ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports ESG ETFs and ETPs listed globally gathered a record US$119 billion of net inflows in the first 9 months of 2021. Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$9.83 billion during September, bringing year-to-date net inflows to US$118.94 billion which is much higher than the US$47 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs decreased by 1.3% from US$327 billion at the end of August 2021 to US$324 billion, according to ETFGI’s September 2021 ETF and ETP ESG industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets of $324 billion invested in ETFs and ETPs listed globally at the end of September are the second highest on record.

- Record YTD 2021 net inflows of $118.94 Bn beating the prior record of $47 Bn gathered YTD 2020.

- $118.94 Bn YTD net inflows are just $30.4 Bn over full year 2020 record net inflows $88.54 Bn.

- $160.48 billion in net inflows gathered in the past 12 months.

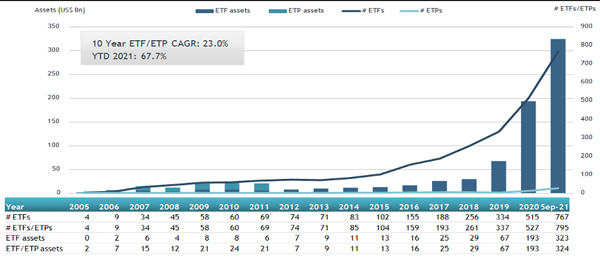

- Assets increased 67.7% YTD in 2021, going from US$193 billion at end of 2020, to US$324 trillion.

- 67th month of consecutive net inflows.

- Equity ETFs and ETPs listed globally gathered a record $88.8 Bn in YTD net inflows 2021.

“The S&P 500 declined 4.65% in September as due to fears of inflation, the ongoing Congressional budget impasse, and anticipation of a reduction in Fed liquidity provision. Developed markets ex-U.S. declined 2.99% and emerging markets were down 3.12% in September.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ESG ETF and ETP asset growth as at end of September 2021

Global there are 795 ESG ETFs/ETPs, with 2,224 listings, assets of US$324 Bn, from 168 providers on 40 exchanges in 32 countries at the end of September.

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 795 ESG ETFs/ETPs and 2,224 listings globally at the end of September 2021.

During September, 41 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$4.57 Bn in September. iShares Trust iShares ESG Aware MSCI USA ETF (ESGU US) gathered $522 Mn largest individual net inflow.

Top 20 ESG ETFs/ETPs by net new assets September 2021

|

Name |

Ticker |

Assets (US$ Mn) Sep-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Sep-21 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

21,634.50 |

6,218.52 |

522.06 |

|

Huatai-PineBridge CSI Photovoltaic Industry ETF |

515790 CH |

1,936.16 |

(23.05) |

403.12 |

|

Invesco Global Clean Energy UCITS ETF - Acc |

GCLX LN |

33.73 |

1,109.72 |

402.33 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

6,726.28 |

2,469.01 |

259.89 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

4,339.81 |

2,145.23 |

247.03 |

|

Mirae Asset TIGER China Electric Vehicle Solactive ETF |

371460 KS |

1,759.86 |

1,528.03 |

245.84 |

|

UBS Irl ETF plc - S&P 500 ESG UCITS ETF - USD - Acc |

S5ESG SW |

866.41 |

70.45 |

204.96 |

|

iShares Euro Corp Bond SRI UCITS ETF |

SUOE LN |

2,814.98 |

668.09 |

200.60 |

|

Vanguard ESG US Stock ETF |

ESGV US |

5,177.94 |

1,687.97 |

198.62 |

|

One ETF ESG - Acc |

1498 JP |

471.06 |

424.52 |

193.94 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF - CHF Hdg |

EMHC SW |

183.32 |

188.87 |

188.32 |

|

KraneShares Global Carbon ETF |

KRBN US |

923.89 |

761.19 |

181.09 |

|

iShares MSCI EM IMI ESG Screened UCITS ETF - Acc - Acc |

SAEM LN |

1,746.64 |

620.22 |

179.03 |

|

iShares MSCI ACWI Low Carbon Target ETF |

CRBN US |

1,066.05 |

384.66 |

178.77 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

2,900.97 |

1,365.23 |

166.86 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

3,834.71 |

1,074.99 |

164.10 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

3,375.78 |

2,471.68 |

163.59 |

|

Mackenzie Global Sustainable Bond ETF |

MGSB CN |

158.03 |

157.59 |

157.59 |

|

iShares MSCI EM SRI UCITS ETF - Acc |

SUES LN |

2,772.71 |

1,115.21 |

157.45 |

|

iShares MSCI USA ESG Enhanced UCITS ETF - Acc |

EDMU GY |

3,236.57 |

1,651.10 |

155.18 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

.jpg)