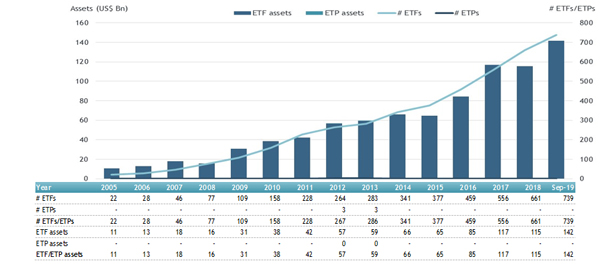

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs listed in Canada saw net inflows of US$347 million in September, bringing year-to-date net inflows to US$11.35 billion. In the month, Canadian ETF assets increased by 2.0%, from US$138.91 billion in August to US$141.75 billion. Year-to-date through to the end of September, Canadian ETF assets increased 22.7% from US$115.48 billion to US$141.75 billion. At the end of September 2019, the Canadian ETF/ETP industry had 739 ETFs/ETPs, with 888 listings, from 37 providers on 2 exchanges. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Canadian ETF/ETP industry reached a record $141.75 billion at end September.

- Assets invested in the Canadian ETF/ETP industry increased by 2.0% in September.

- In September 2019, ETFs/ETPs listed in Canada saw $347 million in net inflows.

Less than a month left to Register to join the discussion with key industry leading ETF issuers, investors, traders, analysts, regulators, and lawyers – at the ETFGI Global ETFs Insights Summit on December 2nd from 8am – 4:45pm in Toronto at the St Regis Toronto hotel.

“The S&P 500® gained 1.9% during September despite slowing economic growth, ongoing trade disputes and a presidential impeachment inquiry. Shifting the focus to the S&P Developed ex-U.S. BMI, the index was up 3.0%, as 23 of 25 countries gained during the month; the highest gainer in the month was Korea (up 6.4%), while Hong Kong continued to decline (down 0.8%). From an Emerging Markets standpoint, the S&P Emerging BMI gained 1.4%, with 15 of the 23 reporting gains. Globally, equities reclaimed prior month losses, gaining 2.1%, as measured by the S&P Global BMI (38 out of 50 countries reporting gains).” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in Canadian ETF and ETP assets as of the end of September 2019

Equity ETFs/ETPs suffered outflows of $839 million in September, bringing net inflows for the year to September 2019 to $1.79 billion, compared to the $5.34 billion in net inflows equity products had attracted for the year to September 2018. Fixed income ETFs/ETPs gathered net inflows of $556 million in September, bringing net inflows for the year to September 2019 to $3.04 billion, considerably greater than the $721 million in net inflows fixed income products had attracted by the end of September 2018.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $1.60 billion in September, iShares MSCI EAFE IMI Index Fund gathered $197.46 million alone.

Top 20 ETFs by net new assets September 2019: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

2371.14 |

753.94 |

197.46 |

|

Purpose High Interest Savings ETF |

PSA CN |

1582.33 |

509.41 |

147.43 |

|

BMO MSCI EAFE Index ETF |

ZEA CN |

2011.70 |

160.38 |

121.33 |

|

Horizons US Dollar Currency ETF |

DLR CN |

159.72 |

115.99 |

116.15 |

|

BMO Low Volatility Canadian Equity ETF |

ZLB CN |

1574.68 |

552.55 |

112.02 |

|

BMO Long Federal Bond Index ETF |

ZFL CN |

990.16 |

732.40 |

100.69 |

|

CI First Asset High Interest Savings ETF |

CSAV CN |

275.74 |

273.86 |

98.36 |

|

BMO Low Volatility US Equity ETF |

ZLU CN |

1023.31 |

370.87 |

81.43 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

3648.10 |

843.78 |

75.45 |

|

Invesco Ultra DLUX Long Term Government Bond Index |

PGL CN |

360.06 |

(84.98) |

68.13 |

|

iShares Global Infrastructure Index Fund |

CIF CN |

111.09 |

61.24 |

62.54 |

|

iShares Global Real Estate Index Fund |

CGR CN |

166.41 |

62.60 |

62.47 |

|

Mackenzie Emerging Markets Local Currency Bond Index ETF |

QEBH CN |

181.93 |

184.68 |

55.81 |

|

Vanguard Canadian Aggregate Bond Index ETF |

VAB CN |

1934.02 |

640.98 |

55.33 |

|

iShares Core MSCI Emerging Markets IMI Index ETF |

XEC CN |

525.59 |

111.79 |

50.00 |

|

BMO MSCI Emerging Markets Index ETF |

ZEM CN |

741.68 |

368.25 |

44.56 |

|

iShares Core Canadian ST Corporate + Maple Bond Index ETF |

XSH CN |

544.07 |

(135.10) |

42.20 |

|

iShares Core Canadian Universe Bond Index ETF |

XBB CN |

2432.26 |

527.99 |

36.76 |

|

Vanguard Canadian Short-Term Corporate Bond Index ETF |

VSC CN |

887.65 |

45.82 |

36.66 |

|

Pimco Global Short Maturity Fund Canada |

PMNT CN |

115.19 |

61.99 |

30.31 |

The top 10 ETP's by net new assets collectively gathered $787.62 million in September. The Xtrackers Physical Gold Euro Hedged ETC gathered $193.53 million alone.

Top 10 ETPs by net inflows in September 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Xtrackers Physical Gold Euro Hedged ETC |

XAD1 GY |

2,345.13 |

317.39 |

193.53 |

|

WisdomTree Physical Swiss Gold |

SGBS LN |

2,379.64 |

1,384.41 |

176.04 |

|

WisdomTree Physical Platinum |

PHPT LN |

498.60 |

250.23 |

129.61 |

|

iShares Physical Gold ETC |

SGLN LN |

6,638.62 |

1,548.15 |

123.48 |

|

Invesco Gold ETC |

SGLD LN |

7,108.17 |

1,258.88 |

63.17 |

|

Xtrackers Physical Gold GBP Hedged ETC |

XGLS LN |

159.49 |

90.46 |

29.16 |

|

Amundi Physical Metals PLC |

GOLD FP |

632.77 |

587.14 |

25.20 |

|

WisdomTree Physical Precious Metals |

PHPM LN |

123.00 |

4.55 |

16.54 |

|

WisdomTree Industrial Metals |

AIGI LN |

170.68 |

(11.48) |

15.54 |

|

WisdomTree WTI Crude Oil 3x Daily Short |

3OIS LN |

33.10 |

26.95 |

15.35 |

Investors have tended to invest in Active/Fixed Income ETFs in September.