ETFGI, a leading independent research and consultancy firm on trends in the Japanese ETF/ETP ecosystem, reported today that that ETFs and ETPs listed in Japan gathered net new assets of US$9.00 billion during December 2018, marking 14 consecutive months of net inflows. Year-to-date, for the whole of 2018, ETFs/ETPs listed in Japan have seen record net inflows of US$72.4 billion, surpassing the previous record for annual net inflows set in 2017 with US$52.6 billion. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs and ETPs listed in Japan gathered net new assets of $9.00 Bn during December 2018, marking 14 consecutive months of net inflows.

- Yearto-date, for the whole of 2018, ETFs/ETPs listed in Japan have seen record net inflows of $72.4 Bn.

- Assets invested in ETFs/ETPs listed in Japan decreased by 4.0% over the month, from $321 Bn at the end of November to $308 Bn at the end of December 2018.

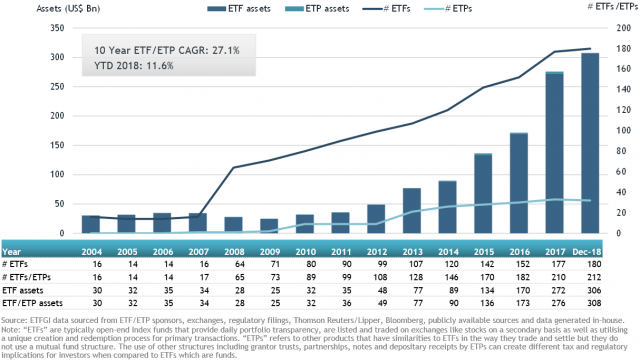

According to ETFGI’s December 2018 Japan ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs/ETPs listed in Japan have decreased by 4.0% over the month, from $321 Bn at the end of November to $308 Bn at the end of December 2018. Year-to-date, assets have increased by 11.6% from $276 Bn at the end of 2017. At the end of December 2018, the Japanese ETF/ETP industry had 212 ETFs/ETPs, with 247 listings, from 19 providers on 2 exchanges.

“The end of 2018 saw the trend in developed markets reverse, and although arguably predictable, the severity left many pundits scratching their heads. This end of year stress has widely been attributed to the disruption caused by trade disputes feeding into economic data, and the view policy makers are not going to be quite as accommodating as initially expected. The S&P 500 returned -9.03% during December, and down -4.38% for 2018. Developed markets ex-US fell -4.62% during December, led by Japan and Canada, bringing the yearly return to -13.21%. Relatively speaking, EM and FM fared the month better, returning -2.68% and -3.15%, finishing 2018 -13.53% and -11.82%, respectively” according to Deborah Fuhr, managing partner and founder of ETFGI.

Japan ETF and ETP asset growth as at end of December 2018

Equity ETFs/ETPs gathered the largest net inflows in December 2018 with $8.29 Bn, followed by leveraged ETFs/ETPs with $1.17 Bn, while leveraged inverse ETFs/ETPs experienced the largest net outflows with $399 Mn. Similarly, for the whole of 2018, equity ETFs/ETPs gathered the largest net inflows with $70.0 Bn, followed by leveraged ETFs/ETPs with $3.91 Bn, while leveraged inverse ETFs/ETPs experienced the largest net outflows with $1.14 Bn.

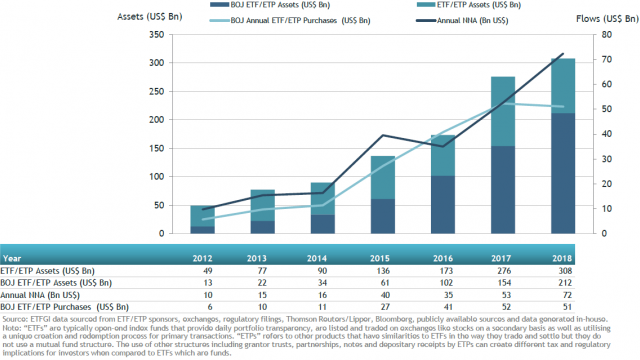

The Bank of Japan purchased $7.05 Bn of ETF assets during December, bringing total ETF purchases to approximately $212 bn.

Growth in BOJ ETF and ETP assets

A high proportion of net inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $100 Bn. The TOPIX Exchange Traded Fund (1306 JP) on its own accounted for net inflows of $2.17 Bn.

Top 20 ETFs/ETPs by net inflows during December 2018: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

TOPIX Exchange Traded Fund |

1306 JP |

71,167 |

22,288 |

2,166 |

|

Daiwa ETF TOPIX |

1305 JP |

34,176 |

11,166 |

1,355 |

|

Listed Index Fund TOPIX |

1308 JP |

31,765 |

9,198 |

1,264 |

|

Nikkei 225 Exchange Traded Fund |

1321 JP |

50,018 |

7,319 |

1,210 |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

1570 JP |

5,317 |

3,902 |

1,002 |

|

Daiwa ETF NIKKEI 225 |

1320 JP |

22,371 |

2,899 |

674 |

|

MAXIS TOPIX ETF |

1348 JP |

9,331 |

2,648 |

452 |

|

MAXIS NIKKEI225 ETF |

1346 JP |

11,758 |

1,275 |

368 |

|

Listed Index Fund 225 |

1330 JP |

23,835 |

1,105 |

258 |

|

One ETF Nikkei 225 |

1369 JP |

3,162 |

570 |

202 |

|

NEXT FUNDS JPX-Nikkei Index 400 Exchange Traded Fund |

1591 JP |

5,783 |

1,639 |

122 |

|

One ETF TOPIX |

1473 JP |

1,294 |

469 |

78 |

|

Simplex Nikkei225 Bull 2x ETF |

1579 JP |

334 |

214 |

70 |

|

MAXIS JPX-Nikkei Index 400 ETF |

1593 JP |

2,640 |

807 |

63 |

|

Listed Index Fund JPX-Nikkei Index 400 |

1592 JP |

1,527 |

489 |

57 |

|

MAXIS J-REIT ETF |

1597 JP |

1,208 |

332 |

57 |

|

iShares Core TOPIX ETF |

1475 JP |

1,863 |

1,149 |

55 |

|

Daiwa ETF JPX-Nikkei 400 |

1599 JP |

1,581 |

358 |

44 |

|

iShares Japan REIT ETF |

1476 JP |

1,449 |

824 |

42 |

|

Rakuten ETF-Nikkei 225 Leveraged Index |

1458 JP |

129 |

103 |

33 |

Investors tended to invest in core fixed income and equity, emerging markets, market cap and lower cost ETFs in December.