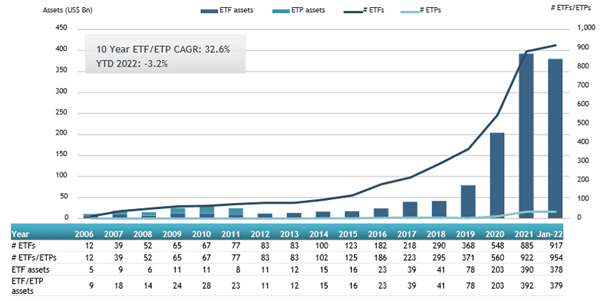

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$9.81 billion during January, which is lower than the US$19.76 billion gathered in January 2021. Total assets invested in ESG ETFs and ETPs decreased by 3.2% from US$392 billion at the end of December 2021 to US$379 billion, according to ETFGI’s January 2022 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets of $379 Bn invested in ESG ETFs listed globally at the end of January 2022 are the 2nd highest on record.

- Net inflows of $9.81 Bn gathered in January 2022.

- $151.57 Bn in net inflows gathered in the past 12 months.

- Assets decreased 3.2% in 2022, going from $392 Bn at end of 2021, to $379 Bn.

- 37th month of consecutive net inflows.

“The S&P 500 decreased by 5.17% in January. Developed markets excluding the US, experienced a loss of 5.33% in January. All countries in developed markets experienced losses, with New Zealand suffering the biggest loss of 14.35%. Emerging markets decreased by 0.94% during January. Chile (up 12.44%) and Colombia (up 12.36%) gained the most, whilst Russia (down 8.74 %) and Poland (down 4.82%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ESG ETF and ETP asset growth as at end of January 2022

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily. The Global ESG ETFs industry had 954 products, with 2,730 listings, assets of $379 Bn, from 188 providers listed on 41 exchanges in 32 countries.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$6.66 Bn in January. BNP Paribas Easy MSCI USA SRI S-Series PAB 5% Capped (EKUS FP) gathered $626 Mn, the largest individual net inflow.

Top 20 ESG ETFs/ETPs by net new assets January 2022

|

Name |

Ticker |

Assets ($ Mn) Jan-22 |

NNA ($ Mn) YTD-22 |

NNA ($ Mn) Jan-22 |

|

BNP Paribas Easy MSCI USA SRI S-Series PAB 5% Capped |

EKUS FP |

1,162.16 |

626.03 |

626.03 |

|

Fidelity Sustainable Research Enhanced US Equity UCITS ETF - Acc |

FUSS LN |

1,127.13 |

608.07 |

608.07 |

|

iShares MSCI EMU Paris-Aligned Climate UCITS ETF - Acc |

EMPA NA |

571.26 |

563.27 |

563.27 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

24,680.58 |

545.69 |

545.69 |

|

iShares MSCI EMU ESG Enhanced UCITS ETF |

EMUD LN |

412.31 |

418.44 |

418.44 |

|

China Southern CSI Yangtze River Protection ETF |

517160 CH |

327.43 |

358.34 |

358.34 |

|

E Fund CSI Yangtze River Protection ETF |

517330 CH |

323.97 |

353.79 |

353.79 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

2,708.47 |

308.60 |

308.60 |

|

Xtrackers Emerging Markets Carbon Reduction and Climate Improvers ETF |

EMCR US |

755.17 |

301.71 |

301.71 |

|

iShares JP Morgan ESG USD EM Bond UCITS ETF - CHF Hdg - Acc |

CMES SW |

364.89 |

293.93 |

293.93 |

|

Fidelity Sustainable Global Corporate Bond Multifactor UCITS ETF - GBP Hdg Acc |

FSMP LN |

567.16 |

293.13 |

293.13 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

9,048.09 |

263.10 |

263.10 |

|

BNP Paribas Easy MSCI Europe SRI S-Series PAB 5% Capped |

SRIE FP |

1,314.96 |

253.68 |

253.68 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF - CHF Hdg |

EMHC SW |

430.85 |

253.21 |

253.21 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

3,576.77 |

215.80 |

215.80 |

|

Xtrackers MSCI AC World ESG Screened UCITS ETF |

XMAW GY |

1,538.43 |

212.08 |

212.08 |

|

UBS ETF CH - MSCI Switzerland IMI Socially Responsible |

CHSRI SW |

623.41 |

200.29 |

200.29 |

|

iShares MSCI USA Small-Cap ESG Optimized ETF |

ESML US |

1,487.23 |

198.67 |

198.67 |

|

iShares MSCI World ESG Enhanced UCITS ETF - Acc |

EDMW GY |

2,099.86 |

198.53 |

198.53 |

|

Huatai-PineBridge CSI Photovoltaic Industry ETF |

515790 CH |

2,073.01 |

198.35 |

198.35 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.