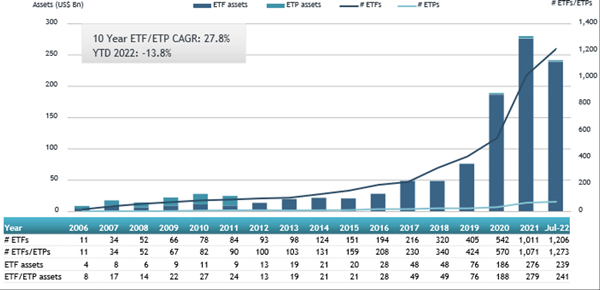

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today net inflows of US$1.51 billion into Thematic ETFs listed globally during July, bringing year to date net inflows to US$22.69 billion. Total assets invested in Thematic ETFs and ETPs have increased by 7.2% from US$225 billion at the end of June 2022 to US$241 billion, according to ETFGI’s July 2022 ETF and ETP Thematic industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Net inflows of $1.51 Bn during July 2022

- YTD net inflows of $22.69 Bn are the 2nd highest on record, after YTD net inflows in 2021 of $69.92 Bn.

- 14th month of net inflows

- Assets of $241 Bn invested in Thematic ETFs and ETPs listed globally at the end of July 2022

- Assets decreased by 13.8% YTD in 2022, going from $279 Bn at end of 2021, to $241 Bn.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global Thematic ETF and ETP asset growth as at end of July 2022

Since the launch of the first Thematic ETF in 2001, the iShares North American Natural Resources ETF, the number and diversity of products have increased steadily. There were 1,273 Thematic ETFs listed globally with 2,486 listings, assets of $241 Bn, from 254 providers listed on 47 exchanges in 37 countries at the end of July 2022. During July, 26 new Thematic ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $3.66 Bn during July. E Fund CSI SEEE Carbon Neutral ETF (562990 CH) gathered $519 Mn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets July 2022

|

Name |

Ticker |

Assets ($ Mn) Jul-22 |

NNA ($ Mn) YTD-22 |

NNA ($ Mn) Jul-22 |

|

E Fund CSI SEEE Carbon Neutral ETF |

562990 CH |

518.97 |

518.97 |

518.97 |

|

ARK Innovation ETF |

ARKK US |

9,334.31 |

1,912.52 |

443.12 |

|

China Southern CSI SEEE Carbon Neutral ETF |

159639 CH |

366.29 |

374.32 |

374.32 |

|

Fullgoal CSI SEEE Carbon Neutral ETF |

561190 CH |

337.36 |

345.12 |

345.12 |

|

GF CSI SEEE Carbon Neutral ETF |

560550 CH |

229.59 |

234.72 |

234.72 |

|

iShares Global Infrastructure UCITS ETF |

INFR LN |

2,056.16 |

576.54 |

197.00 |

|

Lyxor Net Zero 2050 S&P 500 Climate PAB DR UCITS ETF |

ZPA5 GY |

928.32 |

452.33 |

183.58 |

|

Invesco Solar ETF |

TAN US |

2,905.65 |

(6.57) |

162.76 |

|

UBS (Irl) ETF plc - Global Gender Equality UCITS ETF |

GENDER SW |

1,701.65 |

884.79 |

146.31 |

|

China Merchants CSI SEEE Carbon Neutral ETF |

159641 CH |

130.19 |

130.85 |

130.85 |

|

Fullgoal CSI Battery Thematic ETF |

561160 CH |

110.62 |

115.26 |

115.26 |

|

China Universal CSI SEEE Carbon Neutral ETF |

560060 CH |

110.90 |

111.34 |

111.34 |

|

FlexShares STOXX Global Broad Infrastructure Index Fund |

NFRA US |

2,698.89 |

252.72 |

104.04 |

|

ICBC Credit Suisse CSI SEEE Carbon Neutral ETF |

159640 CH |

101.98 |

101.98 |

101.98 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

6,684.59 |

834.54 |

90.88 |

|

Guotai CSI Bio-medicine ETF |

512290 CH |

581.24 |

151.88 |

88.27 |

|

Lyxor Euro Government Green Bond UCITS ETF - Acc |

ERTH FP |

113.52 |

113.58 |

87.39 |

|

Tachlit Sal TA-125 - A - Acc |

TCHF2 IT |

862.00 |

134.41 |

72.68 |

|

iShares Euro Govt Bond Climate UCITS ETF - Dist |

SECD GY |

781.03 |

411.57 |

71.98 |

|

Blackrock US Carbon Transition Readiness ETF |

LCTU US |

1,408.98 |

5.79 |

70.77 |