ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the ETFs industry in Japan reached a new record of US$648.38 billion at the end of June. During June the ETFs industry in Japan suffered net outflows of US$2.72 billion, bringing year-to-date net inflows to US$2.21 billion, according to ETFGI's June 2025 Japanese ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Japan ETF Industry Reaches New Asset Record Despite Outflows

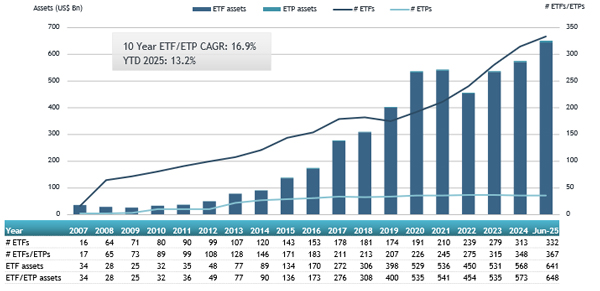

The ETF market in Japan continues to show resilience and long-term growth, even amid short-term fluctuations:

- Record AUM: Assets under management reached a new high of $648.38 billion at the end of June, surpassing the previous record of $629.77 billion in May.

- YTD Growth: Assets have grown 13.2% year-to-date, rising from $572.78 billion at the end of 2024.

- June Outflows: Despite the record AUM, the industry saw net outflows of $2.72 billion in June—marking the second consecutive month of outflows.

- YTD Net Inflows: Total net inflows for 2025 stand at $2.21 billion, ranking as the tenth highest on record. For context, the highest YTD net inflows were $44.95 billion in 2020, followed by $39.08 billion in 2018.

These figures reflect a maturing ETF market in Japan, with long-term asset growth continuing despite short-term investor repositioning.

The S&P 500 rose 5.09% in June, bringing its H1 2025 gain to 6.20%. Developed Markets (ex-US) increased 3.24% in June, and are up a strong 20.29% year-to-date. Top Performers in June: Korea: +16.12% and Israel: +11.60%. Emerging Markets gained 4.80% in June, with a year-to-date increase of 11.41%. Top Performers in June: Taiwan: +8.53% and Turkey: +8.49%, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the ETFs industry in Japan as of the end of June

The ETFs industry in Japan has 367 products, with 389 listings, assets of US$648.38 Bn, from 16 providers listed on 2 exchanges at the end of June.

During June, ETFs suffered net outflows of $2.72 Bn. Equity ETFs suffered net outflows of $2.10 Bn, bringing net inflows for the year to $1.33 Bn, lower than the $4.64 Bn in net inflows YTD in 2024. Fixed income ETFs reported net inflows of $51.81 Mn during June, bringing YTD net outflows to $429.12 Mn, lower than the $974.14 Mn in net inflows YTD in 2024. Commodities ETFs reported net inflows of $277.14 Mn during June, bringing YTD net inflows to $1.18 Bn, much higher than the $366.82 Mn in net inflows YTD in 2024.

At the end of June, assets invested in the ETFs industry in Japan were US$648.38 Bn, while the Bank of Japan held ETF assets of US$245 Bn.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $1.48 Bn in June. NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund (1357 JP) gathered $224.58 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets June 2025: Japan

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund |

1357 JP |

796.66 |

251.26 |

224.58 |

|

Japan Physical Gold ETF |

1540 JP |

5,323.81 |

1,026.36 |

198.17 |

|

NZAM ETF Nikkei 225 |

2525 JP |

1,051.43 |

259.00 |

174.42 |

|

Simplex - Nikkei Average Bear Double Exchange Trade Fund |

1360 JP |

324.05 |

45.34 |

113.39 |

|

NEXT FUNDS Nikkei 225 High Dividend Yield Stock 50 Index Exchange Traded Fund |

1489 JP |

2,555.80 |

452.44 |

109.03 |

|

Global X Japan Mid & Small Cap Leaders ESG ETF |

2837 JP |

151.99 |

92.65 |

101.51 |

|

Global X Japan Global Leaders ESG ETF |

2641 JP |

615.85 |

68.96 |

76.18 |

|

iShares MSCI Japan High Dividend ETF |

1478 JP |

878.44 |

150.55 |

54.09 |

|

Rakuten ETF-Nikkei 225 Double Inverse Index |

1459 JP |

164.54 |

12.38 |

49.80 |

|

NZAM ETF J-REIT Index |

1595 JP |

1,380.53 |

43.38 |

49.20 |

|

One ETF TOPIX |

1473 JP |

4,345.25 |

112.96 |

43.13 |

|

Listed Index Fund 225 |

1330 JP |

38,089.55 |

734.19 |

39.95 |

|

iShares Core 7-10 Year US Treasury Bond JPY Hedged ETF |

1482 JP |

1,084.70 |

(144.26) |

37.50 |

|

iShares Euro Investment Grade Corporate Bond JPY Hedged ETF |

2623 JP |

85.89 |

25.86 |

36.64 |

|

NEXT FUNDS NOMURA Crude Oil Long Index Linked ETF |

1699 JP |

149.50 |

17.47 |

34.60 |

|

NEXT FUNDS Nomura Japan Equity High Dividend 70 ETF |

1577 JP |

1,026.67 |

(30.96) |

33.43 |

|

Simplex Nikkei225 Bear -1x ETF |

1580 JP |

104.18 |

(0.86) |

29.90 |

|

iShares Germany Government Bond JPY Hedged ETF - JPY Hdg |

2857 JP |

111.75 |

(139.57) |

29.87 |

|

NEXT FUNDS Nikkei 225 Inverse Index ETF |

1571 JP |

158.76 |

12.32 |

21.74 |

|

SMDAM TOPIX ETF |

2557 JP |

516.50 |

38.13 |

19.35 |

Investors have tended to invest in Leveraged Inverse ETFs during June.