ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in Europe reported net inflows of US$6.55 billion during October, bringing year-to-date net inflows to US$74.40 billion which is less than the US$88.77 billion gathered at this point in 2019. Assets invested in the European ETFs/ETPs industry have decreased by 1.4%, from US$1.11 trillion at the end of September, to US$1.09 trillion, according to ETFGI's October 2020 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs and ETPs listed in Europe reported net inflows of US$6.55 billion during October

- $1.09 trillion invested in European domiciled ETFs and ETPs at the end of October – 3dr highest record.

- Commodity ETFs/ETPs gathered YTD net inflows of $19.60 billion, much higher than the $8.74 billion gathered YTD in 2019.

“During October, the S&P 500 decreased by 2.66% due to the uncertainty of US elections and rise in virus infections. Developed markets outside the US fell 3.56% during October, 21 of 24 countries lost ground as a large portion of Europe announced new lockdown plans. Emerging markets reported positive a return of 2.04% in October.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

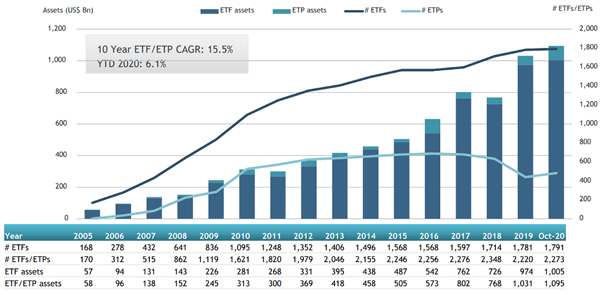

Europe ETFs and ETPs asset growth as at the end of October 2020

The European ETF/ETP industry had 2,273 ETFs, with 8,747 listings, assets of $1.09 Tn, from 73 providers on 27 exchanges, at the end of October 2020.

Equity ETFs/ETPs listed in Europe reported net inflows of $2.37 billion during October, bringing net inflows for the year 2020 to $20.79 billion, lower than the $24.52 billion in net inflows equity products had attracted at this point in 2019. Fixed income ETFs/ETPs listed in Europe had net inflows of $1.90 billion during October, taking net inflows for the year to $32.90 billion, lower than the $51.92 billion in net inflows fixed income products had reported at this point in 2019. Commodity ETFs/ETPs reported $1.37 billion in net inflows in October, bringing YTD net inflows to $19.60 billion, which is significantly higher than the $8.74 billion in net inflows gathered at this point in 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $6.20 billion during October. Xtrackers MSCI USA Information Technology Index UCITS ETF DR (XUTC GY) gathered $750 million alone.

Top 20 ETFs by net inflows in October 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Xtrackers MSCI USA Information Technology Index UCITS ETF DR |

XUTC GY |

1,543.66 |

1,359.71 |

750.36 |

|

iShares China CNY Bond UCITS ETF |

CNYB NA |

2,822.55 |

2,613.88 |

531.09 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

SEMB LN |

8,128.29 |

221.30 |

480.52 |

|

Xtrackers MSCI USA Health Care Index UCITS ETF DR |

XUHC GY |

1,199.86 |

784.75 |

478.57 |

|

iShares J.P. Morgan $ EM Bond EUR Hedged UCITS ETF (Dist) - EUR Hdg |

EMBE LN |

4,563.22 |

872.04 |

342.35 |

|

BNP Paribas Easy S&P 500 UCITS ETF - Acc |

ESD FP |

2,227.61 |

(93.72) |

328.11 |

|

iShares China CNY Bond UCITS ETF - Acc |

CYBA NA |

1,000.66 |

977.15 |

322.77 |

|

iShares MSCI EM UCITS ETF USD (Dist) |

IEEM LN |

2,731.29 |

(599.63) |

272.82 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

914.05 |

388.31 |

270.66 |

|

Xtrackers MSCI USA Consumer Staples Index UCITS ETF DR |

XUCS GY |

433.06 |

383.21 |

245.85 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

2,426.53 |

1,401.59 |

238.37 |

|

Xtrackers II Japan Government Bond UCITS ETF - Acc |

XJSE GY |

1,612.94 |

950.39 |

237.09 |

|

iShares Germany Govt Bond UCITS ETF |

SDEU LN |

573.02 |

288.72 |

234.88 |

|

iShares $ Treasury Bond 7-10yr UCITS ETF |

IBTM LN |

4,371.82 |

260.63 |

232.70 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

730.40 |

622.95 |

217.88 |

|

iShares $ High Yield Corp Bond UCITS ETF |

IHYU LN |

4,965.63 |

445.70 |

211.51 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

748.93 |

599.63 |

203.53 |

|

iShares Edge MSCI World Value Factor UCITS ETF - Acc |

IWVL LN |

1,896.41 |

101.68 |

203.17 |

|

Vanguard FTSE All-World UCITS ETF - Acc |

VWRA LN |

1,466.66 |

694.01 |

202.16 |

|

AMUNDI INDEX MSCI WORLD SRI - UCITS ETF DR (C) - Acc |

WSRI FP |

975.70 |

755.13 |

196.71 |

The top 10 ETPs by net new assets collectively gathered $632 million during October. WisdomTree Physical Gold - GBP Daily Hedged - Acc (GBSP LN) gathered $1.40 billion alone.

Top 10 ETPs by net inflows in October 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

GBSP LN |

1,338.45 |

746.17 |

632.79 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

14,125.88 |

4,916.69 |

181.56 |

|

Xetra Gold EUR - Acc |

4GLD GY |

13,528.09 |

1,068.81 |

125.02 |

|

WisdomTree Physical Swiss Gold - Acc |

SGBS LN |

3,568.05 |

251.78 |

106.32 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

2,232.89 |

468.91 |

97.86 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

3,563.49 |

257.46 |

80.63 |

|

iShares Physical Silver ETC - Acc |

SSLN LN |

526.28 |

234.93 |

77.59 |

|

Xtrackers Physical Gold ETC (EUR) - Acc |

XAD5 GY |

4,039.04 |

(61.87) |

40.91 |

|

Xtrackers IE Physical Silver ETC Securities - Acc |

XSLR LN |

28.91 |

30.26 |

29.51 |

|

Invesco Palladium ETC - Acc |

SPAL LN |

33.05 |

28.26 |

29.12 |

Investors have tended to invest in Equity ETFs and ETPs during October.

.jpg)