ETFGI, a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends, reported today that assets invested in the ETFs industry in Canada reached a new record of US$463.25 billion at the end of May. During May the ETFs industry in Canada gathered net inflows of US$7.88 billion, bringing year-to-date net inflows to US$40.49 billion – also a record, according to ETFGI's May 2025 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Canadian ETFs industry reached a record US$463.25 billion at the end of May, surpassing the previous high of US$438.26 billion recorded at the end of April 2025.

- Net inflows of $7.88 Bn in May 2025.

- Year-to-date net inflows of US$40.49 billion mark the highest on record, surpassing the previous highs of US$22.22 billion in 2021 and US$20.64 billion in 2024, which now rank as the second and third highest, respectively.

- 35th month of consecutive net inflows.

“The S&P 500 Index rose by 6.29% in May, bringing its year-to-date (YTD) gain to 1.06% in 2025. The Developed Markets ex-U.S. Index increased by 5.12% in May and is up 16.52% YTD. Among developed markets, Austria and the Netherlands led with gains of 11.40% and 9.12%, respectively. The Emerging Markets Index climbed 4.42% in May, with a 6.30% YTD increase. Taiwan and Greece posted the strongest monthly performances among emerging markets, rising 12.57% and 10.99%, respectively,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

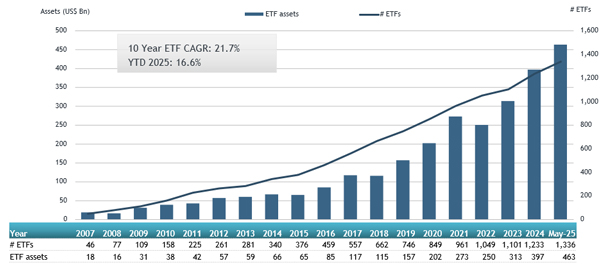

Growth in assets in the ETFs industry in Canada as of the end of May

The ETFs industry in Canada ETF had 1,336 ETFs, with 1,679 listings, assets of US$463.25 Bn, from 45 providers listed on 2 exchanges at the end of May.

During May, ETFs gathered net inflows of $7.88 Bn. Equity ETFs reported net inflows of $2.74 Bn during May, bringing YTD net inflows to $13.93 Bn, higher than the $11.36 Bn in YTD net inflows in 2024. Fixed income ETFs gathered net inflows of $1.46 Bn during May, bringing YTD net inflows to $5.67 Bn, higher than the $1.72 Bn in net inflows YTD in 2024. Active ETFs reported net inflows of $3.40 Bn during the month, gathering YTD net inflows of $19.56 Bn, much higher than the $7.78 Bn in YTD net inflows in 2024. Crypto ETFs reported net inflows of $16 Mn during May, bringing YTD net inflows to $189 Mn, higher than the $574 Mn in YTD net outflows in 2024.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.95 Bn during May. iShares ESG Aware MSCI Emerging Markets Index ETF (XSEM CN) gathered $405.58 Mn, the largest individual net inflow.

Top 20 ETFs by net new assets May 2025: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XSEM CN |

2856.27 |

384.47 |

405.58 |

|

|

BMO Aggregate Bond Index ETF |

ZAG CN |

8221.09 |

1007.28 |

329.15 |

|

iShares Core S&P/TSX Capped Composite Index ETF |

XIC CN |

11779.34 |

515.58 |

312.13 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

16146.29 |

1681.18 |

289.36 |

|

iShares S&P/TSX 60 Index Fund |

XIU CN |

12218.65 |

(376.52) |

255.65 |

|

TD Canadian Long Term Federal Bond ETF |

TCLB CN |

533.22 |

(67.12) |

226.16 |

|

BMO MSCI EAFE Index ETF |

ZEA CN |

7379.11 |

537.60 |

209.87 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

8877.31 |

1223.23 |

203.27 |

|

Fidelity All-in-One Balanced ETF |

FBAL CN |

2365.90 |

787.84 |

193.27 |

|

Fidelity All-in-One Equity ETF |

FEQT CN |

987.46 |

437.52 |

175.67 |

|

Scotia US Equity Index Tracker ETF |

SITU CN |

1736.19 |

405.90 |

161.34 |

|

BMO Equal Weight US Banks Index ETF |

ZBK CN |

664.32 |

125.97 |

155.21 |

|

iShares Core Equity ETF Portfolio |

XEQT CN |

5585.38 |

1108.62 |

152.65 |

|

BMO Money Market Fund |

ZMMK CN |

3590.81 |

1219.08 |

137.84 |

|

CI Yield Enhanced Canada Aggregate Bond Index ETF |

CAGG CN |

940.63 |

66.50 |

132.47 |

|

BMO Gold Bullion ETF |

ZGLD CN |

785.57 |

194.36 |

126.44 |

|

Purpose Cash Management Fund |

MNY CN |

931.63 |

317.02 |

122.75 |

|

BMO Short Corporate Bond Index ETF |

ZCS CN |

3092.68 |

1057.85 |

122.19 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

3459.83 |

756.48 |

121.89 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

8287.14 |

619.60 |

118.47 |

Investors have tended to invest in Active ETFs during May.