ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports ETFs listed in Europe reached record assets and net inflows at the end of August have surpassed the prior full year record. The net inflows into ETFs and ETPs listed in Europe were US$12.07 billion during August, bringing year-to-date net inflows to US$139.42 Bn which is US$19 Bn greater than the full year 2020 net inflows of US$119.93 Bn and $14 Bn more than the record $125.18 Bn net inflows gathered in 2019. Assets invested in the European ETFs/ETPs industry have increased by 2.1%, from US$1.51 trillion at the end of July, to a record US$1.54 trillion, according to ETFGI's August 2021 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $1.54 trillion invested in ETFs and ETPs listed in Europe at the end of August 2021.

- Record YTD 2021 net inflows of $139.42 Bn beating the prior record of $78.11 Bn gathered in YTD 2017.

- $139.42 Bn YTD net inflows are $19 Bn greater than the $119.93 Bn full year 2020 net inflows and $14 Bn more than the record $125.18 Bn net inflows gathered in 2019.

- $199.3 billion in net inflows gathered in the past 12 months.

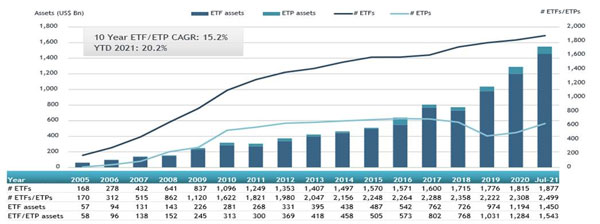

- Assets increased 20.2% YTD in 2021, going from US$1.28 trillion at end of 2020, to US$1.54 trillion.

- 17th month of consecutive net inflows

- Equity ETFs and ETPs listed in Europe gathered a record $101.35 Bn in YTD net inflows 2021.

“At the end of August, the S&P 500 posted its 7th straight month of gains, up 3.0% in the month, benefitting from continued support from the Fed and as positive earnings. Developed ex-U.S. markets gained 1.8% in August as most countries advanced, while Korea (down 1.3%) and Hong Kong (down 0.9%) declined the most, due in part to concerns of the new announced regulatory requirements set to take effect in China. Emerging markets were up 3.0% with Thailand (up 10.8%) and the Philippines (up 10.4%) leading the gains at the end of August.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of August 2021

The European ETFs and ETPs industry had 2,499 products, with 9,737 listings, assets of $1.543 trillion, from 85 providers listed on 29 exchanges in 24 countries at the end of August 2021,.

Equity ETFs/ETPs listed in Europe reported net inflows of $7.43 Bn during August, bringing net inflows for the year 2021 to $101.35 Bn, much higher than the $12.20 Bn in net inflows equity products had attracted year to date in 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $3.72 Bn during August, taking net inflows for the year to $28.07 Bn, less than the $30.56 Bn in net inflows fixed income products had reported at this point in 2020. Commodity ETFs/ETPs reported $279 Mn in net inflows, bringing net inflows to $3.03 Bn for 2021, which is lower than the $17.33 Bn in net inflows gathered over the same period in 2020. Active ETFs/ETPs listed in Europe reported net inflows of $487 Mn, bringing net inflows for the year 2021 to $4.20 Bn, significantly higher than the $460 Mn in net inflows active products had attracted year to date in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $6.36 Bn during August. iShares Core MSCI World UCITS ETF - Acc (IWDA LN) gathered $805 Mn largest individual net inflow.

Top 20 ETFs by net inflows in August 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

42,057.20 |

7,462.15 |

804.77 |

|

iShares Core S&P 500 UCITS ETF - Acc |

CSSPX SW |

50,594.49 |

(322.73) |

584.51 |

|

iShares $ High Yield Corp Bond UCITS ETF - EUR Hdg |

IHYE LN |

1,107.39 |

363.86 |

493.52 |

|

Vanguard FTSE All-World UCITS ETF |

VWRD LN |

9,023.87 |

1,286.16 |

459.92 |

|

Xtrackers II Global Sovereign UCITS ETF - GBP Hdg |

XGSG LN |

704.87 |

571.62 |

375.77 |

|

iShares Core EURO STOXX 50 UCITS ETF (DE) |

SX5EEX GY |

7,362.94 |

-698.91 |

333.74 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

3,622.74 |

1,495.25 |

299.96 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

2,711.54 |

957.76 |

296.98 |

|

BNP Paribas Easy S&P 500 UCITS ETF - Acc |

ESD FP |

2,814.22 |

(312.94) |

266.28 |

|

iShares $ High Yield Corp Bond UCITS ETF - GBP Hdg - Acc |

IHHG LN |

288.97 |

37.15 |

251.80 |

|

Lyxor EUR 2-10Y Inflation expectations UCITS ETF - Acc |

INFL FP |

2,218.43 |

1,019.15 |

233.68 |

|

iShares MSCI ACWI UCITS ETF - Acc |

ISAC LN |

3,067.18 |

1,215.09 |

232.87 |

|

HSBC MSCI World UCITS ETF |

HMWO LN |

3,950.94 |

1,123.39 |

225.90 |

|

Xtrackers MSCI Emerging Markets Index UCITS ETF - Acc |

XMME GY |

6,192.38 |

2,346.52 |

223.33 |

|

SPDR S&P US Dividend Aristocrats UCITS ETF |

SPYD GY |

3,472.69 |

488.22 |

222.74 |

|

Xtrackers MSCI World Health Care Index UCITS ETF (DR) - Acc |

XDWH GY |

2,,216.45 |

1,014.45 |

217.40 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

11,661.86 |

869.44 |

214.97 |

|

iShares MSCI Europe SRI UCITS ETF - Acc |

IESG LN |

4,377.96 |

751.45 |

208.77 |

|

Xtrackers S&P 500 UCITS ETF (DR) (EUR) - 1C - Acc |

XDPE GY |

1,058.67 |

57.05 |

206.14 |

|

Invesco S&P 500 EUR Hedged ETF - Acc |

E500 GY |

850.12 |

249.69 |

203.69 |

The top 10 ETPs by net new assets collectively gathered $867 Mn during August. Invesco Physical Gold ETC - Acc (SGLD LN) gathered $529 Mn largest individual net inflow.

Top 10 ETPs by net inflows in August 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

13,677.54 |

306.79 |

528.65 |

|

Xetra Gold EUR - Acc |

4GLD GY |

13,935.75 |

1,300.08 |

151.94 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,816.55 |

717.07 |

35.70 |

|

ETHetc - ETC Group Physical Ethereum - Acc |

ZETH GY |

192.69 |

159.81 |

32.75 |

|

WisdomTree WTI Crude Oil 1x Daily Short - Acc |

SOIL LN |

44.30 |

39.05 |

28.82 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

2,368.66 |

(853.15) |

25.24 |

|

21Shares Cardano ETP |

AADA SW |

84.93 |

56.45 |

18.70 |

|

Xtrackers IE Physical Silver ETC Securities - Acc |

XSLR LN |

189.79 |

160.86 |

15.79 |

|

21Shares Solana ETP |

ASOL SW |

25.27 |

17.07 |

15.35 |

|

WisdomTree Carbon - Acc |

CARB LN |

12.57 |

14.19 |

14.19 |

Investors have tended to invest in Equity ETFs and ETPs during August.