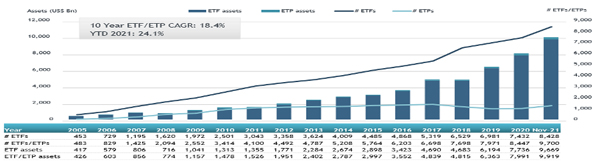

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally have gathered a record US$1.14 trilion in net inflows in the first 11 months of 2021. During November the global ETFs and ETPs industry gathered US$97.44 billion, bringing year-to-date net inflows to US$1.14 trillion which is higher than the US$670.16 billion gathered at this point last year. Assets increased 24.2% YTD in 2021, going from US$7.99 trillion at end of 2020, to US$9.92 trillion at the end of November. Assets decreased by 0.6% from US$9.98 trillion at the end of October 2021, to US$9.92 trillion at the end of November, according to ETFGI's preliminary November 2021 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- $9.92 trillion invested in ETFs and ETPs listed globally at the end of November declined slightly from the record $9.98 trillion reached at the end of October 2021.

- Record YTD 2021 net inflows of $1.14 Tn beating the prior record of $670.16 Bn gathered YTD 2020.

- $1.14 Tn YTD net inflows are $377.23 Bn higher than the record $762.77 Bn gathered in all of 2020.

- $1.23 trillion in net inflows gathered in the past 12 months.

- Assets increased 24.2% YTD in 2021, going from US$7.99 trillion at end of 2020, to US$9.92 trillion.

- 30th month of consecutive net inflows

- Equity ETFs and ETPs listed globally gathered a record $788.95 Bn in YTD net inflows 2021.

“Due to the growing threat of a new COVID variant Omicron, the S&P 500 declined 0.69% in November, however, the index is up 23.18% year to date. Developed markets, excluding the US, experienced a fall of 4.94% in November. Israel (down 1.03%) and the US (down 1.47%) experienced the smallest losses among the developed markets in November, while Luxembourg suffered the biggest loss of 16.90%. Emerging markets declined 3.53% during November. United Arab Emirates (up 8.15%) and Chile (up 5.51%) gained the most, whilst Turkey (down 13.72%) and Poland (down 11.95%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of November 2021

The Global ETF/ETP industry had 9,700 prodcts, with 19,606 listings, assets of $9.92 trillion, from 596 providers listed on 79 exchanges in 62 countries at the end of November.

During November, ETFs/ETPs gathered net inflows of $ 97.44 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $72.28 Bn duirng November, bringing net inflows for 2021 to $788.95 Bn, much greater than the $302.50 Bn in net inflows equity products had attracted for the corresponding period in 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $16.04 Bn during November, bringing YTD net inflows for 2021 to $211.13 Bn, higher than the $210.51 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs listed globally gathered net inflows of $948 Mn, bringing net outflows for 2021 to $9.91 Bn, significantly lower than the $63.34 Bn in net inflows commodity products had attracted over the same period last year. Active ETFs/ETPs reported $5.74 Bn in net inflows, bringing net inflows for 2021 to $126.04 Bn, higher than the $77.12 Bn in net inflows active products had attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $40.09 Bn during November. Vanguard Total Stock Market ETF (VTI US) gathered $5.74 Bn the largest individual net inflow.

Top 20 ETFs by net new inflows November 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

|

VTI US |

287,384.43 |

38,895.37 |

5,739.58 |

|

iShares Core S&P 500 ETF |

|

IVV US |

314,607.33 |

26,545.18 |

4,340.38 |

|

Vanguard S&P 500 ETF |

|

VOO US |

274,833.46 |

48,422.27 |

4,020.88 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

104,387.11 |

12,566.93 |

2,378.88 |

|

iShares 7-10 Year Treasury Bond ETF |

|

IEF US |

16,781.50 |

2,458.75 |

2,224.59 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

100,920.99 |

12,152.42 |

1,651.48 |

|

Nuveen Growth Opportunities ETF |

|

NUGO US |

3,279.59 |

3,282.06 |

1,632.03 |

|

Invesco QQQ Trust |

|

QQQ US |

210,092.41 |

15,830.93 |

1,613.76 |

|

ChinaAMC MSCI China A 50 Connect ETF |

|

159601 CH |

1,585.99 |

1,591.50 |

1,591.50 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

46,955.57 |

6,347.66 |

1,589.74 |

|

iShares TIPS Bond ETF |

|

TIP US |

37,722.39 |

10,784.50 |

1,568.96 |

|

E Fund MSCI China A 50 Connect ETF |

|

563000 CH |

1,553.93 |

1,560.95 |

1,560.95 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

90,929.59 |

8,097.93 |

1,442.76 |

|

iShares Russell 2000 ETF |

|

IWM US |

68,827.89 |

4,071.50 |

1,375.72 |

|

China Universal MSCI China A 50 Connect ETF |

|

560050 CH |

1,324.91 |

1,330.69 |

1,330.69 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

17,160.69 |

(1101.28) |

1,308.81 |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

417,698.54 |

14,895.39 |

1,275.25 |

|

Vanguard Value ETF |

|

VTV US |

88,927.85 |

14,860.99 |

1,270.14 |

|

iShares 0-5 Year TIPS Bond ETF |

|

STIP US |

8,621.87 |

5,635.56 |

1,124.63 |

|

iShares Core S&P Small-Cap ETF |

|

IJR US |

70,542.47 |

3,497.26 |

1,048.91 |

The top 10 ETPs by net new assets collectively gathered $1.71 Bn over November. SPDR Gold Shares (GLD US) gathered $663.25 Mn the largest individual net inflow.

Top 10 ETPs by net new inflows November 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

|

GLD US |

56,592.95 |

(9,771.73) |

663.25 |

|

Invesco Physical Gold ETC - Acc |

|

SGLD LN |

13,748.80 |

471.81 |

204.21 |

|

WisdomTree Physical Swiss Gold - Acc |

|

SGBS LN |

3,611.17 |

146.32 |

131.53 |

|

SparkChange Physical Carbon EUA ETC |

|

CO2P LN |

133.56 |

122.28 |

122.28 |

|

iShares Gold Trust |

|

IAU US |

28,824.50 |

(1,457.50) |

117.17 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

3,780.73 |

659.44 |

110.02 |

|

Invesco DB Agriculture Fund |

|

DBA US |

1,055.37 |

245.12 |

96.99 |

|

United States Natural Gas Fund LP |

|

UNG US |

510.27 |

(38.05) |

94.08 |

|

ProShares Ultra DJ-UBS Natural Gas |

|

BOIL US |

182.70 |

0.82 |

85.91 |

|

iShares S&P GSCI Commodity-Indexed Trust |

|

GSG US |

1,348.08 |

255.10 |

85.45 |

Investors have tended to invest in Equity ETFs/ETPs during November.