ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reports record assets and net inflows for Smart Beta ETFs and ETPs listed in globally of US$1.24 trillion and US$102.03 billion respectively at the end H1 2021. Smart Beta ETFs and ETPs providing equity exposure listed globally gathered net inflows of US$14.27 billion during June, bringing year-to-date net inflows to a record US$102.03 billion which is higher than the US$12.36 billion gathered at this point last year. Year-to-date through the end of June 2021, Smart Beta Equity ETF/ETP assets have increased by 23.8% from US$999 billion to US$1.24 trillion, with a 5-year CAGR of 22.8%, according to ETFGI’s June 2021 ETF and ETP Smart Beta industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar vales in USD unless otherwise noted.)

Highlights

- Record $1.24 Tn invested in Smart Beta ETFs and ETPs industry at end of H1 2021.

- Assets have increased 23.8% in H1 going from $999 Bn at end of 2020 to $1.24 Tn.

- Record H1 net inflows of $102.03 Bn beating prior record of $44.77 Bn gathered in H1 2015.

- $102.03 Bn H1 net inflows are $49.71 Bn greater than the full year 2020 record net inflows $52.32 Bn.

- $142.72 Bn in net inflows gathered in the past 12 months.

- 11th month of consecutive net inflows

- Equity Smart Beta ETFs and ETPs listed gathered a record $102.03 Bn in net inflows in H1 2021.

“The S&P 500 gained 2.33% in June and are up 15.25% in the first half of 2021. Developed markets ex-U.S. lost 0.82% in June but are up 9.96% in the first half. Emerging markets are up 0.47% in June and are up 9.03% in the first half. According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of June 2021, there were 1,325 smart beta equity ETFs/ETPs, with 2,634 listings, assets of $1.24 Tn, from 194 providers listed on 45 exchanges in 37 countries.

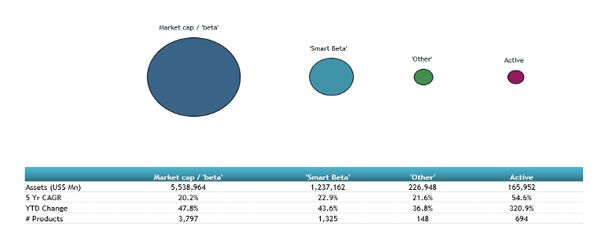

Comparison of assets in market cap, smart beta, other and active equity products

Following net inflows of $14.27 Bn and market moves during the month, assets invested in Smart Beta ETFs/ETPs listed globally increased by 1.64%, from $1.22 Tn at the end of May 2021 to $1.24 Tn. Fundamental ETFs and ETPs attracted the greatest monthly net inflows, gathering $10.16 Bn during June. Volatility ETFs and ETPs suffered the largest net outflows during the month at $433 Mn.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $11.60 Bn during June. Vanguard Value ETF (VTV US) gathered $1.25 Bn the largest net inflow.

Top 20 Smart Beta ETFs/ETPs by net new assets June 2021

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Value ETF |

|

VTV US |

81,704.88 |

10,234.10 |

1,245.16 |

|

SPDR Portfolio S&P 500 Growth ETF |

|

SPYG US |

12,378.48 |

1,405.25 |

1,221.76 |

|

Schwab US Dividend Equity ETF |

|

SCHD US |

26,038.71 |

6,554.07 |

1,117.53 |

|

iShares Edge MSCI World Value Factor UCITS ETF - Acc |

|

IWVL LN |

6,789.58 |

3,008.73 |

888.92 |

|

iShares S&P Small-Cap 600 Value ETF |

|

IJS US |

10,103.53 |

1,759.36 |

797.02 |

|

Vanguard Growth ETF |

|

VUG US |

78,864.17 |

1,600.61 |

622.91 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

|

ESGU US |

18,417.78 |

2,900.00 |

616.44 |

|

iShares Edge MSCI USA Momentum Factor ETF |

|

MTUM US |

15,305.22 |

1,121.41 |

521.02 |

|

iShares MSCI EAFE Value ETF |

|

EFV US |

14,368.53 |

6,327.90 |

493.18 |

|

iShares Edge MSCI USA Quality Factor ETF |

|

QUAL US |

21,575.91 |

2,744.46 |

467.48 |

|

Invesco DWA Momentum ETF |

|

PDP US |

2,170.35 |

105.48 |

407.00 |

|

iShares Edge MSCI International Value Factor ETF |

|

IVLU US |

1,336.07 |

706.78 |

404.47 |

|

iShares Core Dividend Growth ETF |

|

DGRO US |

19,207.03 |

2,531.45 |

387.81 |

|

iShares ESG MSCI EM ETF |

|

ESGE US |

7,991.97 |

1,384.70 |

373.97 |

|

iShares Edge MSCI Europe Value Factor UCITS ETF |

|

IEFV LN |

3,938.81 |

1,723.02 |

368.04 |

|

First Trust Rising Dividend Achievers ETF |

|

RDVY US |

4,781.71 |

2,416.12 |

363.72 |

|

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF |

|

GSLC US |

13,104.74 |

75.15 |

352.68 |

|

BMO Equal Weight Banks Index ETF |

|

ZEB CN |

1,651.23 |

245.17 |

331.06 |

|

Vanguard Small-Cap Value ETF |

|

VBR US |

24,590.70 |

2,585.94 |

313.67 |

|

SPDR Portfolio S&P 500 High Dividend ETF |

|

SPYD US |

4,666.57 |

1,789.30 |

304.44 |