ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the ETFs industry in the United States reached a new record of US$11.04 trillion at the end of May. During May, the ETFs industry in the United States gathered net inflows of US$82.44 billion, bringing year-to-date net inflows to a record US$443.34 billion, according to ETFGI's May 2025 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in the United States reached a record of $11.04 Tn at the end of May, beating the previous record of $10.73 Tn in January 2025.

- Net inflows of $82.44 Bn in May.

- YTD net inflows of $443.34 Bn are the highest on record, followed by YTD net inflows of $399.10 Bn in 2021 and the third highest recorded YTD net inflows are of $358.17 Bn in 2024.

- 37th month of consecutive net inflows.

“The S&P 500 Index rose by 6.29% in May, bringing its year-to-date (YTD) gain to 1.06% in 2025. The Developed Markets ex-U.S. Index increased by 5.12% in May and is up 16.52% YTD. Among developed markets, Austria and the Netherlands led with gains of 11.40% and 9.12%, respectively. The Emerging Markets Index climbed 4.42% in May, with a 6.30% YTD increase. Taiwan and Greece posted the strongest monthly performances among emerging markets, rising 12.57% and 10.99%, respectively,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

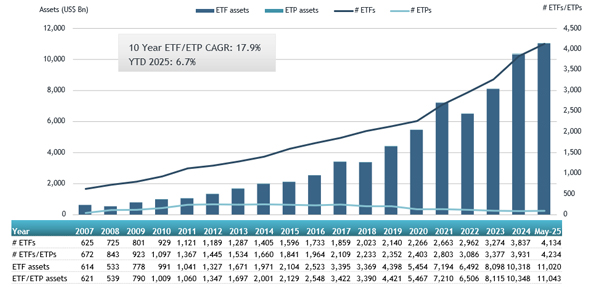

Growth in assets in the ETFs industry in the United States as of the end of May

The ETFs industry in the United States has 4,234 products, assets of US$11.04 Tn, from 391 providers listed on 3 exchanges at the end of May.

During May, ETFs gathered net inflows of $82.44 Bn. Equity ETFs gathered net inflows of $24.49 Bn in May, bringing YTD net inflows to $148.47 Bn, lower than the $160.17 Bn in net inflows YTD in 2024. Fixed income ETFs reported net inflows of $25.58 Bn during May, bringing YTD net inflows to $93.67 Bn, higher than the $58.01 Bn in net inflows YTD in 2024. Commodities ETFs reported net outflows of $1.57 Bn during May, bringing YTD net inflows to $14.18 Bn, higher than the $4.99 Bn in net outflows YTD in 2024. Active ETFs attracted net inflows of $33.77 Bn in May, gathering YTD net inflows of $176.73 Bn, much higher than the $108.52 Bn in net inflows YTD in 2024.

Substantial inflows can be attributed to the top 20 ETF‘s by net new assets, which collectively gathered $61.64 Bn in May. Vanguard S&P 500 ETF (VOO US) gathered $10.49 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets May 2025: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

VOO US |

657,340.88 |

65,480.72 |

10,493.83 |

|

Invesco QQQ Trust |

QQQ US |

334,124.94 |

10,416.07 |

8,148.51 |

|

iShares Bitcoin Trust |

IBIT US |

69,213.48 |

11,320.91 |

5,914.78 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

49,836.24 |

49.67 |

3,822.67 |

|

iShares U.S. Thematic Rotation Active ETF |

THRO US |

4,368.00 |

4,341.12 |

3,768.08 |

|

iShares MSCI EAFE Value ETF |

EFV US |

25,414.42 |

2,264.70 |

3,580.05 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

30,683.92 |

1,419.02 |

3,046.81 |

|

iShares Core International Aggregate Bond ETF |

IAGG US |

10,035.90 |

2,963.20 |

3,022.55 |

|

Invesco Nasdaq 100 ETF |

QQQM US |

48,365.86 |

8,331.75 |

2,257.58 |

|

iShares 0-3 Month Treasury Bond ETF |

SGOV US |

46,812.41 |

16,898.76 |

2,052.94 |

|

Vanguard Total Stock Market ETF |

VTI US |

473,452.43 |

15,683.35 |

1,935.59 |

|

SPDR Portfolio S&P 500 ETF |

SPLG US |

67,769.20 |

13,332.93 |

1,839.10 |

|

Vanguard Total Bond Market ETF |

BND US |

127,264.63 |

4,888.36 |

1,736.45 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

124,511.71 |

3,375.08 |

1,598.83 |

|

iShares AI Innovation and Tech Active ETF |

BAI US |

1,694.36 |

1,627.98 |

1,527.57 |

|

iShares MBS ETF |

MBB US |

38,227.93 |

2,299.66 |

1,513.28 |

|

Vanguard Information Technology ETF |

VGT US |

86,681.81 |

3,814.57 |

1,372.85 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

91,777.49 |

6,257.70 |

1,365.45 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

26,287.80 |

6,975.15 |

1,341.01 |

|

YieldMax MSTR Option Income Strategy ETF |

MSTY US |

4,098.14 |

3,137.52 |

1,306.04 |

The top 10 ETPs by net assets collectively gathered $1.53 Bn during May. MicroSectors FANG+ 3X Leveraged ETN (FNGB US) gathered $916.40 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets May 2025: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

MicroSectors FANG+ 3X Leveraged ETN |

FNGB US |

1,586.27 |

1,306.79 |

916.40 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

373.89 |

(133.37) |

142.30 |

|

Grayscale Bitcoin Mini Trust ETF |

BTC US |

4,555.03 |

564.91 |

129.88 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

389.30 |

74.60 |

91.87 |

|

Grayscale Ethereum Mini Trust ETF |

ETH US |

1,293.55 |

67.86 |

63.90 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

129.72 |

(90.38) |

55.19 |

|

Fidelity Ethereum Fund |

FETH US |

1,123.02 |

(75.85) |

54.32 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

230.06 |

(249.88) |

46.22 |

|

Invesco CurrencyShares Australian Dollar Trust |

FXA US |

92.46 |

25.48 |

15.90 |

|

VanEck Merk Gold ETF |

OUNZ US |

1,677.14 |

167.36 |

15.75 |

Investors have tended to invest in Active ETFs/ETPs during May.