ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in Europe reported net outflows of

US$22.83 billion at the end of March, the largest monthly outflow for Europe, bringing year-to-date net outflows to US$1.63 billion. Assets invested in the European ETFs/ETPs industry have decreased by 12.3%, from US$997.31 billion at the end of February, to US$874.87 billion, according to ETFGI's March 2020 European ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- April 2020 marks the 20thanniversary of the listing of the first ETFs to be listed in Europe.

- Commodities attracted the largest monthly inflows among the asset classes of $3.46 billion.

- Commodity ETFs/ETPs gathered year-to-date net inflows of $7.90 billion, much higher than the

$616 million had attracted by this time last year. - Assets invested in the European ETFs/ETPs industry of $874.87 billion are the highest in comparison with previous years at this point.

April 2020 marks the 20thanniversary of the listing of the first ETFs to be listed in Europe. The LDRS DJ STOXX 50 and LDRS DJ EUROSTOXX 50 sponsored by Merrill Lynch were listed on 11 April 2000 on the Deutsche Borse, closely followed by the listing of the iShares FTSE 100 ETF on the London Stock Exchange on April 28, 2000. The LDRS ‘leaders’ were acquired by Barclays Global Investors from Merrill Lynch in September 2003 and their names were changed to iShares DJ STOXX 50 and iShares DJ EUROSTOXX 50.

“At the end of March, the S&P 500 was down 12.35% as the pandemic (Covid-19) forced US government to take strict measures and set some form of lockdown around the states reinforcing the fear for deep recession and high unemployment. Outside the U.S., the S&P Developed ex-U.S. BMI plummeted nearly 14.29%. The S&P Emerging BMI dove 16.97% during the month and Global equities as measured by the S&P Global BMI plunged 14.32% as well.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

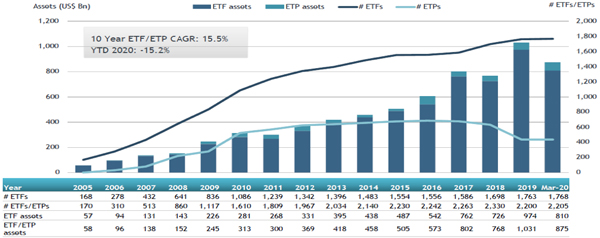

Europe ETFs and ETPs asset growth as at the end of March 2020

At the end of March 2020, the European ETFs/ETPs industry had 2,205 ETFs/ETPs, with 8,440 listings, from 67 providers on 27 exchanges listed in 23 countries.

ETFs and ETPs listed in Europe reported net outflows of US$22.83 billion at the end of March. Commodity ETFs/ETPs gathered $3.46 billion in net inflows during March bringing net inflows to $7.90 billion for2020, which is greater than the $616 million in net inflows gatheredat this point in 2019. Equity ETFs/ETPs listed in Europe reported net outflows of $14.13 billion in March, bringing net outflows for the year 2020 to $5.31 billion, lower than the $10.19 billion in net inflows equity products had attracted at this point in 2019. Fixed income ETFs/ETPs listed in Europe had net outflows of $10.83 billion in March, bringing net outflows for the year to $3.35 billion, much lower than the $19.82 billion in net inflows fixed income products had at end of March 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $11.76 billion at the end of March. The Vanguard FTSE All-World High Dividend Yield UCITS ETF (VHYD LN)gathered $1.03 billion alone.

Top 20 ETFs by net inflows in March 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard FTSE All-World High Dividend Yield UCITS ETF |

VHYD LN |

1,895.58 |

1,167.34 |

1,032.36 |

|

iShares MSCI Europe UCITS ETF EUR (Dist) |

IMEU LN |

6,556.32 |

1,145.15 |

937.63 |

|

Lyxor UCITS ETF EURO CASH |

CSH FP |

1,529.76 |

524.97 |

831.71 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

5,475.70 |

959.61 |

808.34 |

|

iShares STOXX Europe 600 UCITS ETF (DE) |

SXXPIEX GY |

5,309.54 |

552.22 |

777.81 |

|

iShares eb.rexx Money Market UCITS ETF (DE) |

EBMMEX GY |

927.79 |

690.64 |

720.94 |

|

iShares Core FTSE 100 UCITS ETF |

ISF LN |

9,426.35 |

1,075.56 |

716.16 |

|

Lyxor CAC 40 (DR) UCITS ETF |

CAC FP |

3,491.62 |

570.20 |

592.65 |

|

Lyxor UCITS ETF EURO STOXX 50 - D-EUR |

MSE FP |

4,855.33 |

(29.16) |

588.45 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

3,714.42 |

904.50 |

549.96 |

|

SPDR Barclays 1 – 3 Year Euro Government Bond UCITS ETF |

SYB3 GY |

1,616.05 |

503.59 |

519.17 |

|

Xtrackers DAX UCITS ETF |

XDAX GY |

3,137.67 |

60.60 |

432.00 |

|

Xtrackers USD Corporate Bond UCITS ETF (DR) |

XDGU GY |

1,013.11 |

460.86 |

426.94 |

|

iShares Core DAX UCITS ETF (DE) |

DAXEX GY |

5,120.99 |

(279.24) |

426.16 |

|

iShares $ Treasury Bond 1-3yr UCITS ETF (EUR) |

IBTE LN |

816.80 |

454.85 |

419.49 |

|

Vanguard FTSE 100 UCITS ETF |

VUKE LN |

3,397.28 |

472.41 |

413.23 |

|

iShares EURO STOXX 50 UCITS ETF |

EUN2 GY |

3,705.04 |

(254.36) |

397.45 |

|

SPDR Barclays Euro Government Bond UCITS ETF |

SYBB GY |

1,219.54 |

487.88 |

392.38 |

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

19,295.87 |

1,148.43 |

391.64 |

|

iShares Core € Govt Bond UCITS ETF |

SEGA LN |

3,377.29 |

595.43 |

389.13 |

The top 10 ETPs by net new assets collectively gathered $5.65 billion at the end of March. The Invesco Physical Gold ETC (SGLD LN) gathered $1.74 billion alone.

Top 10 ETPs by net inflows in March 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC |

SGLD LN |

9,554.42 |

2,049.46 |

1,744.79 |

|

iShares Physical Gold ETC |

SGLN LN |

10,753.68 |

2,670.16 |

1,510.85 |

|

Amundi Physical Metals PLC |

GOLD FP |

2,378.39 |

1,238.97 |

866.06 |

|

Xtrackers Physical Gold Euro Hedged ETC |

XAD1 GY |

3,025.93 |

381.43 |

596.83 |

|

WisdomTree WTI Crude Oil |

CRUD LN |

592.53 |

621.40 |

457.33 |

|

WisdomTree Physical Gold |

PHAU LN |

7,526.89 |

0.15 |

180.29 |

|

WisdomTree Brent Crude Oil 1mth |

OILB LN |

207.62 |

153.61 |

150.35 |

|

WisdomTree WTI Crude Oil 2x Daily Leveraged |

LOIL LN |

41.70 |

89.05 |

62.63 |

|

Xtrackers Brent Crude Oil Booster Euro Hedged ETC |

XETC GY |

92.92 |

64.36 |

50.06 |

|

WisdomTree Physical Gold - GBP Daily Hedged |

GBSP LN |

558.33 |

41.13 |

34.66 |

Investors have tended to invest in Commodity ETFs and ETPs at the end of March.