ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in US gathered net inflows of US$28.38 billion during May, bringing year-to-date net inflows to US$131.45 billion which is significantly higher than the US$67.25 billion net inflows gathered at this point last year.Assets invested in the US ETFs/ETPs industry have increased by 4.6%, from US$4.05 trillion at the end of April, to US$4.23 trillion at the end of May, according to ETFGI's May 2020 US ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $4.23 trillion invested in ETFs/ETPs listed in US at the end of May are the 4th highest on record.

- During May 2020, ETFs/ETPs listed in US gathered $28.38 billion in net inflows. Fixed Income products gathered the majority of NNA.

- Year-to-date net inflows of $131.45 billion are nearly double the $67.25 billion gathered at the end of May 2019.

- The Feds investment in May into Investment Grade and High Yield ETFs has helped to support the ETF industry

“The S&P 500 gained 4.8% in May, and remains only 5.0% down from its level at the beginning of the year, as markets anticipated relief from a COVID-19-driven economic slowdown. Developed markets outside the U.S. were also up 4.8% for the month with Sweden (up 9.9%) and Germany (up 9.2%) the top performers, while Hong Kong (down 7.7%), was the only market to be down for the month due to recent political turmoil. Emerging markets lagged during the month, gaining 1.3% as the economic impact of virus shutdowns remains somewhat more uncertain compared to developed regions.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

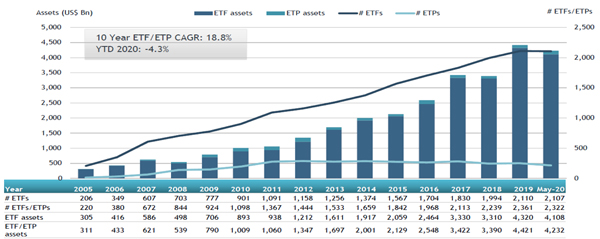

Growth in US ETF and ETP assets as of the end of May 2020

At the end of May 2020, the US ETFs/ETPs industry had 2,322 ETFs/ETPs, from 158 providers on 3 exchanges.

According to a release from the Fed on May 29th, the Fed has invested $1.3Bn into IG and HY ETFs, as of 26 May, since it started its purchases on 12 May in a bid to calm the markets following the rapid spread of coronavirus.

During May 2020, ETFs/ETPs listed in the U.S. gathered net inflows of $28.38 billion. Fixed income ETFs/ETPs listed in US reported net inflows of $24.14 billion during May, bringing YTD net inflows for 2020 to $54.75 billion, which is more than the $41.88 billion in net inflows Fixed income products had attracted for the corresponding period in 2019. Commodity ETFs/ETPs listed in US attracted net inflows of $6.22 billion during May, bringing YTD net inflows for 2020 to $27.59 billion, much higher than the $2.80 billion in net outflows for the corresponding period in 2019. Equity ETFs/ETPs experienced net outflows of $6.16 Bn in May, bringing the YTD net inflows to $27.59 Bn which is greater than the $20.09 Bn collected at this point in 2019.

Supported by the launches of some new ETFs using the recent SEC approved semi-transparent models - Active ETFs/ETPs gathered net inflows of $6.10 billion, bringing the YTD net inflows to $13.94 billion for 2020, which is higher than the $7.41 billion in net inflows for the corresponding period to May 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $30.32 billion during May, iShares iBoxx $ High Yield Corporate Bond ETF (HYG US)gathered $4.32 billion alone.

Top 20 ETFs by net new assets May 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

24,626.97 |

6,305.42 |

4,324.51 |

|

Invesco QQQ Trust |

QQQ US |

109,486.97 |

12,635.47 |

3,675.38 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

49,711.38 |

12,216.66 |

2,742.83 |

|

Vanguard Total Bond Market ETF |

BND US |

53,652.58 |

2,960.15 |

2,119.56 |

|

Vanguard Short-Term Corporate Bond ETF |

VCSH US |

26,327.06 |

392.39 |

1,711.98 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

72,995.18 |

651.27 |

1,658.17 |

|

Health Care Select Sector SPDR Fund |

XLV US |

26,821.32 |

6,100.64 |

1,464.73 |

|

Vanguard Information Technology ETF |

VGT US |

30,073.40 |

2,774.59 |

1,345.02 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

29,541.90 |

3,368.31 |

1,299.46 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

11,378.32 |

1,144.41 |

1,273.22 |

|

Communication Services Select Sector SPDR Fund |

XLC US |

9,424.87 |

2,400.70 |

1,077.72 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

11,606.90 |

366.48 |

997.61 |

|

iShares Short-Term Corporate Bond ETF |

IGSB US |

16,741.24 |

3,426.40 |

974.06 |

|

iShares National Muni Bond ETF |

MUB US |

16,386.38 |

977.94 |

961.77 |

|

SPDR Portfolio Intermediate Term Corporate Bond ETF |

SPIB US |

6,311.99 |

1,235.11 |

897.28 |

|

VanEck Vectors Gold Miners ETF |

GDX US |

14,662.77 |

71.52 |

864.94 |

|

Vanguard Short-Term Bond ETF |

BSV US |

23,439.54 |

272.99 |

785.28 |

|

iShares Core Dividend Growth ETF |

DGRO US |

10,466.41 |

1,268.85 |

766.51 |

|

iShares TIPS Bond ETF |

TIP US |

19,750.25 |

(1,835.40) |

739.43 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

18,223.47 |

2,538.54 |

645.39 |

The top 10 ETPs by net new assets collectively gathered $7.09 billion during May. The SPDR Gold Shares - Acc (GLD US)gathered $3.69 billion alone.

Top 10 ETPs by net new assets May 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares - Acc |

GLD US |

61,379.93 |

12,481.74 |

3,688.49 |

|

iShares Gold Trust - Acc |

IAU US |

24,542.10 |

4,434.98 |

1,084.72 |

|

iShares Silver Trust - Acc |

SLV US |

8,144.19 |

1,545.94 |

847.09 |

|

VelocityShares Daily 3x Long Natural Gas ETN - Acc |

UGAZ US |

560.90 |

459.27 |

382.98 |

|

VelocityShares Daily 2x VIX Short Term ETN - Acc |

TVIX US |

970.93 |

(1,820.22) |

265.47 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

520.30 |

(771.35) |

239.66 |

|

Aberdeen Physical Swiss Gold Shares - Acc |

SGOL US |

2,054.10 |

673.80 |

225.34 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN - Acc |

VXX US |

669.00 |

(1,279.92) |

179.31 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

1,584.06 |

2,117.41 |

89.74 |

|

Invesco CurrencyShares Swiss Franc Trust |

FXF US |

238.75 |

104.11 |

85.20 |

Investors have tended to invest in corporate bond and other Fixed Income ETFs/ETPs during May.