ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports record assets and net inflows in ESG (Environmental, Social, and Governance) ETFs world-wide of US$309 billion and US$97 billion respectively at the end of July. ESG ETFs gathered net inflows of US$14.93 billion during July, bringing year-to-date net inflows to a record US$97.38 billion which is much higher than the US$37.18 billion gathered at this point last year and US$ 8 billion more than the US$89.07 billion gathered in all of 2020. Total assets invested in ESG ETFs and ETPs increased by 5.8% from US$292 billion at the end of June 2021 to US$309 billion, according to ETFGI’s July 2021 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Record assets of $309 trillion invested in ETFs and ETPs listed globally at the end of July 2021.

- Record YTD 2021 net inflows of $97.38 Bn beating the prior YTD record of $37.18 Bn gathered in 2020.

- $97.38 Bn YTD net inflows are $8 Bn larger than the full year 2020 record net inflows $89.07 Bn.

- $149 billion in net inflows gathered in the past 12 months.

- Assets increased 60% YTD in 2021, going from $193 billion at end of 2020, to $309 trillion.

- 65th month of consecutive net inflows.

“The S&P 500 gained 2.38% in July, despite concerns about a slowing economy, rising inflation and the possible impact of the COVID "delta variant". Developed markets ex-U.S. gained 0.40% in July while Emerging markets were down by 5.59% in July.” According to Deborah Fuhr, managing partner, and founder of ETFGI.

Globally there were 695 ETFs/ETPs, with 1,983 listings, assets of $309 Bn, from 155 providers listed on 39 exchanges in 31 countries at the end of July.

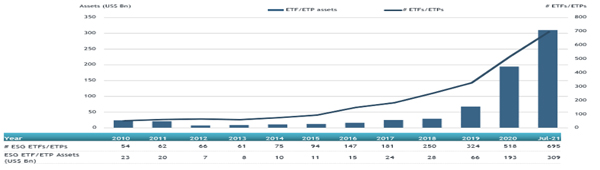

Global ESG ETF and ETP asset growth as at end of July 2021

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily. During July, 52 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $9.00 Bn in July. iShares Trust iShares ESG Aware MSCI USA ETF (ESGU US) gathered $2 Bn the largest net inflows.

Top 20 ESG ETFs/ETPs by net new assets July 2021

|

Name |

Ticker |

Assets (US$ Mn) Jul-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Jul-21 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

20,827.30 |

4,905.20 |

2,005.20 |

|

iShares MSCI USA Momentum Factor ESG UCITS ETF - Acc |

IUME NA |

1,497.26 |

1,455.77 |

1,455.77 |

|

iShares MSCI USA Value Factor ESG UCITS ETF - Acc |

IUVE NA |

1,425.31 |

1,413.11 |

1,413.11 |

|

Cathay Global Autonomous and Electric Vehicles ETF |

00893 TT |

711.11 |

703.88 |

703.88 |

|

Invesco Global Clean Energy UCITS ETF - Acc |

GCLX LN |

29.50 |

605.56 |

580.62 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

6,312.58 |

1,943.72 |

308.35 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

3,203.56 |

1,195.28 |

250.58 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

4,084.20 |

1,807.61 |

244.13 |

|

iShares MSCI EMU ESG Screened UCITS ETF - Dist |

SMUD LN |

425.81 |

185.26 |

193.77 |

|

UBS Lux Fund Solutions - MSCI EMU Socially Responsible UCITS ETF (EUR) A-dis |

UIMR GY |

1,596.35 |

211.51 |

191.02 |

|

Invesco MSCI USA ESG Universal Screened UCITS ETF - Acc |

ESGU LN |

1,111.05 |

898.20 |

186.45 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

5,741.69 |

1,779.06 |

181.23 |

|

iShares EUR Corp Bond 0-3yr ESG UCITS ETF |

SUSS LN |

2,469.30 |

1,300.53 |

178.36 |

|

Invesco S&P 500 ESG UCITS ETF - Acc |

SPXE LN |

1,033.59 |

333.66 |

177.60 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

3,721.89 |

795.47 |

162.85 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

1,163.07 |

864.35 |

161.31 |

|

iShares MSCI USA ESG Select ETF |

SUSA US |

3,550.87 |

722.69 |

155.10 |

|

iShares MSCI Japan ESG Screened UCITS ETF - Acc - Acc |

SAJP LN |

797.83 |

552.53 |

153.42 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

2,358.71 |

660.78 |

150.71 |

|

One ETF ESG - Acc |

1498 JP |

253.99 |

220.87 |

146.74 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Investors have tended to invest in Equity focused ESG ETFs/ETPs during July.