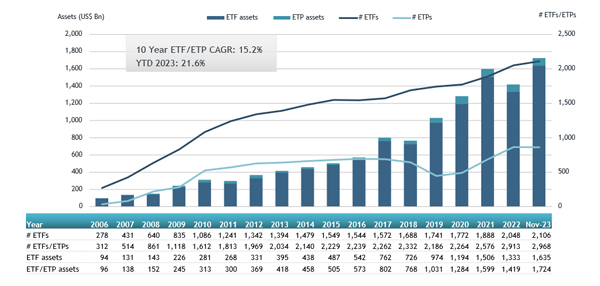

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that reports that assets invested in the ETFs industry in Europe reached a new milestone of US$1.72 trillion at the end of November. Net inflows of US$18.24 billion were gathered during November, bringing year-to-date net inflows to US$138.49 billion. Year-to-date, assets invested in the ETFs industry in Europe increased by 21.6%, going from US$1.42 trillion at end of 2022 to US$1.72 trillion, according to ETFGI's November 2023 European ETFs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in the ETFs industry in Europe reached a new milestone of $1.72 trillion at the end of November beating the previous record of $1.69 Tn set at the end of July 2023.

- Assets have increased 21.6% YTD in 2023, going from $1.42 Tn at end of 2022 to $1.72 Tn.

- Net inflows of $18.24 Bn in November 2023.

- YTD net inflows of $138.49 Bn are 2nd highest on record after YTD net inflows of $181.69 Bn in 2021.

- 14th month of consecutive net inflows.

“The S&P 500 index was up 9.13% in November and is up 20.8% YTD in 2023. Developed markets excluding the US index increased by 9.75% in November and is up 11.65% YTD in 2023. Israel (up 19.37%) and Sweden (up 18.02%) saw the largest decreases amongst the developed markets in November. Emerging markets increased by 7.19% during November and were up 6.98% YTD in 2023. Egypt (up 14.64%) and Brazil (up 14.15%) saw the largest increases amongst emerging markets in November.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

The ETFs industry in Europe had 2,968 products, with 12,117 listings, assets of $1.724 trillion, from 99 providers listed on 29 exchanges in 24 countries at the end of November 2023.

During November, ETFs gathered net inflows to $18.24 billion. Equity ETFs gathered net inflows of

$12.12 Bn during November, bringing YTD net inflows to $80.02 Bn, higher than the $51.83 Bn in net inflows YTD in 2022. Fixed income ETFs had net inflows of $7.90 Bn during November, bringing YTD net inflows to $59.12 Bn, higher than the $31.18 Bn in net inflows YTD in 2022. Commodities ETFs/ETPs reported net outflows of $2.17 Bn during November, bringing YTD net outflows to $6.96 Bn, much more than the $4.01 Bn in net outflows YTD in 2022. Active ETFs attracted net inflows of $38 Mn during the month, gathering net inflows YTD of $6.26 Bn, much higher than the $2.51 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $13.53 Bn during November. iShares Core € Corp Bond UCITS ETF (IEBC LN) gathered $2.69 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in November 2023: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

IEBC LN |

16,664.23 |

4,593.00 |

2,693.28 |

|

|

SPDR S&P 500 UCITS ETF |

SPY5 GY |

7,273.45 |

1,301.19 |

1,261.39 |

|

iShares € High Yield Corp Bond UCITS ETF |

IHYG LN |

6,366.17 |

1,173.73 |

943.14 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

62,090.31 |

8,635.65 |

892.17 |

|

Xtrackers MSCI AC World ESG Screened UCITS ETF |

XMAW GY |

3,058.25 |

1,346.39 |

659.74 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF |

IBTU LN |

12,278.49 |

1,904.47 |

652.06 |

|

SPDR S&P 500 ESG Leaders UCITS ETF - Acc |

SPPY GY |

1,472.94 |

568.17 |

562.42 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

4,188.35 |

835.95 |

530.15 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

17,926.77 |

2,825.65 |

525.18 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

8,291.17 |

1,587.11 |

511.55 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

5,198.45 |

1,120.31 |

503.39 |

|

UBS Irl ETF PLC - MSCI USA Socially Responsible UCITS ETF - Acc |

4UBI GY |

1,598.32 |

82.90 |

499.29 |

|

Amundi MSCI USA ESG Climate Net Zero Ambition CTB UCITS ETF |

USA FP |

1,641.20 |

565.34 |

470.67 |

|

iShares $ Treasury Bond 3-7yr UCITS ETF - USD D - Acc |

CSBGU7 SW |

6,605.89 |

781.77 |

454.76 |

|

iShares $ Treasury Bond 20+yr UCITS ETF |

IBTL LN |

8,021.60 |

4,596.00 |

435.36 |

|

iShares S&P 500 Information Technology Sector UCITS ETF - Acc |

IITU LN |

4,793.85 |

647.72 |

420.75 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

9,796.14 |

2,504.33 |

395.87 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

9,177.27 |

981.23 |

376.64 |

|

iShares $ Treasury Bond 1-3yr UCITS ETF |

IBTS LN |

10,451.97 |

805.69 |

372.77 |

|

CSIF IE MSCI USA ESG Leaders Blue UCITS ETF - Acc |

USESG SW |

2,380.38 |

144.71 |

368.02 |

The top 10 ETPs by net new assets collectively gathered $677.49 Mn during November. BTCetc – ETC Group Physical Bitcoin - Acc (BTCE GY) gathered $175.08 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in November 2023: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

BTCetc – ETC Group Physical Bitcoin - Acc |

BTCE GY |

1,022.44 |

402.20 |

175.08 |

|

WisdomTree WTI Crude Oil - Acc |

CRUD LN |

721.13 |

(128.64) |

123.35 |

|

WisdomTree Copper - Acc |

COPA LN |

1,256.60 |

824.46 |

95.24 |

|

CoinShares Physical Bitcoin - Acc |

BITC SW |

502.07 |

105.26 |

65.23 |

|

21Shares Bitcoin ETP - Acc |

ABTC SW |

474.12 |

128.27 |

54.62 |

|

WisdomTree S&P 500 VIX Short-Term Futures 2.25x Daily Leveraged - Acc |

VIXL IM |

42.35 |

75.20 |

40.77 |

|

21Shares Ethereum Staking ETP - Acc |

AETH SW |

295.83 |

36.16 |

36.64 |

|

WisdomTree Natural Gas 3x Daily Leveraged - Acc |

3NGL LN |

63.62 |

192.69 |

34.40 |

|

WisdomTree Aluminium - EUR Daily Hedged - Acc |

EALU IM |

41.24 |

39.04 |

28.49 |

|

WisdomTree Broad Commodities Ex-Agriculture and Livestock - Acc |

OOEC GY |

26.71 |

23.50 |

23.68 |

Investors have tended to invest in Equity ETFs and ETPs during November.