DB Commodity Index Tracking Fund |

|

DBC US |

2,521.02 |

677.03 |

81.79 |

|

SPDR Gold MiniShares Trust |

|

GLDM US |

4,560.10 |

712.01 |

80.60 |

|

ProShares VIX Short-Term Futures ETF |

|

VIXY US |

304.03 |

323.29 |

66.78 |

|

MicroSectors FANG Innovation 3X Leveraged ETN |

|

BULZ US |

52.11 |

50.99 |

50.99 |

|

iPath Bloomberg Commodity Index Total Return ETN |

|

DJP US |

821.37 |

167.28 |

49.86 |

|

ProShares UltraShort DJ-UBS Natural Gas |

|

KOLD US |

107.86 |

154.54 |

38.33 |

Investors have tended to invest in Equity ETFs and ETPs during August.