ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed Globally gathered net inflows of

$75.29 billion in November, bringing year-to-date net inflows to US$477.01 billion which is significantly higher than the US$439.61 billion gathered at this point last year. Assets invested in the Global ETF/ETP industry have increased by 2.5%, from US$5.96 trillion at the end of October, to US$6.12 trillion at the end of November, according to ETFGI's November 2019 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Global ETF/ETP industry reached a new record of $6.12 trillion at the end of November.

- The $75.29 billion in net inflowsgathered in November is the 4th highest monthly net inflow on record.

- Year-to-date net inflows of $477.01 billion are the 2nd highest behind November 2017 with $653.97 billion

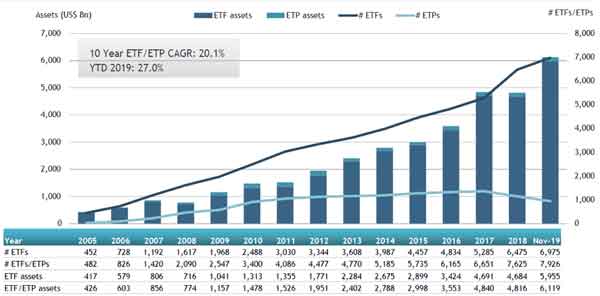

- Assets are up 27% year to date which is greater than the 20.1% CAGR over the past 10 years.

- Equity products have gathered more net inflows than fixed income products as of the end of November.

“During November the S&P 500 gained 3.6% as global markets were resistant to fears of inflation and showed optimism on the trade talks. Global equities as measured by the S&P Global BMI were up 2.5% and the S&P Emerging BMI gained 0.1%.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of November 2019

At the end of November 2019, the Global ETF/ETP industry had 7,926 ETFs/ETPs, with 15,883 listings from 429 providers on 70 exchanges in 58 countries.

In November 2019, ETFs/ETPs gathered net inflows of $75.29 billion. Equity ETFs/ETPs listed Globally gathered net inflows of $56.92 billion in November, bringing net inflows for 2019 to $215.28 billion, substantially less than the $311.62 billion in net inflows equity products had attracted by the end of November 2018. Fixed income ETFs/ETPs listed Globally attracted net inflows of $16.40 billion in November, bringing net inflows for 2019 to $207.65 billion, considerably greater than the $86.16 billion in net inflows fixed income products had attracted by the end of November 2018. Commodity ETFs/ETPs suffered $1.71 billion in net outflows bringing net inflows for 2019 to $18.45 billion, which is greater than the $1.49 billion in net outflows suffered through November 2018.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $29.51 billion in November, the SPDR S&P 500 ETF Trust (SPY US) gathered $6.64 billion alone.

Top 20 ETFs by net new inflows November 2019: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

291,129.85 |

(8,679.79) |

6,636.95 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

71,431.87 |

10,205.88 |

2,724.60 |

|

Vanguard S&P 500 ETF |

|

VOO US |

126,904.64 |

12,917.30 |

1,882.19 |

|

iShares Core MSCI World UCITS ETF |

|

IWDA LN |

21,809.30 |

4,351.44 |

1,443.42 |

|

Invesco QQQ Trust |

|

QQQ US |

82,859.08 |

1,910.65 |

1,440.77 |

|

iShares Core € Corp Bond UCITS ETF |

|

IEBC LN |

14,735.25 |

6,216.04 |

1,322.11 |

|

Vanguard High Dividend Yield Index Fund |

|

VYM US |

28,692.65 |

3,357.14 |

1,263.48 |

|

iShares MSCI Japan ETF |

|

EWJ US |

14,158.93 |

(2,866.97) |

1,203.58 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

15,284.55 |

5,954.87 |

1,196.64 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

67,158.26 |

6,399.52 |

1,070.56 |

|

iShares Core S&P Small-Cap ETF |

|

IJR US |

46,764.54 |

2,946.45 |

1,070.10 |

|

iShares MSCI USA Size Factor ETF |

|

SIZE US |

1,454.55 |

1,133.31 |

1,022.54 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

26,436.98 |

(1,874.51) |

943.87 |

|

iShares Core MSCI Emerging Markets ETF |

|

IEMG US |

57,147.59 |

3,757.18 |

930.10 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

132,081.71 |

13,578.85 |

919.61 |

|

Technology Select Sector SPDR Fund |

|

XLK US |

25,581.41 |

1,147.89 |

911.02 |

|

Samsung KODEX 200 ETF |

|

069500 KS |

6,008.95 |

(270.14) |

906.81 |

|

Vanguard Total Bond Market ETF |

|

BND US |

47,473.97 |

8,589.77 |

897.98 |

|

Vanguard Value ETF |

|

VTV US |

54,503.44 |

4,383.09 |

867.18 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

17,321.75 |

5,520.63 |

857.90 |

The top 10 ETPs by net new assets collectively gathered $1.78 billion in November. The Velocity Shares Daily 3x Long Natural Gas ETN (UGAZ US) gathered $472 million alone.

Top 10 ETPs by net new inflows November 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

VelocityShares Daily 3x Long Natural Gas ETN |

UGAZ US |

923.70 |

1316.83 |

471.88 |

|

VelocityShares Daily 2x VIX Short Term ETN |

TVIX US |

891.77 |

2004.69 |

206.23 |

|

Amundi Physical Metals PLC |

GOLD FP |

822.52 |

794.85 |

182.46 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

928.17 |

1264.57 |

169.47 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

579.45 |

1001.86 |

158.60 |

|

WisdomTree Physical Swiss Gold |

SGBS LN |

2532.64 |

1578.83 |

146.24 |

|

C-Tracks Exchange-Traded Notes Miller/Howard Strategic Dividend Reinvestor |

DIVC US |

143.18 |

144.54 |

144.54 |

|

BNP Paribas EUR Hedged RICI Enhanced Energy ER Index ETC |

B4NX GY |

116.95 |

120.60 |

120.56 |

|

Xetra Gold EUR |

4GLD GY |

9480.72 |

871.76 |

102.05 |

|

C-Tracks Miller/Howard MLP Fu |

Investors have tended to invest in core Equity and core Fixed Income ETFs during November.