ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that 86 ETFs have been cross listed in Mexico in the first seven months of 2020.

There are 1454 ETFs listed in Latin America. The majority of ETFs 1,396 of the listings in Latin America are ETFs that are cross listed from the United States or from Europe: Mexico 1147, Chile 188, Peru 40. Only 58 ETFs have their primary listing on an exchange in Latin America: Mexico 28, Brazil 22, Chile 4, and Columbia 4.

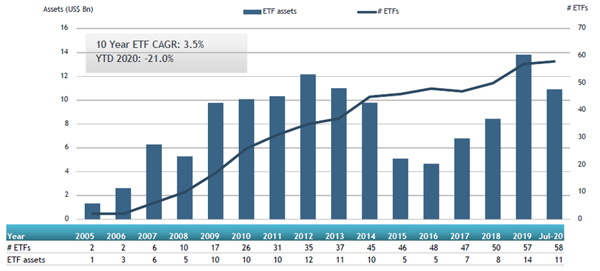

At the end of July 2020, the Latin American ETF industry had 58 ETFs primary listings, total listings of 1,454 ETFs, assets of US$11 Bn, from 44 providers listed on 5 exchanges, according to ETFGI's July 2020 Latin America ETFs and ETPs industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (Assets are counted based on the primary listing of the ETF or ETP. All dollar values in USD unless otherwise noted.)

Highlights

- There was $11 Bn invested in ETFs/ETPs with their primary listing in Latin America the end of July.

- The majority of ETFs 1,396 of the listings in Latin America are ETFs that are cross listed from the United States or from Europe.

- 86 ETFs have been cross listed in Mexico in the first seven months of 2020.

“The S&P 500 gained 5.6% in July, aided by the U.S. Federal Reserve stimulus and strong earnings. International markets also gained, with Developed Ex-U.S. and Emerging up 3.0% and 8.5%, respectively. In the developed markets Scandinavian countries benefited most, led by Norway (up 10.8%) and Sweden (up 10.1%); while Japan (down 2.0%) was the sole negative performer among developed countries. Dollar weakness contributed toward the positive momentum in Emerging markets where 19 of 25 countries gained, led by Brazil (up 14.4%) and Pakistan (up 13.4%), while Taiwan (up 12.1%) neared an all-time high.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Latin America ETF and ETP asset growth as at the end of July 2020

In July 2020, ETFs with their primary listing in Latin America suffered net outflows of $321 Mn. Equity ETFs experienced the largest net outflows with $323 Mn, followed by inverse ETFs with $3 Mn, while leveraged ETFs gathered the largest net inflows with $4 Mn. YTD through end of July 2020, ETFs have seen net inflows of $1.4y Bn. Equity ETFs gathered the largest net inflows YTD with $1.63 Bn, followed by leveraged ETFs with $10 Mn, and inverse ETFs with $7 Mn, while fixed income ETFs experienced the largest net outflows YTD with $167 Mn.

Substantial inflows can be attributed to the top 10 ETFs by net new assets, which collectively gathered $146 Mn during July, the It Now S&P500 TRN Fundo de Indice - BRL Hdg - Acc (SPXI11 BZ) gathered $37 Mn alone.

Top 10 ETFs by net new assets July 2020: Latin America

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

It Now S&P500 TRN Fundo de Indice - BRL Hdg - Acc |

SPXI11 BZ |

144.88 |

69.12 |

36.70 |

|

Fondo Bursátil iShares COLCAP - Acc |

ICOLCAP CB |

1,399.06 |

273.57 |

35.62 |

|

ETF IT NOW S&P IPSA - Acc |

CFMITNIP CI |

135.05 |

21.39 |

24.11 |

|

Horizons Colombia Select - Acc |

HCOLSEL CB |

337.23 |

118.90 |

16.81 |

|

It Now Small Cap Fundo de Indice |

SMAC11 BZ |

71.93 |

99.30 |

15.16 |

|

It Now PIBB IBrX-50 Index Fund - Acc |

PIBB11 BZ |

336.02 |

61.26 |

4.60 |

|

It Now IFNC Index Fund - Acc |

FIND11 BZ |

15.07 |

5.76 |

4.14 |

|

iShares S&P 500 FIC FI Investimento no Exterior - Acc |

IVVB11 BZ |

358.37 |

200.57 |

4.09 |

|

ANGELD 10 - Acc |

ANGELD MM |

10.81 |

9.70 |

3.97 |

|

iShares S&P/VALMER Mexico M10TRAC |

M10TRAC MM |

52.34 |

3.45 |

0.91 |