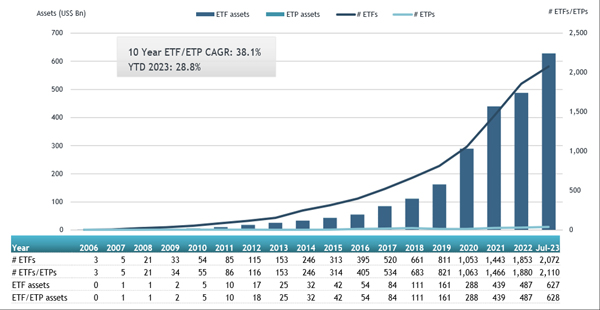

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in actively managed the ETFs listed globally reached a record of US$628 billion at the end of July. During July, actively managed ETFs listed globally gathered US$15.26 billion, bringing year-to-date net inflows to US$84.70 billion. Assets have increased 28.8% year-to-date in 2023, going from US$487.21 billion at the end of 2022 to US$627.69 billion, according to ETFGI's July 2023 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the actively managed ETFs listed globally reached a record of $628 Bn at the end of July beating the previous record of $583 Bn at the end of June 2023.

- Assets have increased 28.8% year-to-date in 2023, going from $487.21 Bn at the end of 2022 to $627.69 Bn.

- Net inflows of $15.26 Bn during July 2023.

- Year-to-date net inflows of $84.70 Bn in 2023 are the second highest on record, after YTD net inflows of $87.65 Bn in 2021.

- 40th month of consecutive net inflows.

“The S&P 500 increased by 3.21% in July and is up 20.65% year-to-date in 2023. Developed markets excluding the US increased by 3.62% in July and are up 15.09% YTD in 2023. Norway (up 8.97%) and Israel (up 8.06%) saw the largest increases amongst the developed markets in July. Emerging markets increased by 6.15% during July and are up 11.08% YTD in 2023. Turkey (up 20.52%) and Pakistan (up 15.89%) saw the largest increases amongst emerging markets in July.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Actively managed ETFs listed globally asset growth as at end of July

There where 2,110 actively managed ETFs listed globally, with 2,626 listings, assets of $628 Bn, from 381 providers listed on 33 exchanges in 25 countries at the end of July.

Equity focused actively managed ETFs listed globally gathered net inflows of $8.18 Bn during July, bringing year to date net inflows to $57.84 Bn, significantly higher than the $47.38 Bn in net inflows YTD in 2022. Fixed Income focused actively managed ETFs listed globally attracted net inflows of $6.69 Bn during July, bringing YTD net inflows to $27.47 Bn, much higher than the $13.90 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 active ETFs by net new assets, which collectively gathered

$7.42 Bn during July. JPMorgan Limited Duration Bond ETF (JPLD US) gathered $825.71 Mn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets July 2023

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Limited Duration Bond ETF |

JPLD US |

825.71 |

825.71 |

825.71 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

4779.30 |

3,319.20 |

733.96 |

|

JPMorgan Equity Premium Income ETF |

JEPI US |

29033.99 |

10,865.84 |

723.18 |

|

Yinhua Traded Money Market Fund |

511880 CH |

16396.58 |

617.02 |

617.02 |

|

Innovator U.S. Equity Power Buffer ETF - July |

PJUL US |

995.80 |

403.68 |

553.13 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

980.53 |

164.98 |

339.09 |

|

Vanguard Ultra Short-Term Bond ETF |

VUSB US |

3718.76 |

290.16 |

333.96 |

|

SAMSUNG KODEX CD Rate Active ETF SYNTH |

459580 KS |

446.51 |

442.39 |

315.49 |

|

Dimensional US Core Equity 2 ETF |

DFAC US |

21825.91 |

2,704.56 |

298.65 |

|

MIRAE ASSET TIGER SYNTH-KOFR ACTIVE ETF |

449170 KS |

962.26 |

959.10 |

287.81 |

|

Janus Henderson Mortgage-Backed Securities ETF |

JMBS US |

1732.04 |

908.76 |

280.85 |

|

Dimensional Emerging Core Equity Market ETF |

DFAE US |

2928.44 |

694.48 |

260.25 |

|

Avantis U.S. Small Cap Value ETF |

AVUV US |

6899.36 |

1,422.93 |

250.26 |

|

JPMorgan Sustainable Municipal Income ETF |

JMSI US |

238.12 |

238.26 |

238.26 |

|

CI High Interest Savings ETF |

CSAV CN |

5933.45 |

1,880.19 |

233.88 |

|

Avantis Emerging Markets Equity ETF |

AVEM US |

3859.73 |

1,065.21 |

230.18 |

|

JPMorgan High Yield Municipal ETF |

JMHI US |

226.07 |

227.61 |

227.61 |

|

JPMorgan Equity Focus ETF |

JPEF US |

226.89 |

226.89 |

226.89 |

|

ARK Innovation ETF |

ARKK US |

9110.63 |

(304.39) |

223.85 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

947.92 |

37.03 |

222.99 |

|