ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that Smart Beta ETFs listed globally gathered US$7.55 billion in net inflows during November, bringing year to date net inflows to US$124.23 billion, which is slightly lower than the US127.47 billion gathered at this point last year. During November 2022, Smart Beta Equity ETFs assets have increased by 7.0% from US$1.18 trillion at the end of October 2022, to US$1.26 trillion, with a 5-year CAGR of 24.1%, according to ETFGI’s November 2022 ETF and ETP Smart Beta industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar vales in USD unless otherwise noted.)

Highlights

- Smart Beta ETFs and ETPs listed globally gathered $7.55 Bn in net inflows in November.

- YTD Net inflows of $124.23 Bn in 2022 are the 2nd highest on record, after $127.47 Bn YTD net inflows in 2021.

- 28th month of consecutive net inflows

- Assets of $1.26 Tn invested in Smart Beta ETFs listed globally at the end of November.

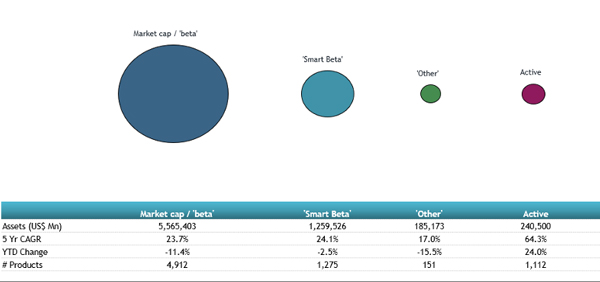

Comparison of assets in market cap, smart beta, other and active equity products

There were 1,275 smart beta ETFs listed globally, with 2,627 listings, assets of $1.26 Tn, from 201 providers listed on 48 exchanges in 38 countries at the end of November. Following net inflows of $7.55 Bn and market moves during the month, assets invested in Smart Beta ETFs listed globally increased by 7.0%, from $1.18 Tn at the end of October 2022 to $1.26 Tn.

Yield ETFs and ETPs attracted the greatest monthly net inflows, gathering $3.98 Bn during November. Value ETFs and ETPs suffered the greatest net outflows during the month and amounted to $3.45 Bn.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $10.83 Bn during November. Schwab US Dividend Equity ETF (SCHD US) gathered $1.70 Bn the largest individual net inflow.

Top 20 Smart Beta ETFs/ETPs by net new assets November 2022

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Schwab US Dividend Equity ETF |

SCHD US |

45,063.57 |

13925.88 |

1,701.22 |

|

Invesco S&P 500 Equal Weight ETF |

RSP US |

33,437.09 |

5062.61 |

1,349.93 |

|

Vanguard Growth ETF |

VUG US |

74,117.27 |

8838.19 |

1,071.97 |

|

SPDR Portfolio S&P 500 Growth ETF |

SPYG US |

14,416.39 |

1995.46 |

976.50 |

|

SPDR Portfolio S&P 500 Value ETF |

SPYV US |

14,947.85 |

2266.57 |

968.25 |

|

iShares S&P 500 Growth ETF |

IVW US |

30,379.93 |

(666.11) |

634.35 |

|

First Trust Morningstar Dividend Leaders Index Fund |

FDL US |

4,620.48 |

2641.36 |

484.39 |

|

SPDR S&P 400 Mid Cap Growth ETF |

MDYG US |

2,100.38 |

610.57 |

463.74 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

67,527.35 |

2858.68 |

369.48 |

|

Vanguard Small-Cap Value ETF |

VBR US |

25,292.65 |

(49.58) |

331.30 |

|

iShares S&P 500 Value ETF |

IVE US |

25,894.14 |

2660.85 |

310.44 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

3,533.92 |

(707.94) |

281.63 |

|

iShares Select Dividend ETF |

DVY US |

23,276.33 |

2919.85 |

270.00 |

|

iShares MSCI USA Min Vol Factor ETF |

USMV US |

31,354.00 |

2804.28 |

254.87 |

|

Nuveen ESG Large-Cap Value ETF |

NULV US |

1,901.58 |

695.90 |

247.26 |

|

SPDR S&P Dividend ETF |

SDY US |

24,271.98 |

2822.49 |

242.43 |

|

Schwab US Large-Cap Growth ETF |

SCHG US |

14,584.85 |

1440.01 |

239.94 |

|

ProShares S&P 500 Aristocrats ETF |

NOBL US |

11,451.13 |

1795.50 |

225.08 |

|

Invesco S&P 500 GARP ETF |

SPGP US |

1,716.35 |

934.16 |

206.50 |

|

Cathay Taiwan Select ESG Sustainability High Yield ETF |

00878 TT |

4,296.07 |

3561.75 |

202.17 |

Investors have tended to invest in Active ETFs during November.