ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in U.S. gathered net inflows of US$7.81 billion during March, bringing year-to-date net inflows to US$59.86 billion which is higher than the US$51.24 billion inflows gathered at this point last year. Assets invested in the US ETFs/ETPs industry have decreased by 12.2%, from US$4.18 trillion at the end of February, to US$3.67 trillion, according to ETFGI's March 2020 US ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs/ETPs listed in U.S. attracted $7.81 billion in net inflows with Equity products being the most attractive among all asset classes.

- Year-to-date net inflows are $59.86 billion which is higher than the $51.24 billion had gathered at the end of March 2019.

- Only 5 new ETFs were listed in the U.S. March

- During Q1 2019 trading volumes in U.S. bond ETFs grew to $1.3 trillion compared to the $2.6 trillion traded in all of 2019

“At the end of March, the S&P 500 was down 12.35% as the pandemic (Covid-19) forced US government to take strict measures and set some form of lockdown around the states reinforcing the fear for deep recession and high unemployment. Outside the U.S., the S&P Developed ex-U.S. BMI plummeted nearly 14.29%. The S&P Emerging BMI dove 16.97% during the month and Global equities as measured by the S&P Global BMI plunged 14.32% as well.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

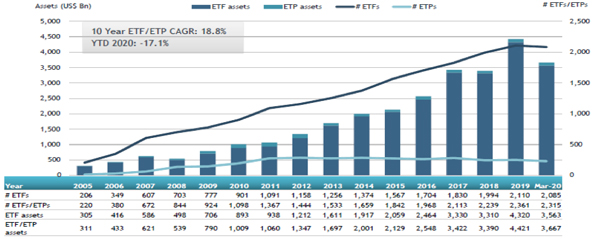

Growth in US ETF and ETP assets as of the end of March 2020

At the end of March 2020, the US ETFs/ETPs industry had 2,315 ETFs/ETPs, from 160 providers listed on 3 exchanges.

ETFs/ETPs listed in the U.S. gathered net inflows of $7.81 billion during March. Equity ETFs/ETPs listed in U.S. reported net inflows of $15.60 billion during March, bringing YTD net inflows for 2020 to $28.04 billion, greater than the $16.14 billion in net inflows Equity products had attracted for the corresponding period to March 2019.

Commodity ETFs/ETPs listed in U.S. attracted net inflows of $5.31 billion during March, bringing YTD net inflows for 2020 to $9.61 billion, much higher than the $155 million in net inflows for the corresponding period in 2019. Fixed Income ETFs/ETPs reported outflows of $13.53 billion, bringing the YTD net inflows to $10.78 billion for 2020, which is lower than the $30.72 billion in net inflows for the corresponding period to March 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $74.15 billion at the end of March, the SPDR S&P 500 ETF Trust (SPY US)gathered $13.10 billion alone.

Top 20 ETFs by net new assets March 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

240,742.93 |

(17,772.90) |

13,096.01 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

BIL US |

18,079.13 |

9,204.05 |

8,663.95 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

39,777.48 |

5,158.73 |

8,402.24 |

|

Vanguard S&P 500 ETF |

VOO US |

120,113.83 |

13,376.20 |

8,096.70 |

|

iShares 1-3 Year Treasury Bond ETF |

SHY US |

23,263.67 |

5,065.79 |

5,546.28 |

|

Invesco QQQ Trust |

QQQ US |

83,478.25 |

5,722.38 |

5,321.35 |

|

Vanguard Total Stock Market ETF |

VTI US |

114,896.34 |

8,868.56 |

3,500.13 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

15,359.34 |

(1,795.43) |

3,403.27 |

|

iShares Short Treasury Bond ETF |

SHV US |

23,453.76 |

2,318.08 |

3,104.14 |

|

iShares MSCI ACWI ETF |

ACWI US |

10,071.36 |

966.46 |

2,069.47 |

|

iShares Core S&P Total U.S. Stock Market ETF |

ITOT US |

21,463.41 |

1,699.77 |

1,839.37 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

8,395.01 |

(2,170.57) |

1,591.09 |

|

iShares Russell 2000 ETF |

IWM US |

33,033.48 |

(1,628.37) |

1,416.08 |

|

Energy Select Sector SPDR Fund |

XLE US |

6,445.36 |

1,622.36 |

1,342.40 |

|

ProShares UltraPro QQQ |

TQQQ US |

3,787.40 |

1,887.80 |

1,267.59 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

36,417.27 |

1,788.39 |

1,216.57 |

|

Technology Select Sector SPDR Fund |

XLK US |

24,156.40 |

426.59 |

1,165.51 |

|

Vanguard Short-Term Treasury ETF |

VGSH US |

7,301.94 |

1,189.72 |

1,072.72 |

|

iShares S&P 500 Growth ETF |

IVW US |

22,060.50 |

920.75 |

1,026.61 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

15,104.31 |

2,279.39 |

1,012.13 |

The top 10 ETPs by net new assets collectively gathered $7.98 billion at the end of March.

The United States Oil Fund LP (USO US)gathered $2.14 billion alone.

Top 10 ETPs by net new assets March 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

United States Oil Fund LP |

USO US |

2,348.08 |

2,732.92 |

2,144.59 |

|

SPDR Gold Shares |

GLD US |

48,939.51 |

3,938.21 |

1,831.78 |

|

ProShares Short VIX Short-Term Futures |

SVXY US |

809.18 |

732.03 |

733.83 |

|

iShares Gold Trust |

IAU US |

20,211.55 |

1,623.88 |

713.43 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

976.67 |

749.38 |

680.47 |

|

VelocityShares 3x Long Crude Oil ETN |

UWT US |

135.76 |

1,201.97 |

592.19 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

397.85 |

872.03 |

563.56 |

|

iShares Silver Trust |

SLV US |

5,501.27 |

426.36 |

330.93 |

|

SPDR Gold MiniShares Trust |

GLDM US |

1,615.11 |

417.94 |

214.33 |

|

iPath Series B S&P GSCI Crude Oil ETN |

OIL US |

182.24 |

184.04 |

178.12 |

Investors have tended to invest in Equity and Commodity ETFs at the end of March.