ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets in the ETFs industry in Europe reached a new record of US$2.61 trillion at the end of May. During May the ETFs industry in Europe gathered net inflows of US$31.19 billion, bringing year-to-date net inflows to US$149.79 billion – also a new record, according to ETFGI's May 2025 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in the ETFs industry in Europe reached a record of $2.61 Tn at the end of May, beating the previous record of $2.47 Tn set at the end of April 2025.

- Net inflows of $31.19 Bn gathered in May.

- Year-to-date net inflows reached a record US$149.79 billion — surpassing the previous highs of US$95.18 billion in 2021 and US$82.42 billion in 2024, which now stand as the second and third highest on record, respectively.

- 32nd month of consecutive net inflows.

“The S&P 500 Index rose by 6.29% in May, bringing its year-to-date (YTD) gain to 1.06% in 2025. The Developed Markets ex-U.S. Index increased by 5.12% in May and is up 16.52% YTD. Among developed markets, Austria and the Netherlands led with gains of 11.40% and 9.12%, respectively. The Emerging Markets Index climbed 4.42% in May, with a 6.30% YTD increase. Taiwan and Greece posted the strongest monthly performances among emerging markets, rising 12.57% and 10.99%, respectively,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

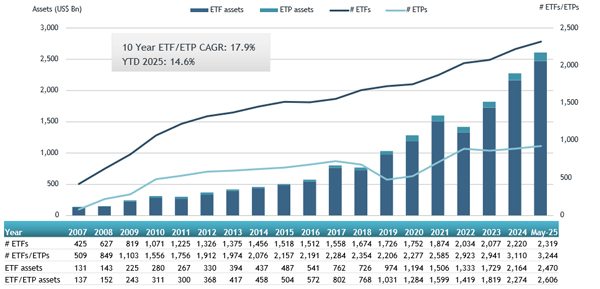

Growth in assets in the ETFs industry in Europe as of the end of May

The ETFs industry in Europe had 3,244 products, with 13,679 listings, assets of $2.61 Tn, from 124 providers listed on 29 exchanges in 24 countries at the end of May.

During May, ETFs gathered net inflows of $31.19 Bn. Equity ETFs gathered net inflows of $20.02 Bn over May, bringing YTD net inflows to $108.71 Bn, higher than the $62.39 Bn in net inflows YTD in 2024. Fixed income ETFs had net inflows of $8.50 Bn during May, bringing YTD net inflows to $24.26 Bn, slightly higher than the $22.85 Bn in net inflows YTD in 2024. Commodities ETFs reported net inflows of $173.86 Mn during May, bringing YTD net inflows to $4.16 Bn, higher than the $5.65 Bn in net outflows YTD in 2024. Active ETFs attracted net inflows of $2.41 Bn during the month, gathering YTD net inflows of $10.88 Bn, higher than the $3.78 Bn in net YTD in 2024.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $15.86 Bn in May. iShares Broad Global Govt Bond UCITS ETF (IGBG NA) gathered $1.95 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets May 2025: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

IGBG NA |

2,918.80 |

2,695.33 |

1,952.62 |

|

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

16,193.50 |

(864.28) |

1,659.12 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc |

ACWIU SW |

8,089.99 |

747.35 |

1,578.81 |

|

Vanguard S&P 500 UCITS ETF |

VUSA LN |

68,126.79 |

4,570.29 |

1,056.74 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF |

IBTU LN |

22,475.19 |

1,731.06 |

893.20 |

|

SPDR S&P 500 UCITS ETF |

SPY5 GY |

25,590.10 |

3,561.01 |

818.01 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C |

XZW0 LN |

6,718.75 |

(1,249.64) |

728.60 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

39,926.85 |

5,449.05 |

718.70 |

|

Xtrackers MSCI World ex USA UCITS ETF |

EXUS LN |

2,856.83 |

2,192.57 |

702.79 |

|

iShares Core MSCI Europe UCITS ETF EUR (Acc) |

SMEA LN |

12,517.84 |

2,615.15 |

666.09 |

|

WisdomTree Europe Defence UCITS ETF |

WDEF IM |

2,486.10 |

2,103.75 |

626.04 |

|

iShares MSCI USA ESG Screened UCITS ETF |

SASU LN |

13,627.57 |

3,660.21 |

591.76 |

|

Xtrackers MSCI AC World Screened UCITS ETF 1C |

XMAW GY |

4,448.52 |

(288.33) |

571.25 |

|

UBS ETF (IE) MSCI World UCITS ETF (USD) A-dis |

UBU7 GY |

3,777.72 |

1,384.79 |

499.91 |

|

Amundi Euro Stoxx Banks UCITS ETF - Acc |

BNKE FP |

2,859.73 |

1,368.13 |

490.00 |

|

iShares Core S&P 500 UCITS ETF |

CSSPX SW |

116,377.25 |

5,011.80 |

478.87 |

|

Amundi Stoxx Europe 600 UCITS ETF - Acc |

MEUD FP |

13,893.33 |

2,924.03 |

474.21 |

|

Xtrackers MSCI EMU INDEX UCITS ETF (DR) - 1D |

XD5E LN |

2,590.54 |

434.34 |

453.50 |

|

Amundi Global Treasury Bond UCITS ETF USD Hedged Acc |

GTSB GY |

1,322.47 |

1,312.58 |

450.68 |

|

iShares MSCI USA ESG Enhanced UCITS ETF |

EEDS LN |

19,818.15 |

207.46 |

445.76 |

The top 10 ETPs by net new assets collectively gathered $1.15 Bn during May. AMUNDI PHYSICAL GOLD ETC (C) - Acc (GOLD FP) gathered $315.75 Mn, the largest individual net inflow.

Top 10 ETPs by net new assets May 2025: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

8,148.08 |

1,211.71 |

315.75 |

|

WisdomTree Core Physical Silver ETC |

WSIL LN |

470.56 |

414.36 |

308.46 |

|

Bitwise Ethereum Staking ETP |

ET32 GY |

220.63 |

146.20 |

107.69 |

|

iShares Physical Gold ETC |

SGLN LN |

22,342.45 |

1,234.83 |

90.47 |

|

WisdomTree Physical Gold - EUR Daily Hedged |

GBSE GY |

723.28 |

151.83 |

83.39 |

|

iShares Bitcoin ETP |

IB1T GY |

294.69 |

257.33 |

59.85 |

|

WisdomTree Physical Gold - GBP Daily Hedged |

GBSP LN |

2,004.36 |

(81.23) |

55.69 |

|

WisdomTree Enhanced Commodity Carry |

CRRY IM |

53.96 |

53.42 |

53.17 |

|

Invesco Physical Silver ETC - Acc |

SSLV LN |

365.89 |

50.31 |

36.60 |

|

WisdomTree Physical Swiss Gold |

SGBS LN |

3,769.01 |

(214.64) |

36.15 |

Investors have tended to invest in Equity ETFs during May.