ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that equity-based Smart Beta ETFs and ETPs listed globally gathered net inflows of US$12.42 billion during December. Total assets invested in the global Smart Beta ETF and ETP industry decreased 7.08%, from US$665 billion at the end of November, to US$618 Bn, according to ETFGI’s December 2018 ETF and ETP Smart Beta industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- In 2018, Smart Beta ETFs/ETPs attracted $77.62 Bn in net new assets.

- Over the year, 141 Smart Beta ETFs/ETPs were launched by 72 providers.

- 35th consecutive month of net inflows into Smart Beta ETFs/ETPs.

“The end of 2018 saw the trend in developed markets reverse, and although arguably predictable, the severity left many pundits scratching their heads. This end of year stress has widely been attributed to the disruption caused by trade disputes feeding into economic data, and the view policy makers are not going to be quite as accommodating as initially expected. The S&P 500 returned -9.03% during December, and down -4.38% for 2018. Developed markets ex-US fell -4.62% during December, led by Japan and Canada, bringing the yearly return to -13.21%. Relatively speaking, EM and FM fared the month better, returning -2.68% and -3.15%, finishing 2018 -13.53% and -11.82%, respectively” according to Deborah Fuhr, managing partner and founder of ETFGI.

At the end of December 2018, there were 1,298 Smart Beta classified ETFs/ETPs, with 2,363 listings, assets of $618 Bn, from 159 providers listed on 40 exchanges in 32 countries. Following net inflows of $12.42 Bn and market moves during the month, assets invested in Smart Beta ETFs/ETPs listed globally decreased by 7.08%, from $665 Bn at the end of November 2018, to $618 Bn.

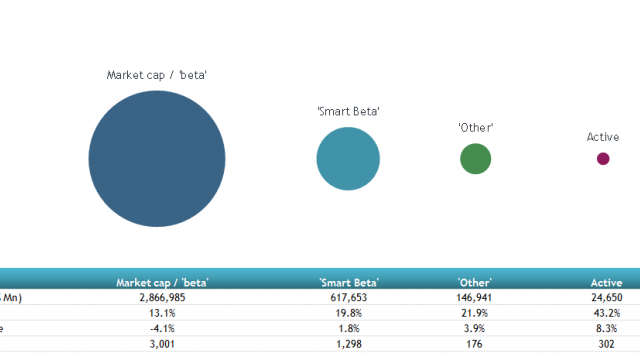

Comparison of assets in market cap, smart beta, other and active equity products

Value factor ETFs and ETPs continued to attract the greatest monthly net inflows, seeing $4.60 Bn in December, bringing 2018 net inflows to $22.47 Bn. Multi-Factor ETFs and ETPs saw the greatest outflows during the month, amounting to $81 Mn, bringing year-to-date inflows to $18.52 Bn.

Substantial inflows during December can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $8.99 Bn. The iShares MSCI USA Minimum Volatility ETF (USMV US) maintained its place at the top of the leader board for net new assets, following inflows of $1.15 Bn in November, the fund saw $1.64 Bn in net inflow in December.

Top 20 Smart Beta ETFs/ETPs by net new assets December 2018

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

18,997 |

4,223 |

1,638 |

|

SPDR S&P Dividend ETF |

SDY US |

16,356 |

836 |

1,309 |

|

Vanguard Value ETF |

VTV US |

41,408 |

8,404 |

1,167 |

|

iShares Select Dividend ETF |

DVY US |

16,697 |

429 |

1,116 |

|

iShares S&P 500 Value ETF |

IVE US |

14,909 |

1,459 |

1,070 |

|

iShares Edge MSCI Minimum Volatility EAFE ETF |

EFAV US |

9,577 |

2,029 |

923 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

29,167 |

3,129 |

866 |

|

iShares S&P 500 Growth ETF |

IVW US |

20,295 |

1,063 |

861 |

|

iShares Core High Dividend ETF |

HDV US |

6,574 |

343 |

484 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

6,722 |

2,980 |

466 |

|

iShares MSCI EAFE Value ETF |

EFV US |

5,753 |

474 |

459 |

|

iShares Core Dividend Growth ETF |

DGRO US |

5,042 |

2,666 |

379 |

|

John Hancock MultiFactor Developed International ETF |

JHMD US |

438 |

393 |

354 |

|

iShares Edge MSCI Minimum Volatility Emerging Markets |

EEMV US |

4,960 |

730 |

349 |

|

iShares S&P Mid-Cap 400 Value ETF |

IJJ US |

5,510 |

510 |

349 |

|

iShares Edge MSCI Min Vol Global ETF |

ACWV US |

3,541 |

31 |

325 |

|

Vanguard Growth ETF |

VUG US |

32,401 |

2,412 |

310 |

|

Schwab US Large-Cap Value ETF |

SCHV US |

4,690 |

1,053 |

277 |

|

Hartford Multifactor Developed Markets (Ex-US) ETF |

RODM US |

1,379 |

1,328 |

277 |

|

Invesco FTSE RAFI US 1000 ETF |

PRF US |

4,834 |

41 |

251 |

Investors have tended to invest short duration, fixed income ETFs during December.

.jpg)