ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$13.46 billion in October, bringing year-to-date net inflows to US$88.89 billion which is nearly double the US$47.71 billion in net inflows at this point last year . Assets invested in the European ETFs/ETPs industry have increased by 3.8%, from US$924.71 billion at the end of September, to a record US$959.96 billion, according to ETFGI's October 2019 European ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the European ETFs/ETPs industry climbed to a record $959.96 billion at the end of October

- Assets invested in the European ETFs/ETPs industry increased 3.8% in October

- During October 2019, ETFs/ETPs listed in Europe attracted $13.46 billion in net inflows

- Year-to-date net inflows are $88.89 billion which is nearly double the $47.71 billion in 2019

“The Fed rate cut and the looming hope for an agreement between US-China shaped a favourable investment environment in equity markets globally which led the S&P 500® to gain 3.2% during October. International markets also gained, with the S&P Developed Ex-U.S. and the S&P Emerging BMI both up 4%. The better performance of the Equity Markets reflected into a new record high of $959.96 billion and higher inflows of ETFs/ETPs exposed to Equity Indices rather than Fixed Income.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

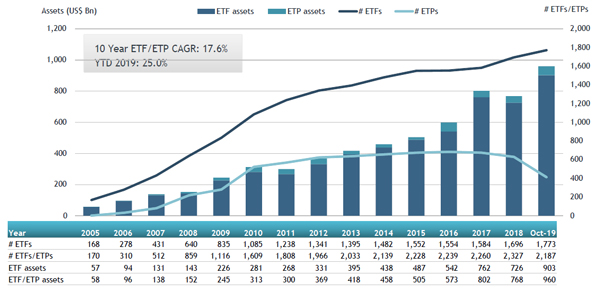

Europe ETF and ETP asset growth as at the end of October 2019

At the end of October 2019, the European ETF/ETP industry had 2,187 ETFs/ETPs, with 8,343 listings, from 72 providers listed on 27 exchanges in 23 countries.

Equity ETFs/ETPs listed in Europe gathered net inflows of $7.72 billion in October 2019, bringing net inflows for the year to October 2019 to $24.53 billion, less than the $33.97 billion in net inflows equity products had attracted for the year to October 2018. Fixed income ETFs/ETPs listed in Europe gathered net inflows of $4.18 billion in October, bringing net inflows for the year to October 2019 to $52.04 billion, considerably greater than the $12.06 billion in net inflows fixed income products had attracted for the year to October 2018. Commodity ETFs/ETPs gathered

$1.53 billion in net inflows bringing net inflows to $8.73 billion for the year to October 2019, which is greater than the $2.10 billion in net inflows gathered for the year to October 2018.

Substantial inflows can be attributed to the top 20 ETF’s by net new assets, which collectively gathered $8.68 billion in October. The UBS ETF (LU) MSCI United Kingdom UCITS ETF (GBP) A-acc (UKGBPB SW) gathered $1.27 billion alone.

Top 20 ETFs by net inflows in October 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

UBS ETF (LU) MSCI United Kingdom UCITS ETF (GBP) A-acc |

UKGBPB SW |

1,798.39 |

1,017.17 |

1,271.62 |

|

Vanguard FTSE 250 UCITS ETF |

VMID LN |

2,191.10 |

1,146.66 |

806.71 |

|

iShares Core MSCI Japan IMI UCITS ETF |

IJPA LN |

4,696.21 |

983.51 |

783.15 |

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

19,800.56 |

2,908.02 |

626.88 |

|

UBS ETF (LU) MSCI EMU UCITS ETF (EUR) A-dis |

UB0F LN |

701.43 |

638.18 |

527.47 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF - Acc |

IB01 LN |

2,313.60 |

2,299.73 |

510.88 |

|

iShares Core FTSE 100 UCITS ETF |

ISF LN |

10,322.49 |

2,619.52 |

445.93 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

9,528.65 |

2,459.03 |

356.09 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

13,617.29 |

4,893.93 |

349.19 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF - Acc |

TBX1 SW |

763.49 |

748.08 |

329.26 |

|

WisdomTree Physical Gold |

PHAU LN |

7,933.00 |

121.69 |

327.37 |

|

Lyxor UCITS ETF STOXX EUROPE 600 BANKS |

BNK FP |

781.87 |

217.57 |

307.48 |

|

Xtrackers MSCI World Index UCITS ETF (DR) - 1C |

XWLD LN |

4,628.13 |

1,016.60 |

293.69 |

|

SPDR MSCI Europe Industrials ETF |

STQ FP |

315.29 |

280.10 |

287.10 |

|

iShares MSCI USA SRI UCITS ETF |

SUAS LN |

1,456.50 |

718.64 |

260.10 |

|

Vanguard Global Aggregate Bond UCITS ETF |

VAGU LN |

363.13 |

362.28 |

255.45 |

|

iShares Euro Corp Bond SRI UCITS ETF |

SUOE LN |

974.33 |

904.77 |

249.88 |

|

iShares Core € Govt Bond UCITS ETF |

SEGA LN |

2,621.18 |

915.67 |

248.12 |

|

AMUNDI INDEX BARCLAYS GLOBAL AGG 500M UCITS ETF DR |

GAHU FP |

414.64 |

412.47 |

221.68 |

|

iShares € Ultrashort Bond UCITS ETF |

ERNE LN |

3,367.85 |

696.14 |

217.80 |

The top 10 ETP's by net new assets collectively gathered $1.19 billion in October. The WisdomTree Physical Gold (PHAU LN) gathered $327.37 million alone.

Top 10 ETPs by net inflows in October 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

WisdomTree Physical Gold |

PHAU LN |

7,933.00 |

121.69 |

327.37 |

|

Invesco Gold ETC |

SGLD LN |

7,422.05 |

1,449.74 |

190.86 |

|

iShares Physical Gold ETC |

SGLN LN |

6,908.43 |

1,687.44 |

139.30 |

|

WisdomTree Precious Metals - EUR Daily Hedged |

00XQ GY |

122.55 |

119.88 |

119.89 |

|

Xetra Gold EUR |

4GLD GY |

9,687.29 |

769.71 |

101.02 |

|

WisdomTree WTI Crude Oil |

CRUD LN |

530.62 |

(49.74) |

94.31 |

|

GBS Bullion Securities |

GBS LN |

3,927.83 |

58.41 |

91.85 |

|

Xtrackers Physical Gold ETC |

XGLD LN |

1,131.25 |

230.22 |

52.54 |

|

WisdomTree Physical Swiss Gold |

SGBS LN |

2,469.10 |

1,432.60 |

48.19 |

|

Amundi Physical Metals PLC |

GOLD FP |

666.86 |

612.39 |

25.24 |

Investors have tended to invest in various types of Equity, Fixed Income and Commodity ETFs and ETPs in October.