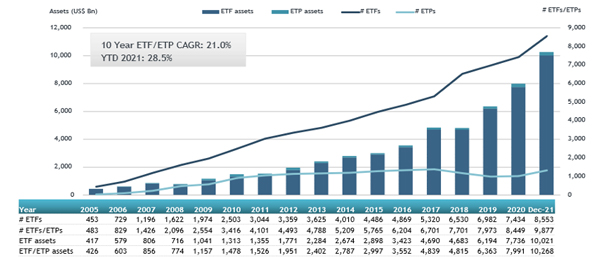

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports the global ETFs industry ended 2021 with a record US$10.27 trillion in assets and record net inflows of US$1.29 trillion. During December the industry gathered net inflows of US$154.97 billion, bringing 2021 net inflows to a record US$1.29 trillion which is higher than the US$762.77 billion gathered in 2020. Assets invested in the global ETFs industry increased by 3.4% in December and 28.5% in 2021, according to ETFGI's December 2021 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets reached a new record of $10.27 Tn in the global industry at the end of 2021.

- Assets increased 28.5% in 2021, going from US$7.99 trillion in 2020, to US$10.27 trillion.

- Record net inflows of $1.29 Tn in 2021 surpassed the prior record of $762.77 Bn gathered in 2020.

- Net inflows of $1.29 Tn in 2021 are $531.22 Bn or 69.6% higher than the $762.77 Bn record set in 2020.

- 31th month of consecutive net inflows

- The top 3 providers, out of 608, account for 65.7% of the $10.27 Tn global assets.

- iShares is the largest provider in terms of assets with 32.3% market share; Vanguard is second with 21.8%, followed by SPDR ETFs with 11.7% market share.

- Equity ETFs and ETPs listed globally gathered a record of $910.16 Bn net inflows in 2021.

“The S&P 500 increased 4.48% in December and was up 28.71% in 2021. Developed markets excluding the US, experienced a gain of 4.89% in December and was up 11.38% in 2021. Luxembourg (Up 12.65%) and Ireland (Up 9.68%) experienced the largest gains among the developed markets in December. Emerging markets were up 1.60% during December and gained 1.22% in 2021. Mexico (up 12.80%) and Czech Republic (up 12.55%) gained the most among emerging markets in December, whilst Chile (down 5.26%) and China (down 2.73%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of December 2021

At the end of 2021, the Global ETFs industry had 9,877 products, with 20,007 listings, assets of $10.268 Tn, from 608 providers listed on 79 exchanges in 62 countries.

During December 2021, ETFs/ETPs gathered net inflows of $154.97 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $119.85 Bn over December, bringing net inflows for 2021 to $910.16 Bn, much greater than the $365.43 Bn in net inflows equity products had attracted in 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $28.22 Bn during December, bringing net inflows for 2021 to $238.95 Bn, higher than the $230.53 Bn in net inflows fixed income products had attracted in 2020. Commodity ETFs/ETPs listed globally gathered net outflows of $270 Mn, bringing net outflows for 2021 to $10.17 Bn, significantly lower than the $61.23 Bn in net inflows commodity products had attracted in 2020. Active ETFs/ETPs reported $5.20 Bn in net inflows, bringing net inflows for 2021 to $131.23 Bn, higher than the $91.11 Bn in net inflows active products had attracted in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $73.61 Bn during December. SPDR S&P 500 ETF Trust (SPY US) gathered $25.58 Bn the largest individual net inflow.

Top 20 ETFs by net new inflows December 2021: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

460,638.99 |

40,474.20 |

25,578.80 |

|

iShares Core S&P 500 ETF |

IVV US |

333,122.97 |

31,951.66 |

5,406.49 |

|

Invesco QQQ Trust |

QQQ US |

215,953.41 |

22,852.64 |

5,049.32 |

|

Vanguard Total Stock Market ETF |

VTI US |

296,642.01 |

43,368.58 |

4,473.21 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

110,104.52 |

16,054.74 |

3,487.81 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

21,698.93 |

(4,038.06) |

3,012.61 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

19,667.08 |

1,886.31 |

2,987.59 |

|

Huatai-Pinebridge CSI 300 ETF |

510300 CH |

8,950.98 |

1,905.13 |

2,376.30 |

|

Vanguard FTSE Emerging Markets ETF |

VWO US |

81,071.34 |

11,362.50 |

2,373.02 |

|

China AMC China 50 ETF |

510050 CH |

10,879.97 |

2,728.20 |

2,089.31 |

|

iShares Core S&P Small-Cap ETF |

IJR US |

75,280.44 |

5,504.59 |

2,007.33 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

53,016.13 |

12,974.65 |

1,894.97 |

|

Financial Select Sector SPDR Fund |

XLF US |

44,071.59 |

9,636.25 |

1,754.16 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

92,152.84 |

9,846.97 |

1,749.03 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

38,988.42 |

(14,114.85) |

1,699.72 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

104,267.62 |

13,767.19 |

1,614.77 |

|

iShares Core MSCI Total International Stock ETF |

IXUS US |

32,858.80 |

6,347.11 |

1,534.55 |

|

China CSI 500 ETF - Acc |

510500 CH |

8,582.42 |

1,443.84 |

1,523.16 |

|

ProShares UltraPro QQQ |

TQQQ US |

20,642.25 |

1,117.66 |

1,499.32 |

|

Vanguard Total Bond Market ETF |

BND US |

84,187.04 |

18,702.91 |

1,497.30 |

The top 10 ETPs by net new assets collectively gathered $1.97 Bn over December. Invesco Physical Gold ETC - Acc (SGLD LN) gathered $351 Mn the largest individual net inflow.

Top 10 ETPs by net new inflows December 2021: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

14,225.27 |

823.17 |

351.36 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

XAD5 GY |

2,918.67 |

(1,148.04) |

294.24 |

|

WisdomTree Core Physical Gold - Acc |

WGLD LN |

411.79 |

394.17 |

236.40 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

717.31 |

328.58 |

201.16 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,960.36 |

858.40 |

198.96 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

12,855.31 |

(797.24) |

194.88 |

|

iPath Bloomberg Commodity Index Total Return ETN |

DJP US |

1,013.78 |

328.01 |

168.44 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

816.76 |

1,675.82 |

129.73 |

|

WisdomTree WTI Crude Oil - Acc |

CRUD LN |

1,600.46 |

(539.15) |

119.68 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

173.51 |

72.73 |

71.91 |

Investors have tended to invest in Equity ETFs/ETPs during December and in 2021.