ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that actively managed ETFs and ETPs saw net inflows of US$7.04 billion during June, bringing year-to-date net inflows to US$26.69 billion which is significantly more than the US$16.41 billion gathered at this point in 2019. Assets invested in actively managed ETFs/ETPs finished the month up to 8.1%, from US$168.98 billion at the end of May to US$182.72 billion a new record, according to ETFGI's June 2020 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets in actively managed ETFs/ETPs reached a new record high of $182.72 Bn at the end of June.

- YTD net inflows of $26.69 Bn are significantly more than the $16.41 Bn gathered at this point in 2019

- Actively managed fixed Income ETFs/ETPs account for 67.4% of overall assets followed by 27.1% in equity products.

“The S&P 500 gained 1.99% during June. In Q2, U.S. equities staged a recovery from the Q1’s decline. Although Covid cases in the U.S. are still increasing the stimulus from the Fed and Congress, aided the market rebound. During June developed markets outside the U.S. were up 3.44% and up 16.8% in Q2. In June Hong Kong (up 11.35%), New Zealand (up 10.09%) Netherlands (up 8%) and Germany (up 6.08%) as the top performers. Emerging markets gained 7.6% in June and are up 19.3% in Q2.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

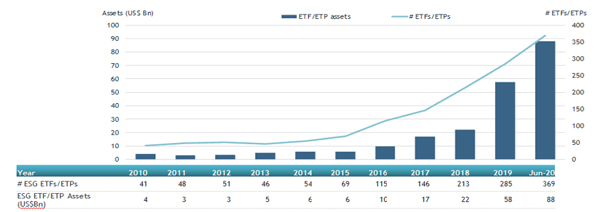

Growth in actively managed ETF and ETP assets as of the end of June 2020

Fixed Income focused actively managed ETFs/ETPs listed globally gathered net inflows of $4.82 BN during June, bringing net inflows for the year to June to $14.38 BN, more than the $12.88 Bn in net inflows Fixed Income products attracted for the year to June 2019. Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $1.89 Bn during June, bringing net inflows for the year to June 2020 to $10.35 Bn, greater than the $3.25 Bn in net inflows equity products had attracted for the year to June 2019.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$6.41 billion during June. JPMorgan Ultra-Short Income ETF gathered $1.36 billion alone.

Top 20 actively managed ETFs/ETPs by net new assets June 2020

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

12,782.38 |

2,508.79 |

1,364.38 |

|

iShares Liquidity Income ETF |

ICSH US |

3874.66 |

1,230.48 |

828.42 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

13,877.35 |

209.12 |

610.25 |

|

ARK Innovation ETF - Acc |

ARKK US |

4,766.14 |

1,694.89 |

583.61 |

|

HSBC Multi Factor Worldwide Equity UCITS ETF |

HWWA LN |

770.52 |

422.41 |

408.76 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

3,865.51 |

23.78 |

390.16 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

2,762.35 |

1,409.03 |

272.36 |

|

Franklin Liberty US Treasury Bond ETF |

FLGV US |

245.39 |

243.64 |

243.64 |

|

Janus Short Duration Income ETF - Acc |

VNLA US |

1,782.25 |

712.60 |

212.92 |

|

Franklin Liberty Investment Grade Corporate ETF - Acc |

FLCO US |

905.00 |

302.72 |

210.65 |

|

ARK Web x.O ETF - Acc |

ARKW US |

1,280.27 |

503.74 |

192.16 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

5,593.03 |

1,661.14 |

178.27 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

469.72 |

17.34 |

159.28 |

|

Invesco Ultra Short Duration ETF |

GSY US |

2,535.92 |

201.95 |

146.13 |

|

ARK Genomic Revolution Multi-Sector ETF - Acc |

ARKG US |

1,318.73 |

473.11 |

124.23 |

|

Hartford Core Bond ETF |

HCRB US |

136.01 |

134.95 |

114.85 |

|

American Century Focused Dynamic Growth ETF |

FDG US |

130.75 |

124.95 |

109.51 |

|

BetaShares Australian Strong Bear Hedge Fund |

BBOZ AU |

310.98 |

292.92 |

97.46 |

|

Fidelity Limited Term Bond ETF |

FLTB US |

232.09 |

91.40 |

85.92 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF |

PDBC US |

2,108.63 |

802.48 |

78.92 |

Investors have tended to invest in Fixed Income actively managed ETFs/ETPs during June.