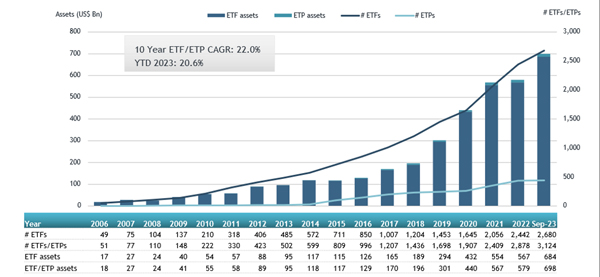

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today net inflows of US$16.30 billion into the ETFs industry in Asia Pacific ex Japan during September, bringing year-to-date net inflows to US$119.56 billion. Assets have increased by 20.6% year-to-date in 2023, going from $578.72 billion at end of 2022 to $698.07 billion, according to ETFGI's September 2023 Asia Pacific (ex-Japan) ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in Asia Pacific ex Japan gathered net inflows of $16.30 Bn during September.

- YTD net inflows of $119.56 Bn are the highest record, the second highest recorded YTD net inflows are of $92.13 Bn for 2022.

- 27th month of consecutive net inflows.

- Assets of $698 Bn invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) at end of September.

- Assets increased by 20.6% YTD in 2023, going from $578.72 Bn at end of 2022 to $698.07 Bn.

“The S&P 500 decreased by 4.77% in September and is up 13.07% YTD in 2023. Developed markets excluding the US decreased by 3.54% in September and are up 6.66% YTD in 2023. Netherlands (down 7.90%) and Ireland (down 7.31%) saw the largest decreases amongst the developed markets in September. Emerging markets decreased by 1.86% during September but are up 3.47% YTD in 2023. Thailand (down 9.38%) and Poland (down 9.33%) saw the largest decreases amongst emerging markets in September.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

ETFs industry in Asia Pacific ex Japan asset growth as at the end of September

ETFs industry in Asia Pacific ex Japan industry had 3,124 products, with 3,290 listings, assets of $698 Bn, from 250 providers on 20 exchanges in 15 countries at the end of September.

During September, ETFs gathered net inflows of $16.30 Bn. Equity ETFs gathered net inflows of $12.30 Bn during September, bringing YTD net inflows to $84.28 Bn, higher than the $78.02 Bn YTD in 2022. Fixed income ETFs had net inflows of $3.75 Bn during September, bringing YTD net inflows in 2023 to $24.07 Bn, higher than the YTD $8.05 Bn YTD in 2022. Commodities ETFs/ETPs reported net inflows of $277 Mn during September, bringing YTD net inflows to $1.30 Bn, higher than the $1.49 Bn in net outflows YTD in 2022. Active ETFs had net outflows of $296 Mn over the month, gathering YTD net inflows of $8.19 Bn, higher than the $5.63 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $9.10 Bn during September. Fuh Hwa Taiwan Technology Dividend Highlight ETF (00929 TT) gathered $1.15 Bn, the largest individual net inflow.

Top 20 ETFs by net new assets in September 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Fuh Hwa Taiwan Technology Dividend Highlight ETF |

00929 TT |

2,602.19 |

2,547.37 |

1,148.01 |

|

Mirae Asset TIGER CD Rate Investment Synth ETF |

357870 KS |

5,074.79 |

2,232.14 |

863.45 |

|

Capital TIP Taiwan Select High Dividend ETF |

00919 TT |

1,410.51 |

955.81 |

815.55 |

|

SAMSUNG KODEX CD Rate Active ETF SYNTH |

459580 KS |

2,100.93 |

1,957.95 |

736.95 |

|

Hang Seng China Enterprises Index ETF |

2828 HK |

3,726.74 |

(574.16) |

676.04 |

|

China Universal CSI 800 ETF |

515800 CH |

1,101.63 |

1,000.28 |

576.58 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

12,979.81 |

6,752.04 |

515.47 |

|

Yuanta US Treasury 20+ Year Bond ETF |

00679B TT |

3,463.09 |

2,029.20 |

432.92 |

|

iShares MSCI Asia ex Japan Climate Action ETF |

ICM SP |

428.10 |

428.10 |

428.10 |

|

ChinaAMC Hang Seng TECH ETF QDII |

513180 CH |

2,852.00 |

689.08 |

317.23 |

|

SAMSUNG KODEX 24-12 Bank Bond AA+ Active ETF |

465680 KS |

422.71 |

311.65 |

311.65 |

|

Tracker Fund of Hong Kong (TraHK) |

2800 HK |

16,180.36 |

721.39 |

298.02 |

|

Huatai-Pinebridge CSI 300 ETF |

510300 CH |

16,457.39 |

6,564.70 |

282.53 |

|

Guotai CSI All Share Securities Companies ETF - Acc |

512880 CH |

4,342.40 |

(198.54) |

266.14 |

|

Samsung KODEX Top5Plus Total Return ETF - Equity |

315930 KS |

601.01 |

(58.03) |

261.43 |

|

Harvest CSI 300 Index ETF - Acc |

159919 CH |

4,228.82 |

1,542.24 |

261.32 |

|

E Fund CSI Science and Technology Innovation Board 50 ETF |

588080 CH |

4,027.78 |

2,024.25 |

239.64 |

|

Penghua SSE Science and Technology Innovation Board 100 ETF |

588220 CH |

228.52 |

224.14 |

224.14 |

|

Guotai SSE Science and Technology Innovation Board 100 ETF |

588120 CH |

228.56 |

223.53 |

223.53 |

|

CSOP Hang Seng TECH Index Daily 2X Leveraged Product |

7226 HK |

1,223.86 |

664.89 |

217.20 |

The top ETPs by net new assets collectively gathered $269.76 Mn during September. NH QV KIS CD Interest Rate Investment ETN 82 (550082 KS) gathered $150.60 Mn, the largest individual net inflow.

Top ETPs by net inflows in September 2023: Asia Pacific (ex-Japan)

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

NH QV KIS CD Interest Rate Investment ETN 82 |

550082 KS |

301.20 |

229.80 |

150.60 |

|

Global X Physical Silver |

ETPMAG AU |

166.61 |

87.10 |

81.21 |

|

Global X Physical Precious Metals Basket |

ETPMPM AU |

33.61 |

28.27 |

25.75 |

|

Global X Physical Platinum |

ETPMPT AU |

11.47 |

7.49 |

7.49 |

|

Perth Mint Gold - Acc |

PMGOLD AU |

449.11 |

(7.47) |

3.83 |

|

Global X Physical Palladium Fund |

ETPMPD AU |

3.01 |

0.95 |

0.88 |

|

BCC Global Exchange Traded Notes |

BCCGF KZ |

0.09 |

- |

- |

|

Exchange Traded Notes of iX US Aggregated Bonds SPC Limited |

IXA KZ |

0.19 |

- |

- |

|

ETNs of iX Global Emerging Markets Bonds SPC Limited (IXB) |

IXB KZ |

0.19 |

- |

- |

|

iX US High Dividend SPC Limited |

IXD KZ |

0.61 |

- |

- |

|