ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Canada gathered net inflows of US$413 million in January. Assets invested in the Canadian ETF/ETP industry finished the month up 8.17%, from US$115 billion at the end of December, to US$125 billion, according to ETFGI's January 2019 Canadian ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Canadian ETF/ETP industry rise 8.17% in January.

- During January 2019, ETFs/ETPs listed in Canada attracted $413 Mn in net inflows.

- Actively managed products attract largest inflows while Fixed Income see the largest outflows.

“In January, equity markets rebounded from Q4 when global equities suffered steep declines amid persistent worries over trade and economic growth. Fed chair Powell revised his stance on where he believes the neutral rate of interest lies, easing fears of a dramatic and painful tightening cycle. Energy’s decline during the Q4 rout subdued inflation in developed economies taking hiking pressure off central banks while provided stimulus to consumers and businesses, giving stronger core metrics. The S&P 500 finished January up 8.01%, the best January since 1987, while the S&P Topix 150 gained 7.26% and the S&P Europe 350 gained 6.23%. Emerging and Frontier markets were up 7.77% and 4.61% respectively, hampered by dollar strength.” according to Deborah Fuhr, managing partner and founder of ETFGI.

At the end of January 2019, the Canadian ETF/ETP industry had 680 ETFs/ETPs, from 34 providers listed on 2 exchanges. Following net inflows of US$413 Mn and market moves during the month, assets invested in Canada increased by 8.17% from $115 Bn at the end of December, to $125 Bn.

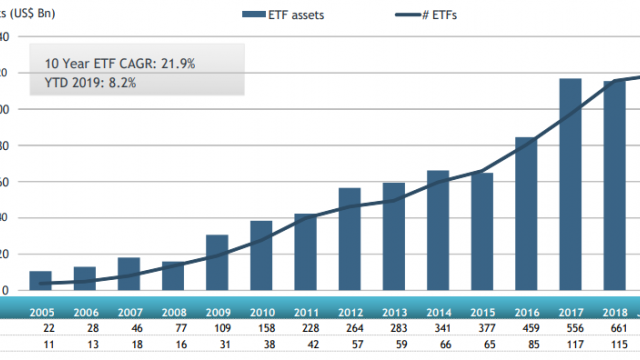

Growth in Canadian ETF and ETP assets as of the end of January 2019

Equity ETFs/ETPs listed in Canada saw net outflows of $28 Mn in January, substantially less than the $761 Mn in net inflows equity products had attracted by the end of January 2018. Fixed income ETFs/ETPs listed in Canada saw net outflows of $108 Mn in January, considerably less than the $263 Mn in net inflows fixed income products had attracted by the end of January 2018.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $1.01 Bn in January, the BMO Ultra Short-Term Bond ETF (ZST CN) gathered $137 Mn alone.

Top 20 ETFs by net new assets January 2019: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

272 |

137 |

137 |

|

AGFiQ Enhanced Core Global Multi-Sector Bond Etf |

QGB CN |

115 |

94 |

94 |

|

Mackenzie US Investment Grade Corporate Bond Index ETF CAD-Hedged |

QUIG CN |

256 |

70 |

70 |

|

RBC Quant U.S. Dividend Leaders ETF |

RUD/U CN |

92 |

58 |

58 |

|

First Asset Morningstar Canada Momentum Index ETF |

WXM CN |

265 |

56 |

56 |

|

iShares S&P/TSX 60 Index Fund |

XIU CN |

7,294 |

53 |

53 |

|

BetaPro Natural Gas 2x Daily Bull ETF |

HNU CN |

86 |

53 |

53 |

|

BMO Ultra Short-Term Bond ETF Acc |

ZST/L CN |

132 |

47 |

47 |

|

iShares Canadian Government Bond Index Fund |

XGB CN |

400 |

47 |

47 |

|

Vanguard Canadian Aggregate Bond Index ETF |

VAB CN |

1,266 |

45 |

45 |

|

First Asset Enhanced Government Bond Etf |

FGO CN |

84 |

45 |

45 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

1,340 |

44 |

44 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

435 |

44 |

44 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

1,529 |

41 |

41 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

1,189 |

34 |

34 |

|

Fidelity US High Dividend Index ETF |

FCUD CN |

48 |

30 |

30 |

|

Vanguard Balanced Etf Portfolio |

VBAL CN |

298 |

28 |

28 |

|

PIMCO Monthly Income Fund |

PMIF CN |

642 |

28 |

28 |

|

BMO MSCI EAFE Index ETF |

ZEA CN |

1,802 |

28 |

28 |

|

RBC 1-5 Year Laddered Canadian Bond ETF |

RLB CN |

185 |

26 |

26 |

.jpg)