ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$8.93 billion during September, bringing year-to-date net inflows to US$69.50 billion which is less than the US$75.37 billion gathered through Q3 in 2019. Assets invested in the European ETFs and ETPs industry have decreased by 2.5%, from US$1.14 billion at the end of August, to US$1.11 trillion, according to ETFGI's September 2020 European ETFs and ETPs industry landscape insights report, the monthly report which is part of annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs and ETPs listed in Europe gathered net inflows of $8.93 Bn during September, bringing YTD net inflows to $69.50 Bn which is less than the $75.37 Bn gathered through Q3 in 2019.

- Assets invested in ETFs and ETPs listed in Europe are $1.11 trillion at the end of Q3 which is the second highest on record.

- Commodity ETFs/ETPs gathered year-to-date net inflows of $17.83 billion, much higher than the $7.21 billion had attracted by this time last year.

- $8.15 billion or most of the net inflows went into equity ETFs and ETPs in September.

“The S&P 500 declined 3.8% in September, with concerns over back-to-school (and resulting COVID cases), U.S. elections and stimulus talks. Strong prior month gains boosted the index higher to close up 8.9% for Q3. Global equities declined 3.1% in September, as measured by the S&P Global BMI. Despite the monthly decline, the global benchmark managed to finish Q3 up 8.1% Q3 and up 0.7% YTD. Emerging markets, declined 2.2% in September but closed up 9.0% for Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

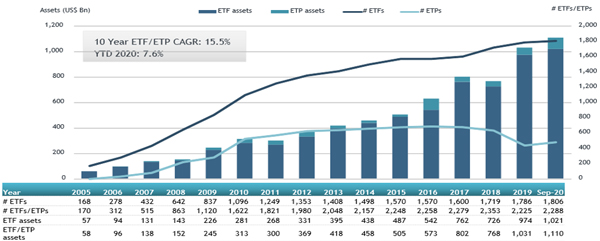

Europe ETFs and ETPs asset growth as at the end of September 2020

At the end of Q3 2020, the European ETF/ETP industry had 2,288 ETFs, with 8,615 listings, assets of $1.11 trillion, from 73 providers listed on 28 exchanges in 23 countries.

Equity ETFs/ETPs listed in Europe reported net inflows of $8.15 billion during September, bringing net inflows for the year 2020 to $20.85 billion, higher than the $16.81 billion in net inflows equity products had attracted at this point in 2019. Commodity ETFs/ETPs listed in Europe had net inflows of $875 million during September, taking net inflows for the year to $17.83 billion, much higher than the $7.21 billion in net inflows commodity products had reported at this point in 2019. Fixed Income ETFs/ETPs reported $219 million in net outflows bringing net inflows to $30.55 billion for 2020, which is much lower than the $47.80 billion in net inflows gathered year to date at this point in 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $7.57 billion during September. iShares China CNY Bond UCITS ETF (CNYB NA) gathered $976 million alone.

Top 20 ETFs by net inflows in September 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares China CNY Bond UCITS ETF |

CNYB NA |

2,246.21 |

2,082.79 |

975.87 |

|

Lyxor UCITS ETF NASDAQ-100 - D-EUR - Dist |

NADQ GY |

704.79 |

679.82 |

679.82 |

|

Invesco EQQQ Nasdaq-100 UCITS ETF |

EQQQ IM |

4,487.76 |

1,211.59 |

549.66 |

|

L&G US Equity Responsible Exclusions UCITS ETF - Acc |

RIUS LN |

1,192.28 |

611.80 |

516.64 |

|

Lyxor S&P 500 UCITS ETF - Daily Hedged - GBP -Acc |

SP5G LN |

548.27 |

541.97 |

508.02 |

|

CSIF IE MSCI USA Blue UCITS ETF - Acc |

CMXUS SW |

2,266.14 |

2,008.81 |

480.08 |

|

UBS ETF (IE) MSCI USA UCITS ETF (USD) A-dis |

UBU3 GY |

644.94 |

400.08 |

448.16 |

|

AMUNDI INDEX MSCI EMERGING MARKETS UCITS ETF DR (C) - Acc |

AEME FP |

1,993.22 |

(1,163.94) |

371.14 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

8,718.57 |

1,021.65 |

329.99 |

|

iShares $ Treasury Bond 20+yr UCITS ETF - Acc |

DTLA LN |

747.76 |

481.94 |

302.87 |

|

Lyxor Core EURO STOXX 50 (DR) - UCITS ETF Dist |

MTDB GY |

269.91 |

278.81 |

278.81 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

5,987.79 |

(2,780.86) |

278.06 |

|

Xtrackers S&P 500 Swap UCITS ETF - Acc |

D5BM GY |

6,509.78 |

(1,191.22) |

276.01 |

|

UBS ETF (LU) MSCI Canada UCITS ETF (CAD) A-dis |

CANCDA SW |

1,113.16 |

158.62 |

269.40 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF - GBP Hdg |

EMHG LN |

463.76 |

335.90 |

265.26 |

|

iShares Global Corp Bond EUR Hedged UCITS ETF (Dist) |

CRPH SW |

1,787.37 |

230.83 |

220.52 |

|

iShares Digital Security UCITS ETF - Acc |

LOCK LN |

910.50 |

573.89 |

219.77 |

|

iShares MSCI Europe UCITS ETF EUR (Acc) - Acc |

IMEA LN |

2,855.98 |

916.33 |

208.58 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

2,079.52 |

1,163.22 |

198.70 |

|

Invesco EQQQ Nasdaq-100 UCITS ETF |

EQAC SW |

524.40 |

421.19 |

197.65 |

The top 10 ETPs by net new assets collectively gathered $2.70 billion during September. SPDR Physical Gold ETC – Acc (SGLN LN) gathered $983.69 million alone.

Top 10 ETPs by net inflows in September 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

15,283.65 |

5,903.86 |

983.69 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

13,981.77 |

4,735.13 |

767.63 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

185.91 |

178.13 |

176.60 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

182.09 |

180.34 |

153.69 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,872.09 |

2,269.88 |

149.95 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

3,516.47 |

176.84 |

148.78 |

|

WisdomTree Precious Metals - EUR Daily Hedged - Acc |

00XQ GY |

114.75 |

(13.01) |

111.94 |

|

WisdomTree Physical Swiss Gold - Acc |

SGBS LN |

3,472.36 |

145.45 |

90.45 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

XGDE GY |

115.97 |

112.06 |

69.02 |

|

Invesco Physical Silver ETC - Acc |

SSLV LN |

161.69 |

66.12 |

46.12 |

Investors have tended to invest in Equity ETFs and ETPs during September.