ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that actively managed ETFs and ETPs gathered net inflows of

US$3.39 billion in November, bringing year-to-date net inflows to US$37.29 billion. Assets invested in actively managed ETFs/ETPs finished the month up 2.7%, from US$147.30 billion at the end of October to US$151.24 billion, according to ETFGI's November 2019 Active ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets in actively managed ETFs/ETPs reached a new record of $151.24 billion.

- During November 2019, actively managed ETFs/ETPs attracted $3.39 billion in net inflows.

- Fixed income ETFs/ETPs still remain the most popular accounting for 70% of all assets.

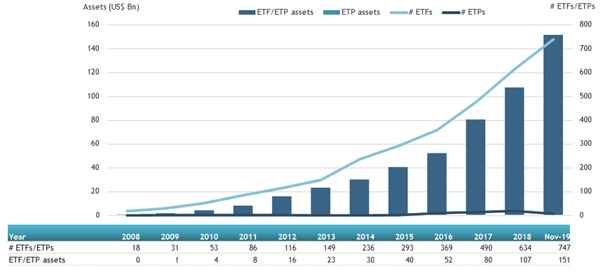

At the end of November 2019, the global active ETF/ETP industry had 747 ETFs/ETPs, with 964 listings, from 147 providers on 24 exchanges in 58 countries. Following net inflows of $3.39 billion and market moves during the month, assets invested in the actively managed ETF/ETP industry increased by 2.7% to $151.24 billion.

Growth in actively managed ETF and ETP assets as of the end of November 2019

Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $19.0 million in October, bringing net inflows for the year to October 2019 to $6.42 billion, slightly less than the $6.47 billion in net inflows equity products had attracted for the year to November 2018. Fixed income focused actively managed ETFs/ETPs listed globally attracted net inflows of $3.47 billion in November, bringing net inflows for the year to November 2019 to $29.94 billion, greater than the $24.32 billion in net inflows fixed income products had attracted for the year to November 2018.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$3.39 billion in November, JPMorgan Ultra-Short Income ETF (JPST US) gathered $580.16 million alone.

Top 20 actively managed ETFs/ETPs by net new assets November 2019

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

10005.21 |

4904.04 |

580.16 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

13387.36 |

1098.63 |

305.94 |

|

iShares Liquidity Income ETF |

ICSH US |

2441.40 |

1561.39 |

254.21 |

|

JPMorgan Global Emerging Markets Research Enhanced Index Equity ESG UCITS ETF |

JREM LN |

224.93 |

217.03 |

201.25 |

|

First Trust Preferred Securities and Income Fund |

FPE US |

4861.78 |

1443.02 |

197.90 |

|

Franklin Liberty Investment Grade Corporate ETF |

FLCO US |

580.22 |

548.35 |

179.71 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

2276.42 |

30.04 |

162.65 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

3881.41 |

1451.78 |

139.88 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

3883.91 |

1814.09 |

137.34 |

|

CI First Asset High Interest Savings ETF |

CSAV CN |

709.92 |

719.82 |

133.64 |

|

Invesco Ultra Short Duration ETF |

GSY US |

2726.36 |

666.10 |

115.94 |

|

PIMCO Total Return Active Exchange-Traded Fund |

BOND US |

2863.00 |

748.65 |

113.73 |

|

BMO Low Volatility Canadian Equity ETF |

ZLB CN |

1777.80 |

726.85 |

91.72 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

1182.97 |

734.11 |

91.60 |

|

ARK Web x.O ETF |

ARKW US |

497.13 |

-4.88 |

83.81 |

|

Firozeh Asia |

FIRO1 |

116.85 |

85.76 |

77.87 |

|

ICBC CICC USD Money Market ETF |

9011 HK |

212.36 |

215.95 |

75.81 |

|

Fidelity Limited Term Bond ETF |

FLTB US |

213.99 |

81.48 |

73.78 |

|

First Trust Managed Municipal ETF |

FMB US |

1193.42 |

660.99 |

63.54 |

|

IQ Ultra Short Duration Etf |

ULTR US |

92.71 |

92.59 |

62.60 |

Investors have tended to invest in actively managed Fixed Income ETFs/ETPs during November.

.jpg)