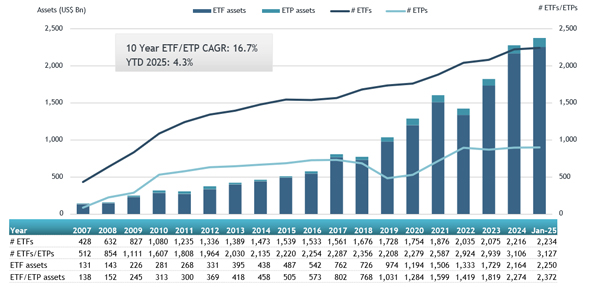

ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets in the ETFs industry in Europe reached a new record of US$2.37 trillion at the end of January. During January the ETFs industry in Europe gathered a net inflows of US$32.93 billion, according to ETFGI's January 2025 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in Europe reached a record of $2.37 Tn at the end of January beating the previous record of $2.29 Tn at the end of November 2024.

- The top three ETF providers in Europe account for 64.9% of the total European ETF AUM. iShares/BlackRock dominates with 41.7% market share, followed by Amundi ETF with 12.3%.

- Net inflows of $32.93 Bn in January are the highest January inflows on record, followed by January 2022 net inflows of $29.12 Bn and the third highest recorded January net inflows are of $21.61 Bn in 2024.

- 28th month of consecutive net inflows.

ETFs industry in Europe has 3,127 products, assets of $2.37 Tn, from 111 providers listed on 29 exchanges in 24 countries at the end of January.

iShares dominates the European ETF market with assets under management (AUM) totaling $988.44 billion across 455 ETFs, securing a 41.7% market share. Amundi ETF follows in second place with $292.75 billion in AUM across 336 ETFs, capturing a 12.3% market share. Xtrackers ranks third with $257.51 billion in AUM across 264 ETFs, holding a 10.9% market share. Together, the top three ETF providers, out of 111, account for 64.9% of the total European ETF AUM. The remaining 108 providers divide up the remaining 35.1% of the market and each hold less than 8% market share.

Top 10 ETF providers in Europe at the end of January

|

Provider |

# ETFs/ |

Assets |

% |

|

iShares |

455 |

988,443 |

41.7% |

|

Amundi ETF |

336 |

292,750 |

12.3% |

|

Xtrackers |

264 |

257,508 |

10.9% |

|

Vanguard |

34 |

171,438 |

7.2% |

|

UBS ETFs |

151 |

122,979 |

5.2% |

|

Invesco |

158 |

120,971 |

5.1% |

|

SPDR ETFs |

106 |

107,854 |

4.5% |

|

HSBC ETFs |

60 |

43,530 |

1.8% |

|

JP Morgan |

48 |

37,588 |

1.6% |

|

BNP Paribas Easy |

70 |

32,766 |

1.4% |

Source: ETFGI

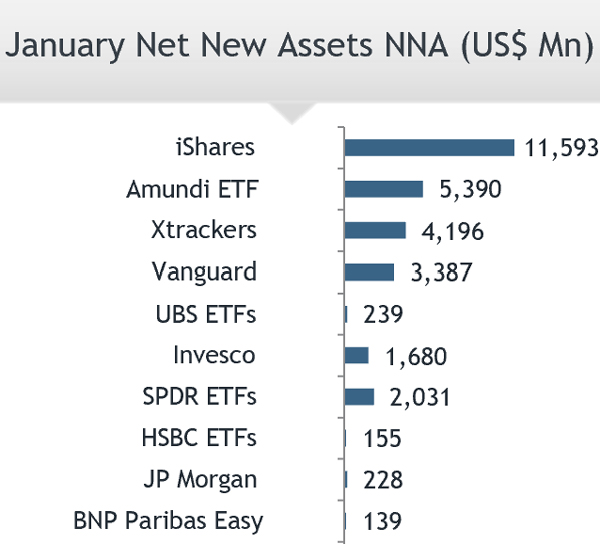

The European ETFs industry gathered $32.93 billion in January. iShares led the way, gathering the largest net inflows with $11.59 billion, followed by Amundi ETF with $5.39 billion, and Xtrackers with $4.20 billion in net inflows.

Net New assets for the top 10 ETF providers in Eurrope

Source: ETFGI

“The S&P 500 index increased by 2.78% in January. The developed markets excluding the US index increased by 4.71% in January. Germany (up 9.04%) and Sweden (up 8.81%) saw the largest increases amongst the developed markets in January. The Emerging markets index increased by 0.31% during January. Colombia (up 17.29%) and Brazil (up 12.68%) saw the largest increases amongst emerging markets in January,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the ETFs industry in Europe as of the end of January

The ETFs industry in Europe has 3,127 products, assets of $2.37 Tn, from 111 providers listed on 29 exchanges in 24 countries at the end of January.

During January, ETFs gathered net inflows of $32.93 Bn. Equity ETFs gathered net inflows of $23.60 Bn which is much higher than the $13.62 Bn in net inflows in January 2024. Fixed income ETFs reported net inflows of $4.54 Bn during January which is lower than the $8.14 Bn in net inflows in January 2024. Commodities ETFs reported net inflows of $2.42 Bn during January which is higher than the $859.18 Mn in net outflows in January 2024. Active ETFs attracted net inflows of $1.88 Bn during the month which is higher than the $727.38 Mn in net inflows in January 2024.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $16.86 Bn in January. iShares MSCI USA ESG Screened UCITS ETF (SASU LN) gathered $1.81 Bn, the largest individual net inflow.

Top 10 ETFs by net new assets January

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares MSCI USA ESG Screened UCITS ETF |

SASU LN |

11,929.63 |

1,808.38 |

1,808.38 |

|

Vanguard S&P 500 UCITS ETF |

VUSA LN |

66,451.42 |

1,740.49 |

1,740.49 |

|

iShares Core S&P 500 UCITS ETF |

CSSPX SW |

114,545.53 |

1,499.62 |

1,499.62 |

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

99,517.57 |

1,483.70 |

1,483.70 |

|

SPDR S&P 500 UCITS ETF |

SPY5 GY |

23,609.50 |

1,304.02 |

1,304.02 |

|

Amundi S&P 500 II UCITS ETF USD |

LSPU LN |

21,810.19 |

1,234.04 |

1,234.04 |

|

Xtrackers II EUR Overnight Rate Swap UCITS ETF - 1C |

XEON GY |

15,282.96 |

1,157.33 |

1,157.33 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

34,448.67 |

939.08 |

939.08 |

|

UBS Lux Fund Solutions - MSCI EMU UCITS ETF (EUR) A-dis |

EMUEUA GY |

4,566.01 |

551.83 |

551.83 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF |

IBTU LN |

20,507.39 |

515.95 |

515.95 |

The top 10 ETPs by net new assets collectively gathered $3.34 Bn during January. iShares Physical Gold ETC (SGLN LN) gathered $1.01 Bn, the largest individual net inflow.

Top 10 ETPs by net new assets January

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

SGLN LN |

18,934.90 |

1,012.98 |

1,012.98 |

|

21Shares XRP ETP |

4GLD GY |

15,586.83 |

589.99 |

589.99 |

|

Bitwise Physical XRP ETP |

SGLD LN |

18,579.81 |

464.99 |

464.99 |

|

WisdomTree Physical Swiss Gold |

GOLD FP |

6,295.97 |

396.55 |

396.55 |

|

WisdomTree Physical Bitcoin |

XGDU LN |

6,055.61 |

276.23 |

276.23 |

|

Invesco Physical Gold ETC - Acc |

WGLD LN |

1,398.64 |

159.92 |

159.92 |

|

CoinShares Physical Ethereum |

SGLE IM |

423.32 |

151.17 |

151.17 |

|

WisdomTree Physical Ethereum |

PHAG LN |

1,613.46 |

123.30 |

123.30 |

|

WisdomTree Physical XRP |

SSLN LN |

1,173.37 |

85.11 |

85.11 |

|

WisdomTree Physical Gold - EUR Daily Hedged |

BITC SW |

1,512.75 |

78.75 |

78.75 |

Investors have tended to invest in Equity ETFs during January.