ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in Europe reported net inflows of US$22.15 billion during February, bringing year-to-date net inflows to a record US$42.66 billion. Assets invested in the European ETFs/ETPs industry have increased by 2.3%, from US$1.30 trillion at the end of January, to US$1.33 trillion, according to ETFGI's February 2021 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in European ETFs and ETPs industry reach a record $1.33 trillion at the end of February.

- Net inflows gathered in February were $22.15Bn, are the second highest behind the $27.17 Bn gathered in December 2020.

- 11 consecutive month net inflows.

- YTD net inflows of $42.66 are a record, beating the prior YTD record of $25.86 Bn in February 2018 and much higher than the $21.23Bn gathered at this point in 2020.

- Equity ETFs/ETPs listed in Europe attracted $35.22 Bn accounting for the majority of net inflows in February.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

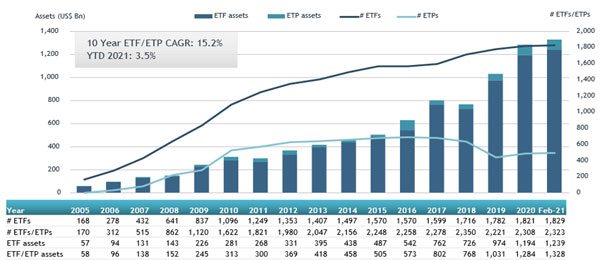

Europe ETFs and ETPs asset growth as at the end of February 2021

The European ETF/ETP industry had 2,323 ETFs and ETPs, with 8,961 listings, assets of $1.33 Tn, from 81 providers listed on 29 exchanges in 24 countries at the end of February.

Equity ETFs/ETPs listed in Europe reported net inflows of $19.29 Bn during February, bringing net inflows for the year 2021 to $35.22 Bn, much higher than the $9.16 Bn in net inflows gathered YTD in 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $1.61 Bn during February, taking net inflows for the year to $3.71 Bn, which is lower than the $7.49 Bn in net inflows gathered at this point in 2020. Commodity ETFs/ETPs reported $505 Mn in net inflows bringing net inflows to $2.87 Bn for 2021, which is lower than the $4.30 Bn gathered at this point in 2020.

Actively managed products saw net inflows of $109 Mn in February, bringing year to date net outflows to $25 Mn, which is less than the net inflows of $41 Mn over the same period last year.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $14.87 Bn during February. SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc (SPPU GY) gathered $5.54 Bn.

Top 20 ETFs by net inflows in February 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

SPPU GY |

5,521.04 |

5,537.99 |

5,537.99 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

3,809.16 |

1,300.75 |

926.79 |

|

Invesco US Municipal Bond UCITS ETF |

MUNS LN |

7.09 |

725.16 |

725.16 |

|

iShares China CNY Bond UCITS ETF |

CNYB NA |

5,065.43 |

1,130.58 |

698.35 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

2,989.48 |

1,065.60 |

671.76 |

|

iShares MSCI EMU UCITS ETF - Acc |

CSEMU SW |

3,067.04 |

678.29 |

656.63 |

|

CSIF (IE) MSCI World ESG Leaders Blue UCITS ETF B USD - Acc |

WDESG SW |

714.96 |

602.85 |

647.01 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF |

EMUG LN |

519.21 |

523.59 |

488.52 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

30,539.71 |

1,163.47 |

488.36 |

|

iShares China CNY Bond UCITS ETF - Acc |

CYBA NA |

3,213.53 |

1,134.73 |

476.67 |

|

L&G LONG DATED ALL COMMOD - Acc |

COMF LN |

1,173.18 |

524.80 |

417.57 |

|

Vanguard FTSE All-World UCITS ETF - Acc |

VWRA LN |

2,303.81 |

492.14 |

401.55 |

|

SPDR Bloomberg Barclays Euro Government Bond UCITS ETF - Acc |

GOVA NA |

556.68 |

397.41 |

394.66 |

|

Lyxor UCITS ETF FTSE MIB |

ETFMIB IM |

794.81 |

354.15 |

380.20 |

|

iShares EUR Corp Bond 0-3yr ESG UCITS ETF |

SUSS LN |

1,676.93 |

467.06 |

368.44 |

|

iShares S&P US Banks UCITS ETF - Acc |

BNKS LN |

690.13 |

434.77 |

344.96 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

2,004.44 |

371.20 |

317.25 |

|

Invesco Elwood Global Blockchain UCITS ETF - Acc |

BCHN LN |

1,016.37 |

434.15 |

316.32 |

|

Lyxor S&P Eurozone Paris-Aligned Climate (EU PAB) (DR) UCITS ETF - Acc |

EPAB FP |

673.42 |

327.14 |

313.96 |

|

iShares Core MSCI World UCITS ETF-D - GBP Hdg |

IWDG LN |

974.59 |

288.36 |

294.17 |

The top 10 ETPs by net new assets collectively gathered $779 million during February. BTCetc - Bitcoin ETP - Acc (BTCE GY) gathered $421 million alone.

Top 10 ETPs by net inflows in February 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

BTCetc - Bitcoin ETP - Acc |

BTCE GY |

846.45 |

310.13 |

290.57 |

|

Xetra Gold EUR - Acc |

4GLD GY |

12,213.12 |

229.34 |

160.45 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

2,609.95 |

153.92 |

67.21 |

|

CoinShares Physical Ethereum - Acc |

ETHE SW |

61.25 |

61.70 |

61.70 |

|

WisdomTree Industrial Metals - Acc |

AIGI LN |

317.55 |

99.63 |

47.74 |

|

WisdomTree Bitcoin - Acc |

BTCW SW |

276.34 |

9.21 |

35.12 |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

GBSP LN |

1,536.12 |

109.04 |

33.89 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

3,378.85 |

182.60 |

31.92 |

|

Invesco Palladium ETC - Acc |

SPAL LN |

60.91 |

26.08 |

26.08 |

|

Ether Tracker Euro - Acc |

COINETH SS |

346.49 |

30.69 |

23.98 |

Investors have tended to invest in Equity ETFs and ETPs during February.