ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that actively managed ETFs and ETPs gathered net inflows of IUS$4.24 billion in September, bringing year-to-date net inflows to US$28.37 billion. Assets invested in actively managed ETFs/ETPs finished the month up 3.5%, from US$136.43 billion at the end of August to US$141.21 billion, according to ETFGI's September 2019 Active ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in actively managed ETFs/ETPs reached a new record of $141.21 billion

- During September 2019, actively managed ETFs/ETPs attracted $4.24 billion in net inflows.

- Fixed income based actively managed ETFs/ETPs still remain the most popular.

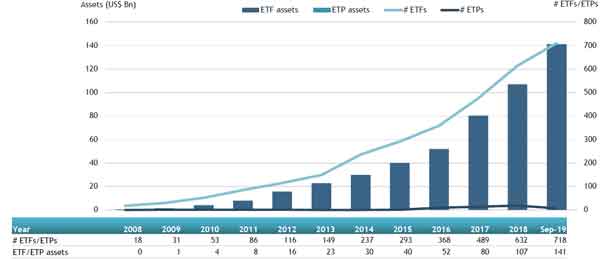

At the end of September 2019, the global active ETF/ETP industry had 718 ETFs/ETPs, with 938 listings, from145 providers on 23 exchanges in 58 countries. Following net inflows of $4.24 billion and market moves during the month, assets invested in the actively managed ETF/ETP industry increased by 3.5% from $136.43 billion at the end of September to $141.21 billion.

Growth in actively managed ETF and ETP assets as of the end of September 2019

Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $336 million in September, bringing net inflows for the year to September 2019 to $4.87 billion, less than the $6.03 billion in net inflows equity products had attracted for the year to September 2018. Fixed income focused actively managed ETFs/ETPs listed globally attracted net inflows of $3.57 billion in September, bringing net inflows for the year to September 2019 to $22.74 billion, greater than the $17.23 billion in net inflows fixed income products had attracted for the year to September 2018.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $3.39 billion in September, Franklin Liberty U.S. Core Bond ETF gathered $537.84 million alone.

Top 20 actively managed ETFs/ETPs by net new assets September 2019

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Franklin Liberty U.S. Core Bond ETF |

FLCB US |

538.91 |

537.84 |

537.84 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

8,862.68 |

3,698.20 |

486.86 |

|

iShares Liquidity Income ETF |

ICSH US |

2,128.98 |

1,241.71 |

269.34 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

2,236.77 |

(18.41) |

254.19 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

4,424.79 |

1,032.07 |

211.09 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

3,550.50 |

1,461.43 |

189.39 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

493.98 |

377.37 |

171.68 |

|

Purpose High Interest Savings ETF |

PSA CN |

1,582.33 |

509.41 |

147.43 |

|

First Trust Enhanced Short Maturity Fund |

FTSM US |

4,891.89 |

813.85 |

129.26 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

12,787.71 |

501.03 |

128.18 |

|

BMO Low Volatility Canadian Equity ETF |

ZLB CN |

1,574.68 |

552.55 |

112.02 |

|

iShares Commodities Select Strategy ETF |

COMT US |

517.42 |

107.17 |

100.25 |

|

CI First Asset High Interest Savings ETF |

CSAV CN |

275.74 |

273.86 |

98.36 |

|

iShares Short Maturity Bond ETF |

NEAR US |

6,847.60 |

891.94 |

88.05 |

|

PGIM Ultra Short Bond ETF |

PULS US |

647.42 |

465.66 |

85.14 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF |

PDBC US |

1,540.11 |

(363.71) |

81.45 |

|

BMO Low Volatility US Equity ETF |

ZLU CN |

1,023.31 |

370.87 |

81.43 |

|

First Trust Managed Municipal ETF |

FMB US |

1,064.86 |

525.33 |

80.45 |

|

Mirae Asset TIGER USD Money Market Active ETF |

329750 KS |

129.72 |

130.46 |

68.44 |

|

First Trust Tactical High Yield ETF |

HYLS US |

1,393.65 |

155.11 |

67.53 |

Investors have tended to invest in actively managed Fixed Income ETFs/ETPs during September.

.jpg)