ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Latin America gathered net inflows of US$635 million during December. During the month, total assets invested in the Latin American ETF and ETP industry increased 8.15%, from US$7.81 billion at the end of November, to US$8.44 billion, according to ETFGI’s December 2018 Latin American ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets invested in ETFs and ETPs listed in Latin America increase 8.15% to $8.44 Bn in December.

- Year-to-date, assets have increased 24.21% from $6.80 Bn at the end of 2017.

- December 2018 marks 2nd highest net inflow on record, rivalled only by $688 Mn in March 2013.

“The end of 2018 saw the trend in developed markets reverse, and although arguably predictable, the severity left many pundits scratching their heads. This end of year stress has widely been attributed to the disruption caused by trade disputes feeding into economic data, and the view policy makers are not going to be quite as accommodating as initially expected. The S&P 500 returned -9.03% during December, and down -4.38% for 2018. Developed markets ex-US fell -4.62% during December, led by Japan and Canada, bringing the yearly return to -13.21%. Relatively speaking, EM and FM fared the month better, returning -2.68% and -3.15%, finishing 2018 -13.53% and -11.82%, respectively” according to Deborah Fuhr, managing partner and founder of ETFGI.

At the end of December 2018, the Latin American ETF/ETP industry had 48 ETFs/ETPs, with 1,196 listings, assets of $8.44 Bn, from 36 providers listed on 5 exchanges. Following net inflows of $635 Mn and market moves during the month, assets invested in ETFs/ETPs listed in Latin America increased by 8.15%, from $7.81 Bn at the end of November 2018, to $8.44 Bn.

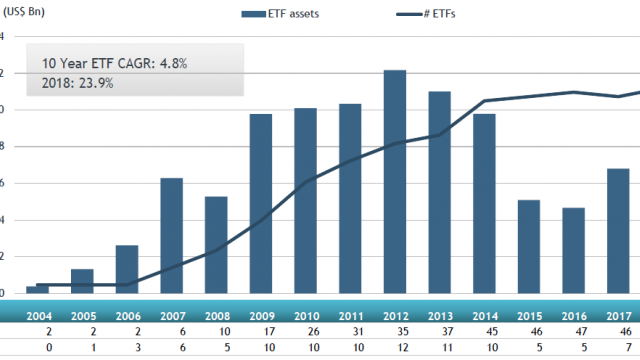

Growth in Latin American ETF and ETP assets as of the end of December 2018

Equity ETFs/ETPs listed in Latin America attracted net inflows of $609 Mn in December, growing net inflows for 2018 to $2.78 Bn, more than the $1.09 Bn in net inflows at this point last year. Fixed Income ETFs and ETPs listed in Latin America saw net outflows of $4 Mn, bringing net inflows for 2018 to $60 Mn, a considerable change compared to the $36 Mn in net outflows at this point last year.

Substantial inflows during December can be attributed to the top 10 ETFs by net new assets, which collectively gathered $674 Mn. The It Now Ibovespa Fundo de Indice ETF (BOVV11 BZ) gathered $267 Mn, the largest net inflow in December.

Top 10 ETFs by net new assets December 2018: Latin America

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

It Now Ibovespa Fundo de Indice |

BOVV11 BZ |

980 |

661 |

267 |

|

iShares NAFTRAC |

NAFTRAC MM |

2,869 |

1,346 |

166 |

|

iShares Ibovespa Fundo de Indice |

BOVA11 BZ |

1,413 |

305 |

124 |

|

Fondo Bursátil iShares COLCAP |

ICOLCAP CB |

1,281 |

359 |

70 |

|

DLRTRAC 15 |

DLRTRAC MM |

170 |

(37) |

32 |

|

DIABLOI 10 |

DIABLOI MM |

23 |

(36) |

6 |

|

iShares BM&FBovespa Small Cap Fundo de Indice |

SMAL11 BZ |

81 |

15 |

4 |

|

It Now S&P500 TRN Fundo de Indice |

SPXI11 BZ |

52 |

14 |

3 |

|

It Now IDIV Index Fund |

DIVO11 BZ |

18 |

2 |

1 |

|

Horizons Colombia Select |

HCOLSEL CB |

243 |

14 |

0 |

Investors have tended to invest in core, market cap and lower cost ETFs in December.